Property & CasualtyInsurance Pricing & Market Update

Q4 2025

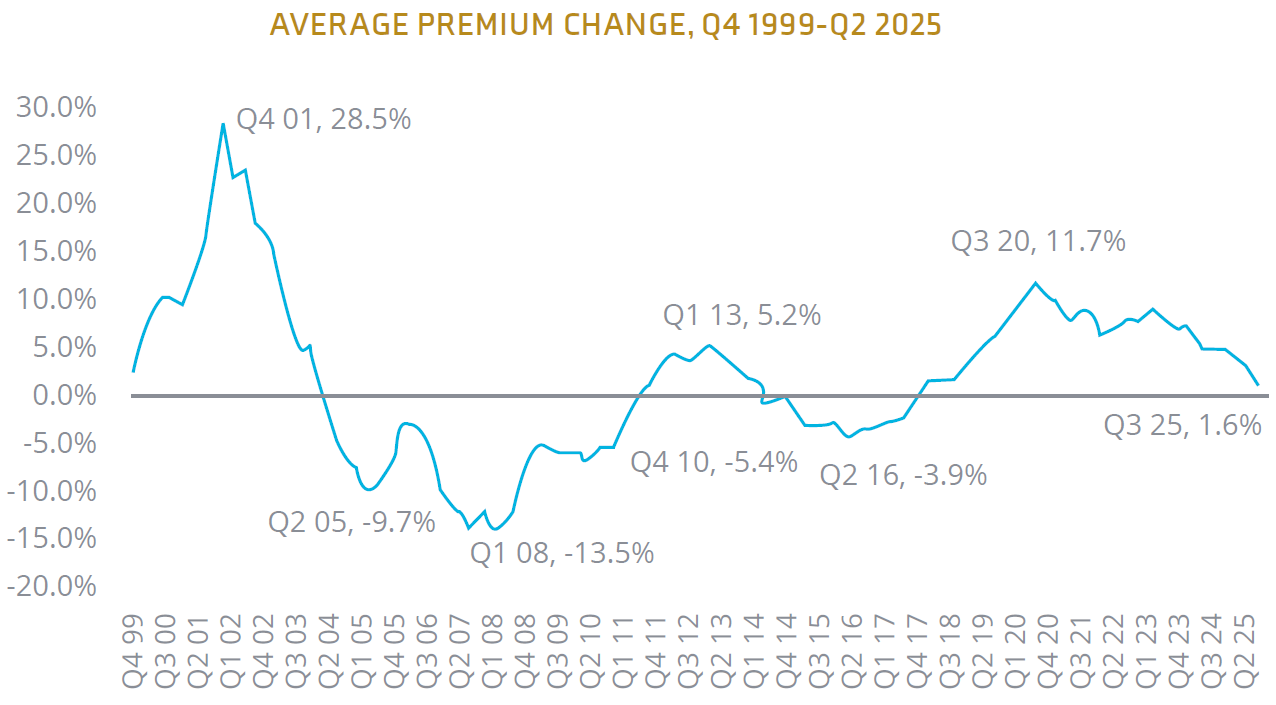

Market conditions are diverging by line of business, with overall premium growth slowing and capacity expanding. Q4 2025 will reflect a softening hard market across the P&C commercial lines sector. Despite these shifts, insurers continue to face elevated claims costs driven by inflation and social inflation, alongside persistent volatility from natural catastrophe events.

Some of the slowdown came from lines that have seen flat or decreasing premiums for several consecutive quarters: Cyber, D&O, employment practices, terrorism, and workers’ compensation. Over the past year, commercial property rates have also softened, with increases slowing considerably from the first half of 2024.

The year brought a paradox for risk managers: improving conditions in some areas while systemic challenges persisted in others. Natural catastrophe losses exceeded $100 billion globally for the sixth consecutive year, yet the relatively quiet third quarter produced less than $15 billion in insured claims— the lowest quarterly total since 2016.2 This reprieve allowed the industry to post strong profitability, with a projected combined ratio of 99.2% for 2025,3 Though this would represent a deterioration from the 2024 results.

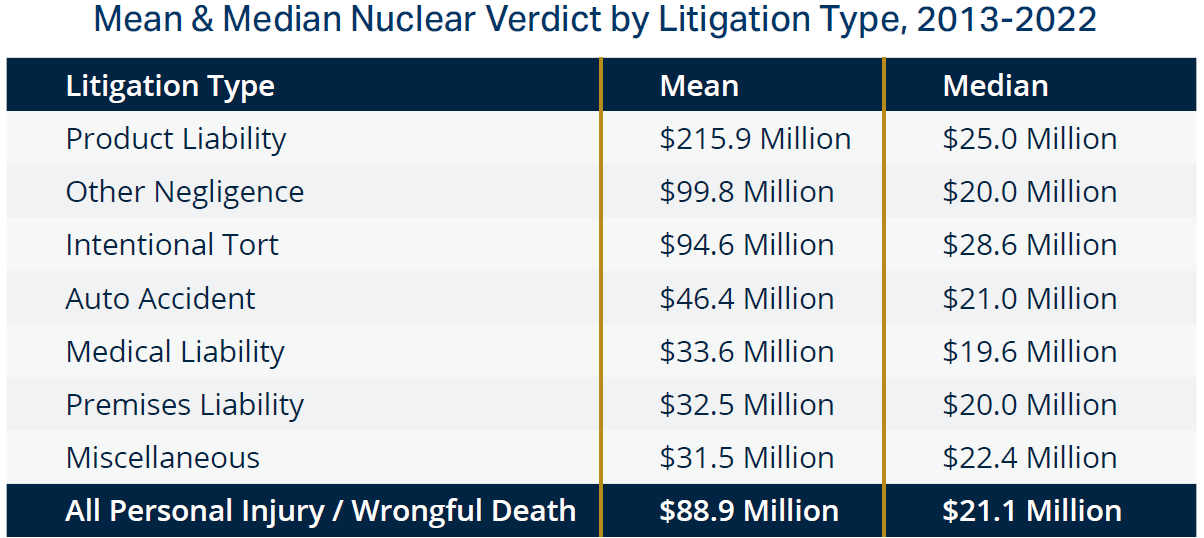

Casualty lines revealed deeper concerns beneath the surface. Products liability and other liability lines faced elevated losses, with direct incurred loss ratios climbing as social inflation continues to be an issue, forcing fundamental changes in how businesses approach liability risk. As noted, it is increasing litigation costs that have greatly affected umbrella rates but also availability, such as premiums for healthcare professionals in areas known for nuclear verdicts.4

While many casualty lines face a challenging environment, workers’ compensation continues to be a bright spot, delivering continuous profitability, even with rate decreases. The stability of this line provided crucial budget relief for businesses navigating uncertainty in other lines.

Profitability and Growth

Profitability in the U.S. Property & Casualty insurance sector are forecasted to peak, with growth continuing to moderate. Expanded capacity—stemming from strong underwriting performance—is contributing to competitive pricing and easing rate momentum. Based on statutory data through the first half of 2025, projections show an average sector return on equity of 12% in 2025 and 10% in 2026. Premium growth is forecasted to decline to 3% next year as heightened competition follows this year’s outperformance.

Federal Disaster Policy Changes

Federal disaster policy changes could fundamentally alter risk financing for many organizations. The proposed Fixing Emergency Management for Americans Act would increase FEMA’s disaster threshold from $1.89 to $7.56 per capita, potentially shifting $41 billion in recovery costs to state and local governments over sixteen years, according to The Urban Institute.5 Businesses may face reduced federal assistance for minor disasters, emphasizing the need for comprehensive property coverage and business continuity planning.

National and Geopolitical Factors

National and geopolitical factors add another layer of complexity across several industries, including pharmaceutical, energy, and manufacturing. The potential for continued tariffs-induced trade wars and instability could push up claims costs, affecting everything from property replacement values to supply chain coverage needs.6 As construction costs have surged in recent years, continued labor shortages, partly due to federal immigration policy, may pressure insurable values and replacement cost calculations for construction-industry companies.

Market Outlook for 2026

Pricing is expected to remain steady and insured-friendly for the first half of 2026, with average premiums renewing flat to -5% for clean risks. The second half of 2026 is uncertain, with macroeconomic factors like increased bankruptcies, regulatory confusion, and rising defense attorney costs potentially influencing market conditions.

The property insurance market is showing signs of increasing competition, particularly in excess and surplus lines (E&S). E&S carriers will likely continue facing competition for catastrophe-exposed accounts, with rate decreases of roughly 10% becoming common, according to Business Insurance.7 This competitive dynamic may accelerate through the first half of 2026, creating opportunities for businesses to secure broader coverage terms and reduced pricing.

| Middle Market | Down 1% to Flat |

| Large/National/Shared & Layered Accounts | Flat to up 2.9% |

General Liability

| General Liability | Up to 2.7% |

Excess Liability

Umbrella and commercial auto continue to see the highest rate increases among casualty coverages. Driven by a persistently challenging legal environment with large settlements and nuclear and thermonuclear verdicts, umbrella premium increases reached double digits, up over 4% in one year.

| Umbrella & Excess Liability | Up 5.5% |

Workers’ Compensation

| Workers’ Compensation | Down 1.9% |

Auto

| Auto | Up to 7.4% |

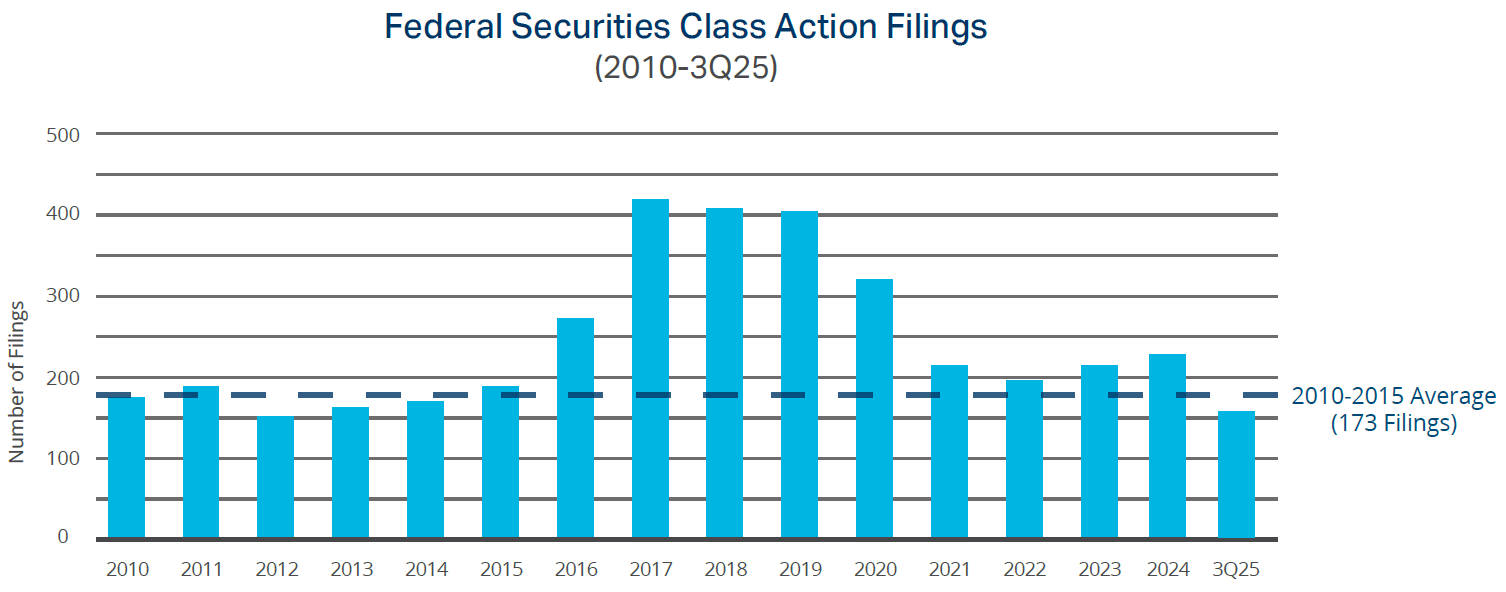

Directors & Officers (D&O)

Public

Private

Cyber

Technology-related risks are under increasing scrutiny. Third-party risk is a growing cyber concern as threat actors focus more attacks on exploiting vulnerabilities in interconnected networks such as supply chains and vendors that serve critical customer bases. As AI becomes more deeply embedded in core business operations, ethical concerns—particularly around bias, privacy, and security—will emerge. Without comprehensive federal AI regulations in the U.S., companies will continue to take the lead in establishing responsible AI practices to earn stakeholder trust and mitigate risk. Expect carriers to continue investing in tech to improve operations, service, and profits.

| Cyber | Down 2.6% |

Liability challenges will likely intensify as tort reform efforts continue across multiple states. Between 2013 and 2022, the median nuclear verdict saw a sharp rise, reaching $21 million, with some cases, particularly in product liability, seeing verdicts soar to even greater awards. In 2022, the median verdict in product liability cases alone peaked at an astounding $36 million—a 50% increase compared to 2013.18 Florida, Texas, Georgia, Utah, and South Carolina have all enacted laws spanning a range of reforms from targeting procedural tactics and damage awards to sweeping systemic changes. Critics charge that these reforms may limit legitimate claims, but the overall impact of these reforms won’t be immediately clear, especially as the reforms are enacted piecemeal across some states, while others, like Illinois, Oregon, New York, and California, have strengthened laws favoring plaintiffs. Nationwide, three case types made up two-thirds of nuclear verdicts in personal injury and wrongful death cases from 2013-2022: product liability (23.3%), auto accidents (23.2%), and medical liability (20.3%):

$966 MILLION AWARD

Decedent was exposed to asbestos via a company’s product. She developed mesothelioma and passed away. Jurors awarded $966 million.20

$106.4 MILLION AWARD

Plaintiffs were riding in a limo, which got into an accident; one plaintiff was rendered quadriplegic. The accident was caused by a construction zone that lacked proper warning signs. Jurors awarded $104.6 million.21

$70.8 MILLION AWARD

Plaintiff had a stroke; however, the hospital did not conduct a CT scan, prescribing medication for a headache. Plaintiff experienced blood clots that led to a stroke, causing permanent damage to her brain and some paralysis. Jurors awarded $70.8 million.22

Partner with your broker early to prepare for any changes to increase greater renewal success.

It is important to work with your broker’s industry experts, who understand the business and the market when placing the specific risk. Collaborating with a team that can best represent your risk and partner with your operations is critical than ever in this disciplined market we are experiencing.

IMA has a team solely dedicated to managing cyber risks. They offer expert assistance, including coverage analysis, financial loss exposure benchmarking, contract language review, in-depth cyber threat analysis, and strategic development of comprehensive, high-value cyber insurance programs.

Our contract review teams add value to our clients’ overall risk management program by ensuring the indemnity language is market standard and doesn’t expose our clients to unforeseen losses that may not be insurable.

Jason Patchen | EVP, National Director of Carrier Relationships

Margie Yamat | VP, Corporate Marketing Manager Carrier Relations

Erik Wargo | EVP, Head of Property

Sonja Gunther | SVP, Workers’ Compensation Specialist

Will Brownlee | SVP, Managing Director-Executive Risk Solutions

Angela Thompson | Marketing Strategist, Market Intelligence & Insights

Brian Spinner | Senior Marketing Coordinator, Market Intelligence & Insights