ConstructionEconomic Overview & Market Update

Q3 2024

This report recognizes that the construction sector can thrive during a general economic downturn due to the lag time between project initiation and completion, while maintaining active spending by owners. Evidence suggests projects are bigger and fewer than in years past. Understanding the availability and potential of projects for contractors requires a close look at spending dynamics, influenced by the broader economy and owners’ decisions to undertake construction projects. To gain a comprehensive view of the current state of the construction economy, we examine construction spending and indicators that provide insight into future expectations. By leveraging this data, we aim to construct a clear picture of the environment and offer insights into the associated risks and insurance implications.

The construction sector thrives even amid a general economic downturn.

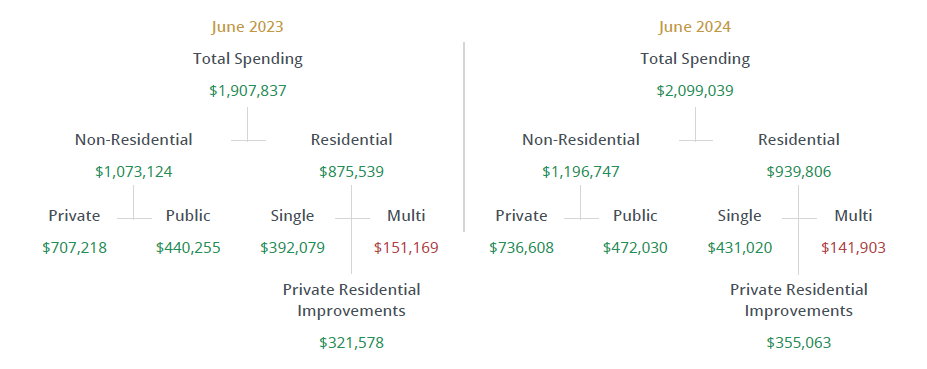

The Construction Spending Tree starts with total construction spending and is further divided into specific components. Not all contractors will benefit from the overall spending in each region. The annual spending rate year-over-year is examined to see how future spending helps with budgeting.

The year-over-year annual spending rate shows a positive trend across all sectors, with the exception of multifamily. While this is not the first occurrence, we anticipate this trend will continue as multifamily starts are down 12.8% year-over-year. The private residential improvements sector has improved from last quarter turning positive, which may encourage private equity firms to continue to acquire business in this arena.

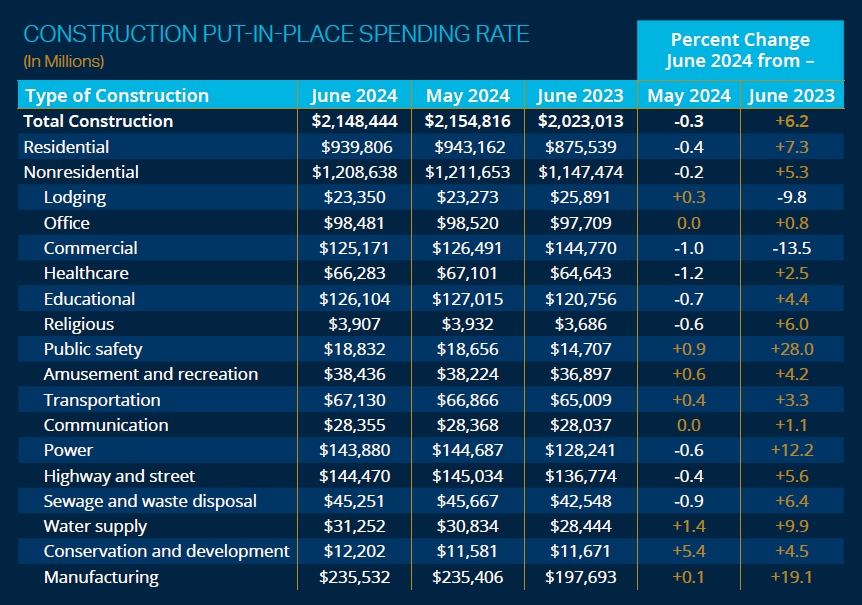

The total construction spending rate in all sectors is 6.2% year‑over‑year. The nonresidential spending rate is up 5.3%, and the residential spending rate is up 7.3%, which is a reversal from 2023. Overall spending has declined by 5.3%, reflecting a continued downward trend from May to June. The month‑over‑month decrease of 0.3% indicates a deceleration in spending activity, highlighting a shift in the overall pace of spending.

In 2023, the average residential spending rate was $875 billion. This year, the rate has increased to $939 billion, marking a 7.3% rise. This is a significant shift from the previous year.

| Residential Spending Rate | YTD 2023 | YTD 2024 | Percent Change |

|---|---|---|---|

| Total Residential | $875,539 | $939,806 | +7.3 |

| New Single-Family | $392,079 | $431,020 | +9.9 |

| New Multifamily | $151,169 | $141,903 | -6.1 |

| Private Family Improvements | $321,578 | $355,063 | +10.4 |

The nonresidential spending rate is up 5.3% year-over-year, but there remains a two‑year lag from the U.S. Census Bureau, resulting in increased construction spending.

At first glance, manufacturing spending appears robust. However, considering the broader context, it’s clear that the nonresidential construction spending rate has cooled off and is starting to taper off.

Backlogs have decreased by 0.9 months from a year ago, now at 8.4 months. Backlog seeks to assess the backlog of work or the increase in value of projects on the contractors’ records. Contractors of all sizes are experiencing a decline in backlog compared to the previous year. This is calculated based on the current month’s total remaining value of projects in backlog, divided by the total revenues of the previous 12 months, then multiplied by 12. Backlogs grow when construction starts outpace the spending rate. If contractors can secure new contracts at a greater speed than they complete existing projects, backlogs increase. This trend has reversed over the past two years, and we are seeing backlogs decrease.

Last year, backlog averaged 9.3 months. However, as of July 2024 it has reduced significantly to 8.4 months. Backlog improvement remains hopeful.

Contractors of all sizes are experiencing a decline in backlog compared to the previous year.

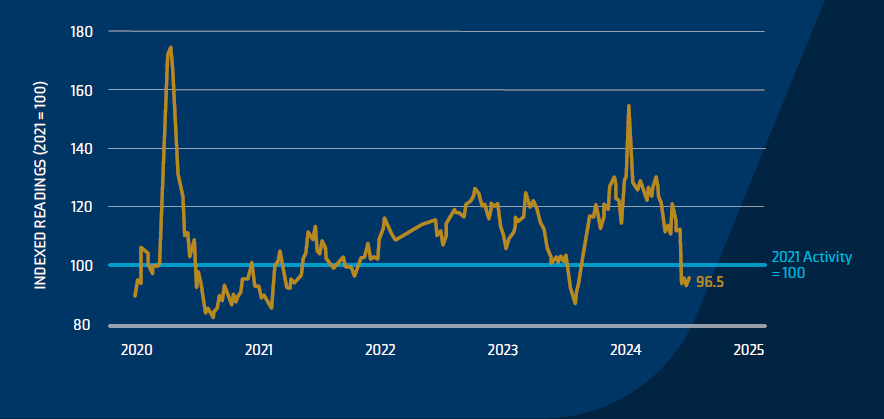

ConstructConnect has a database of projects and created the Project Stress Index. This Index gives insight into the quality and stability of the construction backlog.

A seasonally adjusted, equal weight measure of delayed, on hold and abandoned projects.

Abandoned jobs contributed to two-thirds of the decline within the private sector. Jobs put on hold have happened in the public sector, with the segment spending 22% of total construction spending. Nearly four-fifths of the jobs with bid date delays were in the public sector.

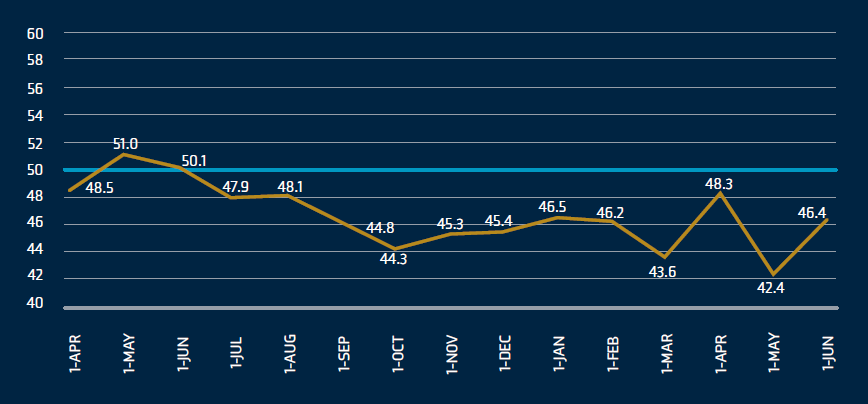

The Architectural Billing Index (ABI) is a leading indicator in the construction industry. The ABI, surveyed by the American Institute of Architects (AIA), measures whether architects are billing more or less than the previous months. If the Index is above 50, it indicates growth, while below 50 suggests a decline.

As a commercial rule of thumb, you have 20% of the project that gets spent in the first 12 months, in the next 12 months, you have 50% of the project spending, and finally, 30% of the project spending that occurs in the following twelve months. Any given year, you have the total amount from when the project starts, which indicates the total spending for the future. This is a result of payments being dispersed over time with various people.

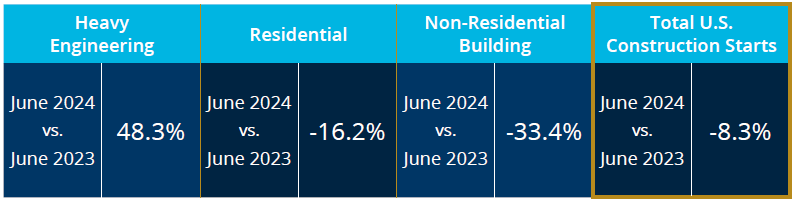

Year-over-year, the number and value of total construction starts have declined by 8.3%. This trend signifies a cooling and flattening of construction spending. The overall trend for nonresidential construction shows a 12.2% decline compared to the same period in 2023. This indicates flattening of construction spending compared to the previous year.

Breaking down the sectors, we see significant declines in key areas:

Regional construction starts highlights include Alaska, which has seen a remarkable 116.7%6 increase in nonresidential construction starts and 132.3% in heavy engineering construction starts.7

Costs for materials and labor constitute a significant portion of construction projects. Demand remains high for materials like concrete, sand, gravel, and crushed stone, showing a 7.4 12‑month percent change, which may be attributed to the government not wanting to pay as much for sand to complete projects.

Supply chain, rate, and union external factors may present challenges for businesses.

Over the past couple of years, optimism within the construction sector has waned, with design activities proceeding at a slower pace than in the past. While sales remain stable, concerns about profitability persist, potentially impacting the top line. Despite this, total construction spending has increased by 6.2% yearly. Nonresidential spending has risen by 5.3% year‑over‑year, and residential spending, particularly in single-family homes, has hit 9.9% year over year despite challenging economic conditions. We continue to add more construction employees in all sectors.

The backlog of work is being depleted faster than new jobs are being secured. However, the private sector maintains a solid 8.4 months of work. Nonetheless, decreasing backlogs may cause commercial contractors to feel uneasy about prospects.

The Architectural Billings Index has shown a four-month trend of decreasing design activity, indicating that future construction starts and spending will likely decline in the coming year. Persistently lower billings suggest that we are at the beginning of a downturn in nonresidential construction spending, which is expected to continue through the end of this year and into the next.

Over the next six months, we anticipate a significant slowdown in construction spending, influenced by the broader economic environment. Even if interest rates were to drop dramatically, it would take approximately six months before new projects could commence. Therefore, we expect the next six months to represent the most substantial decline in construction activity. We are hopeful that changing factors will help the industry recover and stabilize by 2025.

Angela Thompson

Sr. Marketing Specialist, Market Intelligence & Insights

Brian Spinner

Sr. Marketing Coordinator, Market Intelligence & Insights