ConstructionEconomic Overview & Market Update

Q3 2023

The IMA National Construction Group gathers to assess construction economic data, combining it to uncover insights that may impact construction firms’ risk and insurance strategies. Picture the construction economy as the last car on a roller coaster of the economy. As the last car, we get insights into where the general economy is moving. While the general economy is declining, the construction economy is still increasing. This result is due to the lag time from when projects are started compared to when they are finished, and the owners are still spending money. Conversely, there are times when the overall economy is increasing, and the construction economy is still declining.

To get a well-rounded picture of the current state of the construction economy, we look at construction spending, labor, and cost of construction materials, followed by indicators that will give insight into future expectations. Our future state indicators include backlog, construction starts, ConstructConnect’s Project Stress Index and Expansion Index, and the Architectural Billings Index.

While the general economy is declining, the construction economy is still increasing.

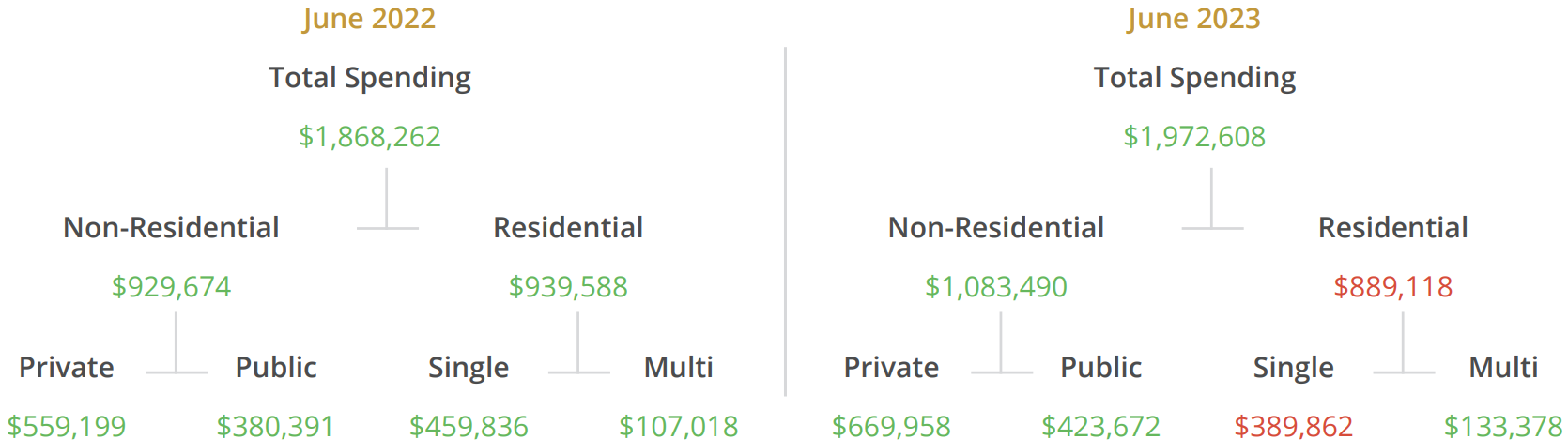

We build what we call the Construction Spending Tree, starting with Total Construction Spending and breaking it out into various components. Analyzing spending in these critical areas is essential because only some contractors will benefit from total expenditures in each area.

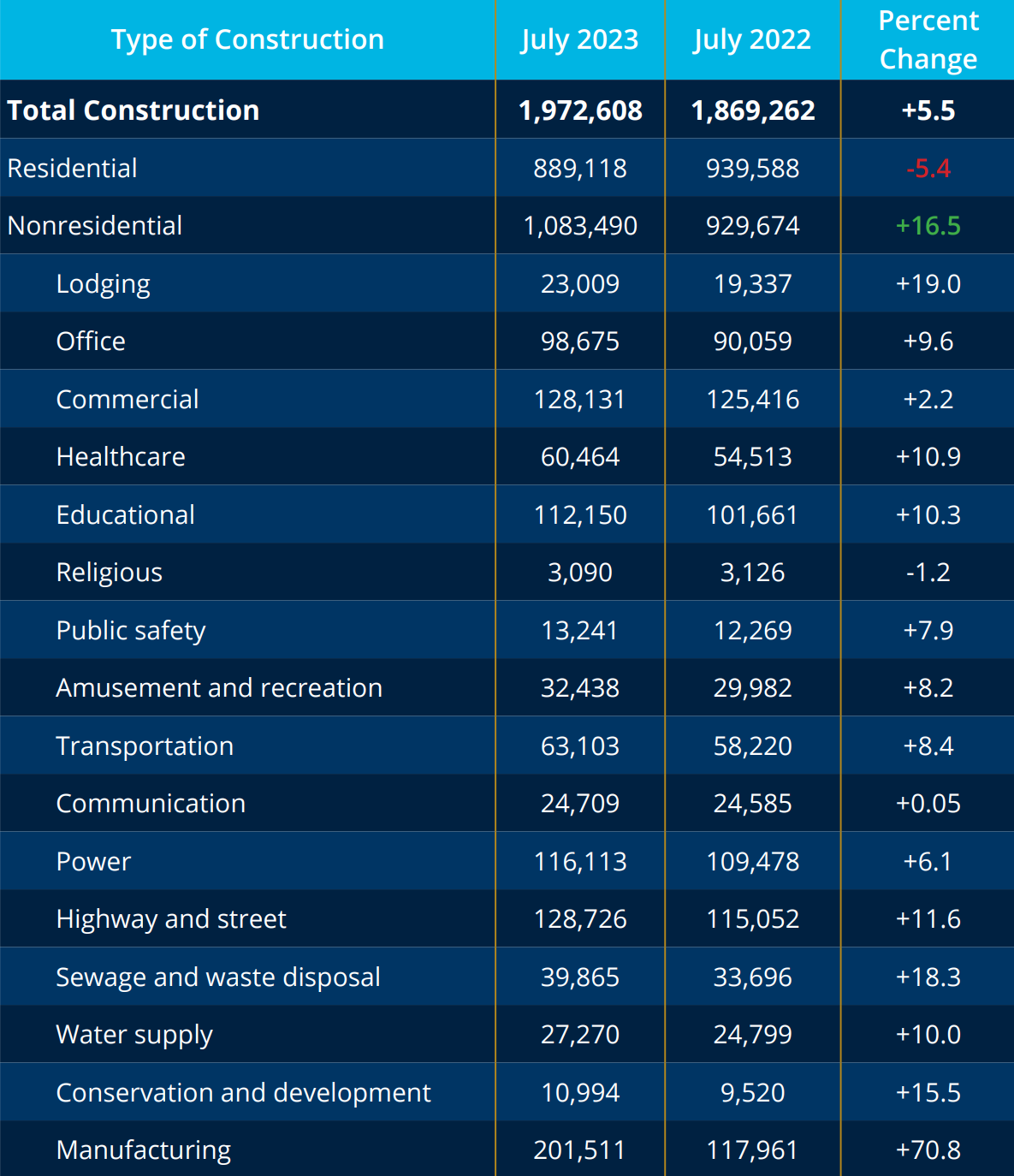

Total construction spending rate is up 5.5% year-over year as of July 2023.

This spending continues a two-year trend of an increasing spending rate for overall construction. It is important to note that the spending we see today is because something was planned, designed, permitted, and started in previous years.

While total construction spending has been increasing for the last twenty-four months, residential spending is down 5.4% year-over-year as of July 2023.

This number is deceptive regarding residential spending. Two distinct narratives emerge when we differentiate between Private Single Family and Private Multifamily spending. Private Single Family spending is a heavyweight percentage of overall residential spending, down 15%. Conversely, the multifamily spending rate is up 24% year-over-year.

Contractors catering to Private Single Family projects have fewer projects to bid and work on. Multifamily projects continue to have a higher rate of owners spending in this area. Apartments comprise a large part of the Private Multifamily.

| Residential Spending | July 2022 | July 2023 | Percent Change |

| Total Residential | $939,588 | $889,118 | -5.4% |

| New Private Single Family | $459,836 | $389,862 | -15.2% |

| New Private Multifamily | $107,018 | $133,378 | +24.6% |

The nonresidential spending rate is up 16.5% year-over-year, which helps to lift the overall Total Construction spending rate to its 5.5% increase. Only spending in the religious sector is less than a year ago. All other sectors, including office projects, enjoy higher spending.

L.E. expects renovation and conversion activity to continue into 2023.

According to Lodging Econometrics (L.E.), renovation and brand conversion activity in the U.S. continues to boom in early 2023, reaching record project counts of 1,953 hotels/253,533 rooms for a 38% year-over-year increase by projects and a 37% year-overyear increase by rooms. L.E. expects renovation and conversion activity to continue into 2023 as owners spend to align their hotels with current brand standards or look elsewhere for new brand identification.1

Previously passed congressional spending bills getting through design, qualifying, and multiple governmental approvals are now showing up in the construction spending numbers.

Federal government funds come with federal conditions. The Equal Employment Opportunity Commission (EEOC) has held hearings on discriminatory practices and lack of diversity in the construction industry. They also put forth their proposed Strategic Enforcement Plan and stopped taking comments as of February 2023.

EEOC’s proposed Strategic Enforcement Plan (SEP) specifically calls out the construction industry for a lack of diversity. There has been a string of EEOC lawsuits and settlements between the EEOC and construction firms since May of 2022; the most recent included a default judgment of $2.7M.

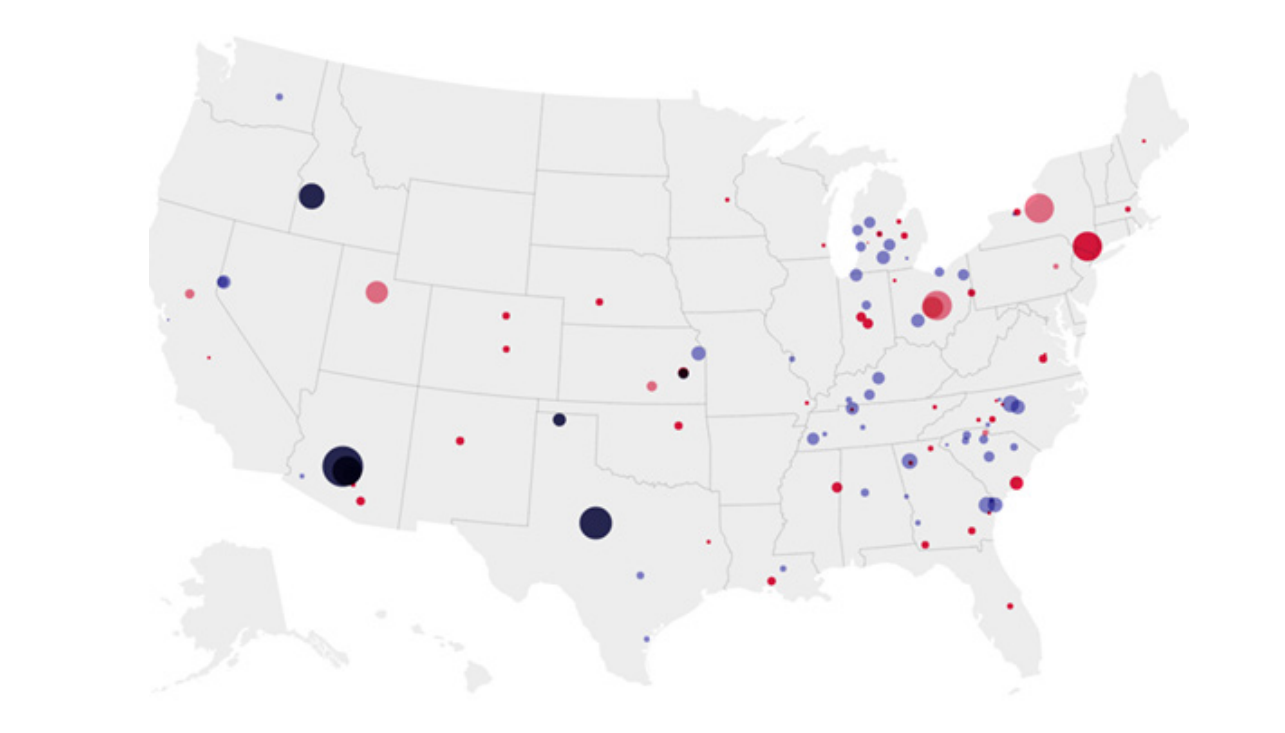

Manufacturing spending is up 70% over last year. This is due to the Government Chips Act and congressional spending bills. Construction Dive maps out where these major manufacturing facilities are being built are located, and parts of the country are not part of the manufacturing renaissance, California specifically given its size and population.

The first wave of spending is starting to occur because of the various congressional spending bills based on the federal government. Public spending includes spending by city, county, state, and federal governmental entities. Public spending accounts for 21.7% of total construction spending.

| July 2022 | July 2023 | Percent Change |

| $380,391 | $423,672 | +11.4% |

The total dollar amount of Public Spending year-overyear is up 11.4%.

Today, the Public Spending Rate comprises the same percentage of overall spending as it did two years ago. The total dollar amount year-over-year is up 11.4%.

We anticipate these numbers will increase over the next two years. With the government becoming a more extensive construction owner, contractors familiar with operating within this space should do well.

Projects funded by federal dollars, in addition to the efforts of the EEOC, include additional conditions. Two are Build America, Buy America, and changes to the Davis-Bacon Act by the current Administration.

BABA is part of the $1.2 trillion Infrastructure Investment and Jobs Act passed in 2021. It applies to all federally funded infrastructure projects. To be eligible as to be labeled Made in America, a product must be produced within the United States, with at least 55% of its component costs originating from domestic manufacturing.2

Construction materials include:

Davis-Bacon Act will see change effective October 23, 2023, related to the wage rate paid to most workers in a particular classification. Learn more about the Davis-Bacon Act Change.

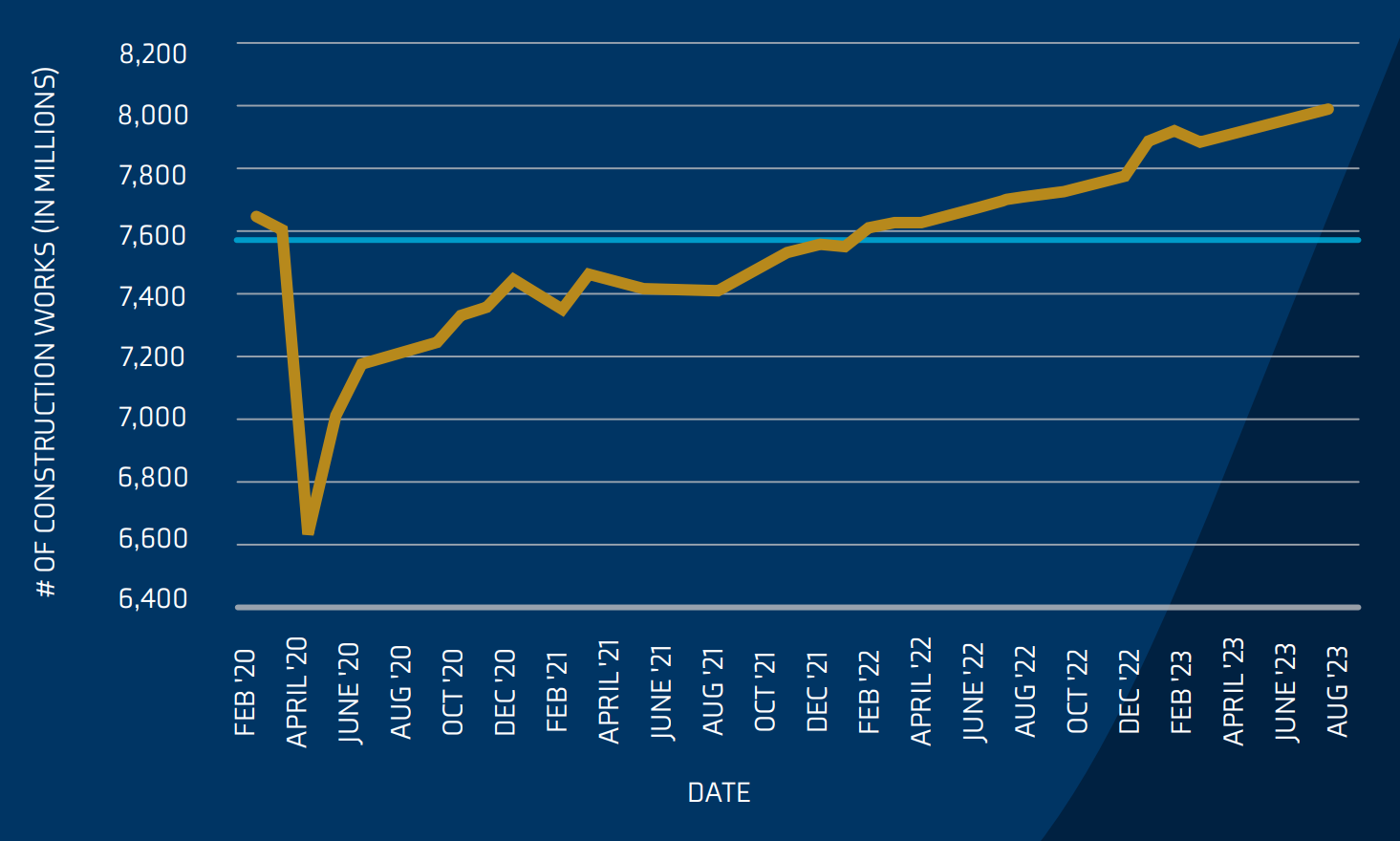

There are nearly 8,000,000 construction workers working in the United States as of July 2023. Before the pandemic, there was an all-time high of 7,600,000 construction workers employed in the industry. Most states recognized contractors as essential employees except for a few states in the Northeast.

The significance of the construction labor information provided by the U.S. Census Bureau and analyzed by the Association of Building Contractors is the 5.2% wage increase from over a year ago. Wages continue to outpace all other private-sector industries. With the advent of more federally funded construction projects and the changes to the Davis-Bacon Act, there is strong reason to believe wages will continue to increase.

On average, including part-time workers, construction workers work 38.9 hours a week compared to their counterparts in All other Private Industries at 34.3 hours per week. This trend of increasing weekly hours has been a phenomenon for several years as the construction industry grappled with a lack of skilled labor.

Be aware of continued physical and mental stress for skilled workers.

Input costs stayed flat from May to June and are down from a year ago. However, input costs are significantly up from three years ago with the recent trend line starting to decrease. Over a year ago, the one input that is up is construction machinery equipment at nearly 8%.

We turn the lens to the future state after providing insight into the current state. Luckily, the industry has several factors that allow us to look at what we can expect going forward.

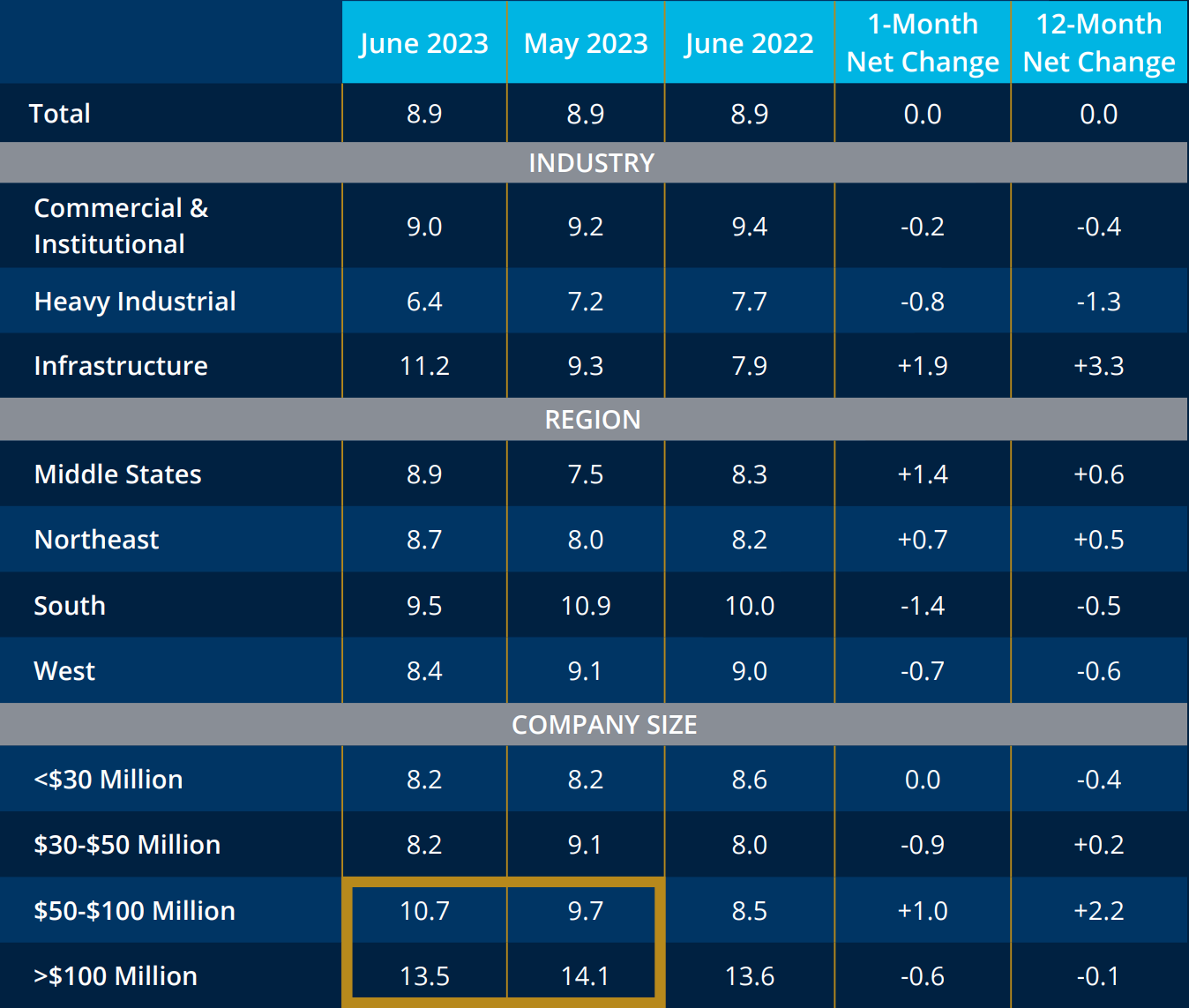

Often, the backlog can be referenced in the current state. However, we put it in the future state because it tells the story of how much work is under contract still yet to be done.

The Association of Builders and Contractors calculates the figure. On average, contractors have almost nine months’ worth of work under contract to be completed. Contractors tend to feel satisfied if the figure is eight months or greater.

Larger contractors have longer backlogs. This is not a complete surprise, as construction projects are increasing in value and larger contractors either have the bonding and/or the capability of managing those projects.

The overall backlog number of 8.9 months has held steady for the last three months. Although the figure has flattened out, the industry is still at elevated levels. This is a positive for future spending.

ConstructConnect has a database of projects, and they have recently created the Project Stress Index. This index gives us insight into the quality of the construction backlog.

Key observations include:

The Project Stress Index would suggest the almost 9 months of backlog for the construction industry is on solid footing.

| Year Ago | Week Ago | Latest | Year Ago | Week Ago | |

| Bid Date Delayed | 127.3 | 114.1 | 122.1 | -4.1% | +7.0% |

| On Hold | 139.0 | 112.2 | 105.8 | -23.8% | -5.7% |

| Abandoned | 104.8 | 101.6 | 108.7 | +3.7% | +6.9% |

| Total | 123.7 | 109.3 | 112.2 | -9.3% | +2.6% |

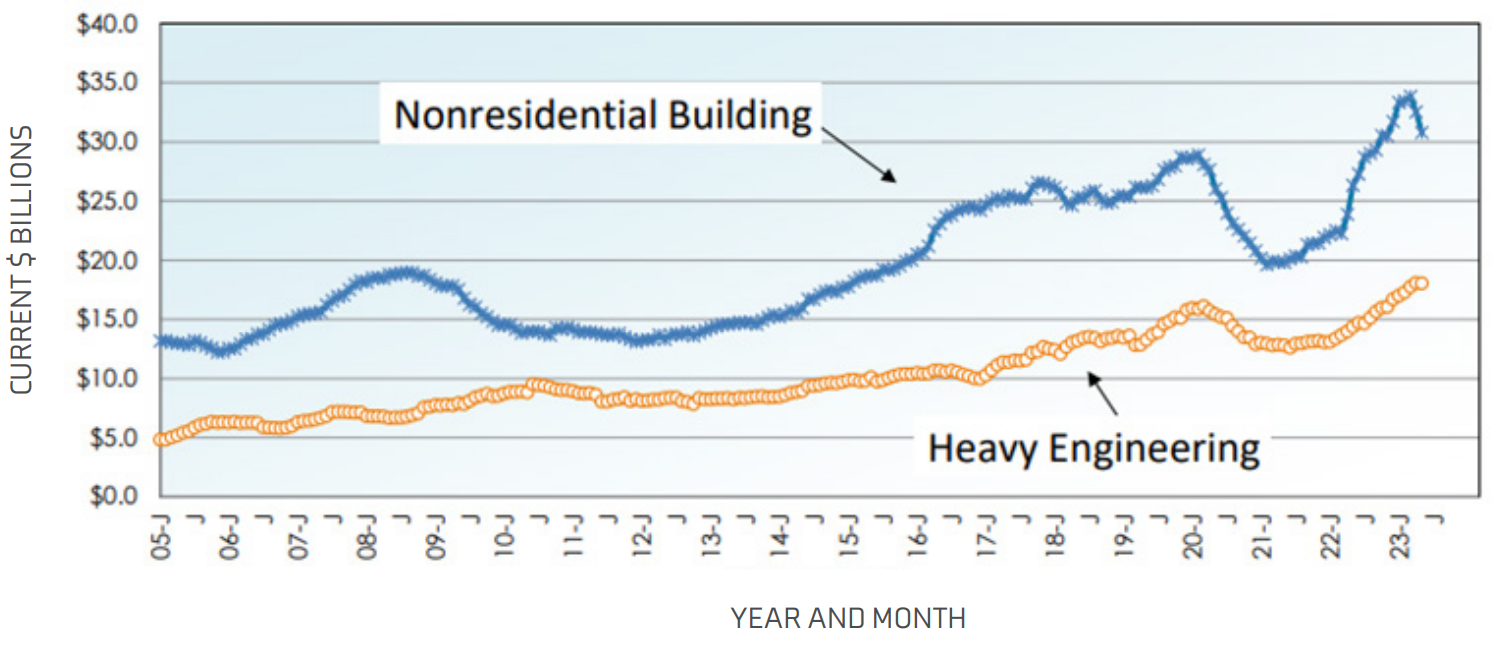

Construction Starts refers to the total project value at the project’s start date. Construction Spending is the total project value spread over the project’s scheduled duration from start to finish.3 For example, at a rate of slightly over a trillion dollars in nonresidential spending, the current state of spending reflects projects initiated around three years prior.

The construction spending curve for single-family housing starts can be spread over 9 to 12 months.

The spending for mega projects starts would be spread out over several years. The focus is analyzing construction starts to predict spending trends over the next two to three years.

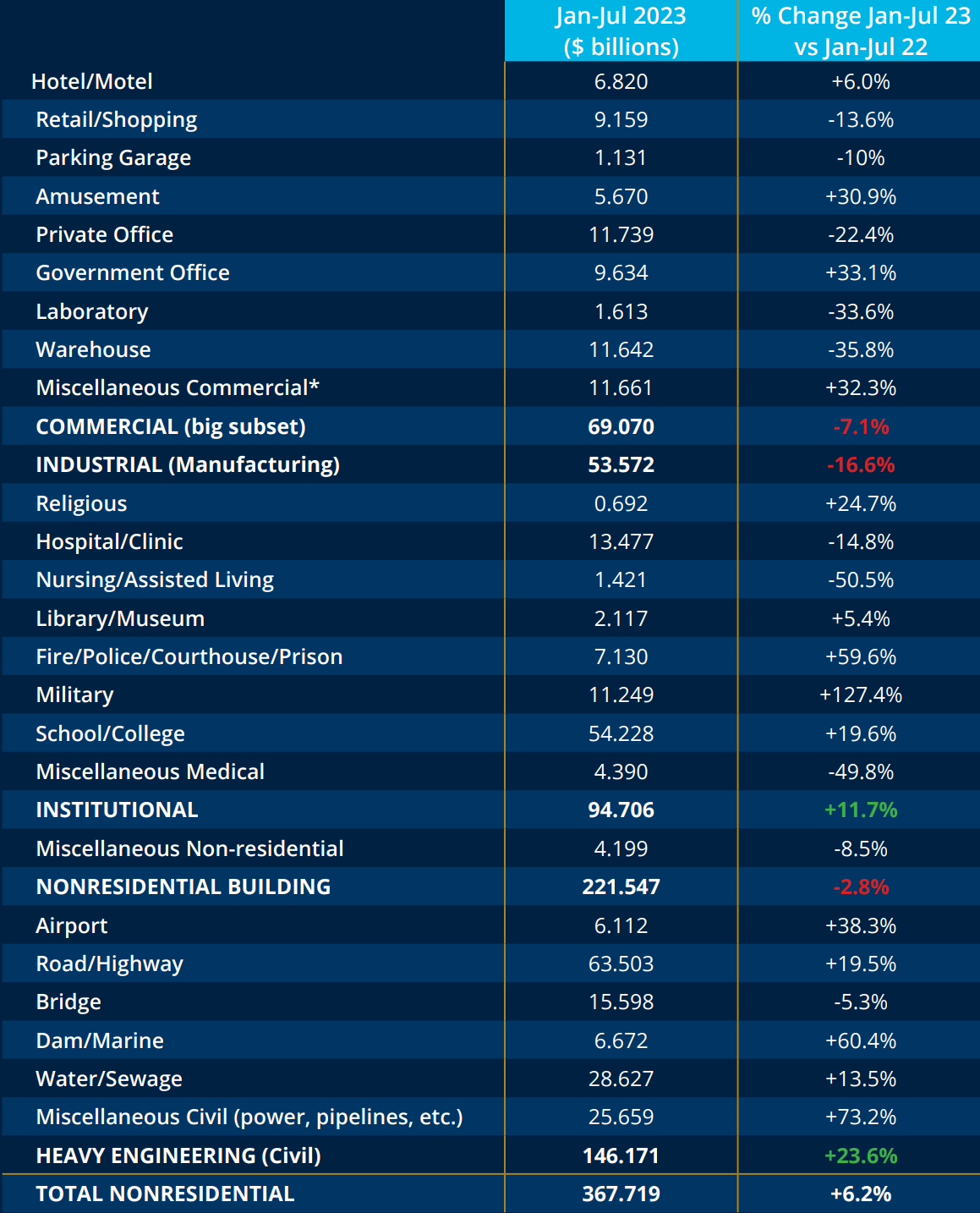

Below is a chart showing Trailing Twelve Month (TTM) Nonresidential Construction starts compared to Heavy Engineering starts as of July 2023. Over the past year, there has been a decline in nonresidential construction starts, while heavy engineering projects have been increasing. This shift is attributed to the impact of Congressional spending bills from 2021, which are beginning to affect construction starts.

There has been a decline in nonresidential construction starts, while heavy engineering projects have been increasing.

The trailing-twelve month trend and the figures above through the first seven months of the year, implies there will be more spending in the future for heavy engineering and public works. The real concern is the sectors associated with private spending given the negative starts through the first seven months of 2023. This includes a 7% decrease in commercial starts and a 16% decrease in Industrial starts. This decline in private sector construction starts will lead to reduced future spending in both the commercial and nonresidential sectors, raising concerns about the overall state of private sector spending.

Multifamily rarely gets broken out when construction starts. Data from the U.S. suggests that through June of this year, construction starts are flat compared to the previous year. Permits for June 2023 are down by a third compared to 2022.4 This permit decrease is an early indicator of potential future declines in construction starts.

Multifamily housing is experiencing strong spending, up 24% compared to the previous year. However, we anticipate a slowdown in multifamily construction, driven by factors like higher interest rates, increased insurance costs impacting project feasibility, and more stringent commercial loan scrutiny by regional banks. Despite the high demand for living spaces, the economic challenges and various headwinds are causing a cautious outlook for apartment construction.

Multifamily housing is up 24% compared to the previous year.

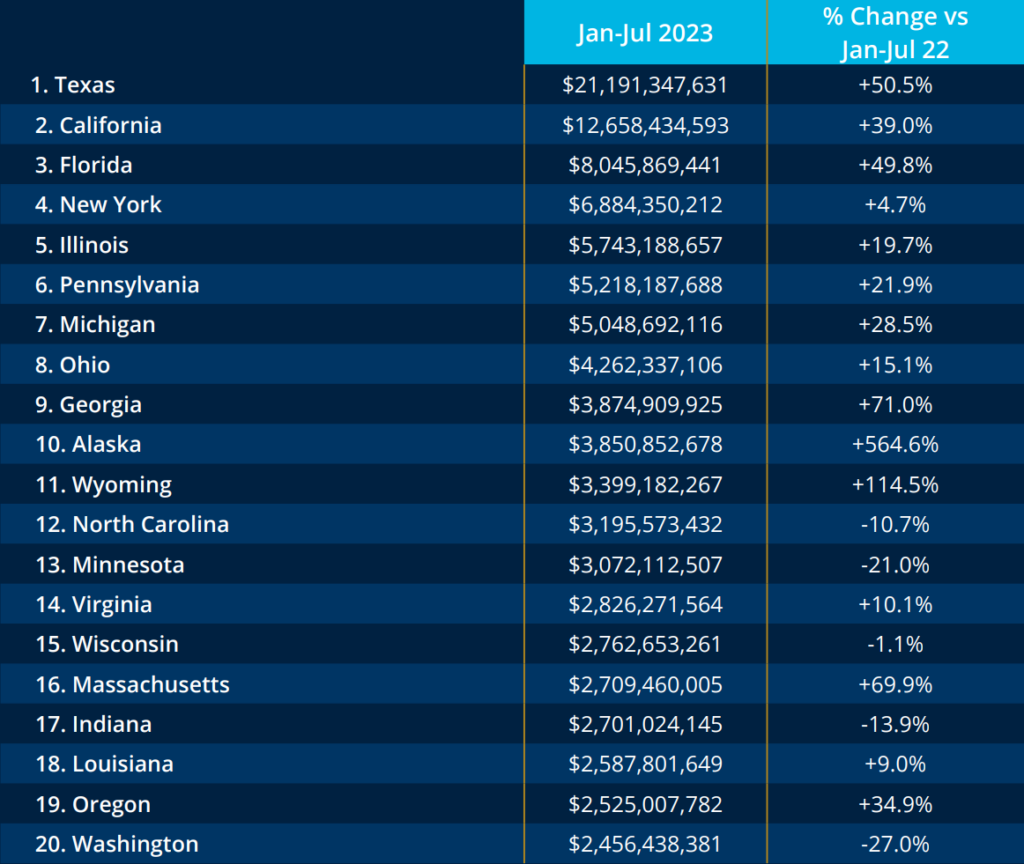

Construction starts vary by state. In California, heavy engineering civil starts have increased by 39%, while Texas has seen a 50% increase in construction heavy engineering starts over the first five months.5 These states, along with others like Massachusetts and Alaska, are experiencing significant opportunities for projects.

However, when shifting the focus to the nonresidential sector, Texas is up by 50% in heavy engineering but only marginally in nonresidential starts. This disparity in nonresidential starts raises concerns about future private sector spending. The three largest states—Texas, California, and Florida—have flat or negative private sector spending starts in the first seven months. This situation is particularly worrying for contractors working in this space and in these states. While spending will not completely dry up, the spending rate and prospects for contractors might be impacted in 2024 or early 2025 in those states.

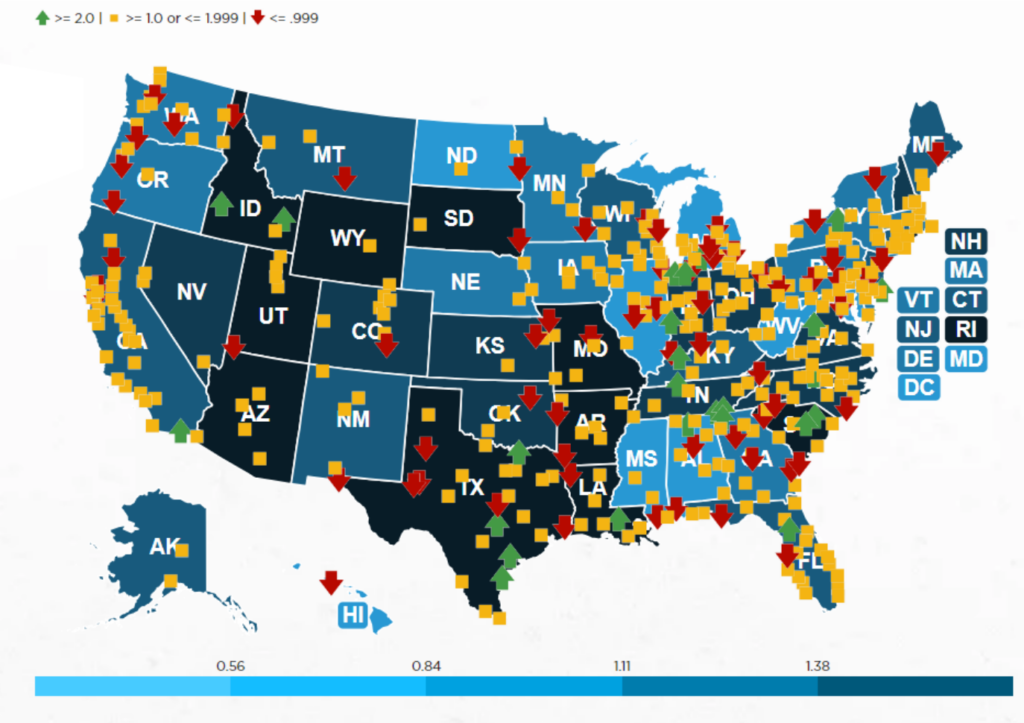

ConstructConnect developed an “Expansion Index” to evaluate projects in the planning stage by comparing the value of current-month planning projects to those of the same month in the previous year. If the ratio is over 2.0, it indicates an increasing market potential.

An index value of 1/0 indicates a market potential is flat or declining. Less than 1 suggests declining market potential. Most of the markets in America are either flat or declining in the dollar value of projects. This early indicator of construction starts would eventually lead to construction spending.

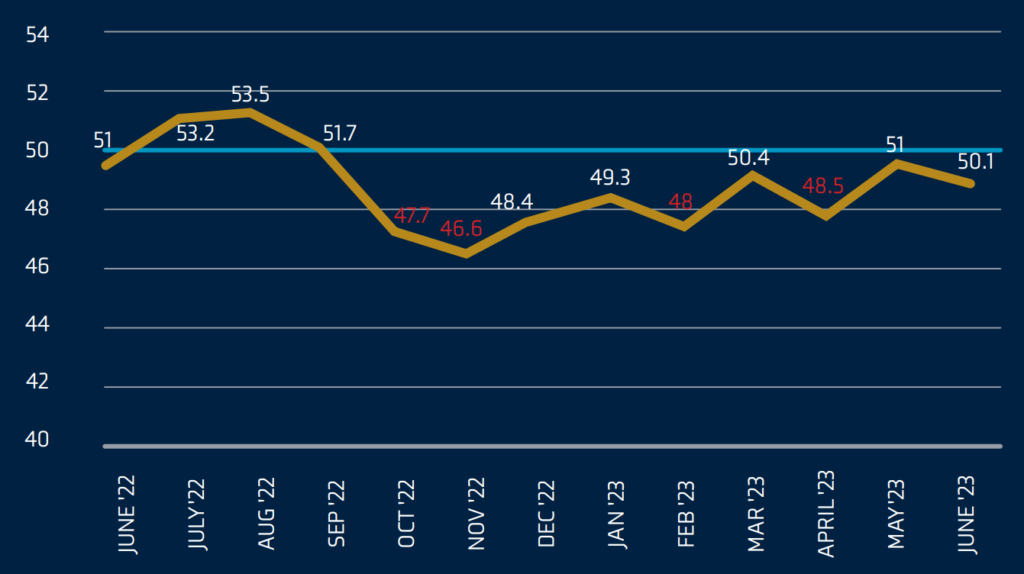

The Architectural Billing Index (ABI) is a leading indicator in the construction industry. The ABI, surveyed by the American Institute of Architects (AIA), measures whether architects are billing more or less than the previous month. If the index is above 50, it indicates growth, while below 50 suggests a decline.

It is concerning the ABI has been hovering mostly below or around 50 for nine consecutive months, indicating a lack of consistent growth in architectural billings. This lack of growth can be attributed to architects not producing as many project plans and design concepts, which could impact future construction starts. The ABI predictions is a leading indicator to construction stars which in turn affects construction spending.

The current state of construction is healthy, with total construction spending up 5.5% and Nonresidential spending up 18.1%. All categories of Nonresidential spending are up, with Manufacturing projects up 79% over last year. The industry backlog calculated by the Association of Building Contractors is 8.9 months. ConstructConnect’s Project Stress Index would suggest the quality and firmness of the backlog are sound.

Spending from public sector projects is starting to show up in the overall spending figures. This is due to multiple spending bills by Congress in 2021 and 2022. Those spending bills and changes within the Administration’s agencies have resulted in compliance risk for contractors.

These include:

In projecting the future state of construction, we rely heavily on construction start data. Construction starts signal the beginning of construction spending over time for the project. The data is consistent that heavy engineering/ public sector starts have begun to increase, suggesting greater construction spending for these types of projects in the future.

Conversely, private sector construction starts are down through the first seven months of this year, suggesting a lower spending rate in those projects tied to private spending. Single-family housing spending is down from the prior year, with higher interest rates remaining the predominant headwind. Institutional investors building single-family homes for rent provide a shot at spending.

Construction starts are flat through six months of this year for multifamily. More concerning, permits for multifamily are down by a third for the same period. This gives us concern about apartment spending headed into the second half of 2024.

Lastly, the flat-to-decline overall impression presented by ConstructConnect’s Expansion Index, coupled with the AIA’s Architectural Billing Index flat to the negative trend line for the last nine months, supports concerns the rate of private section construction spending will be a challenge in the later portion of 2024.

Angela Thompson

Sr. Marketing Specialist, Market Intelligence & Insights