Property & CasualtyInsurance Pricing & Market Update

Q2 2025

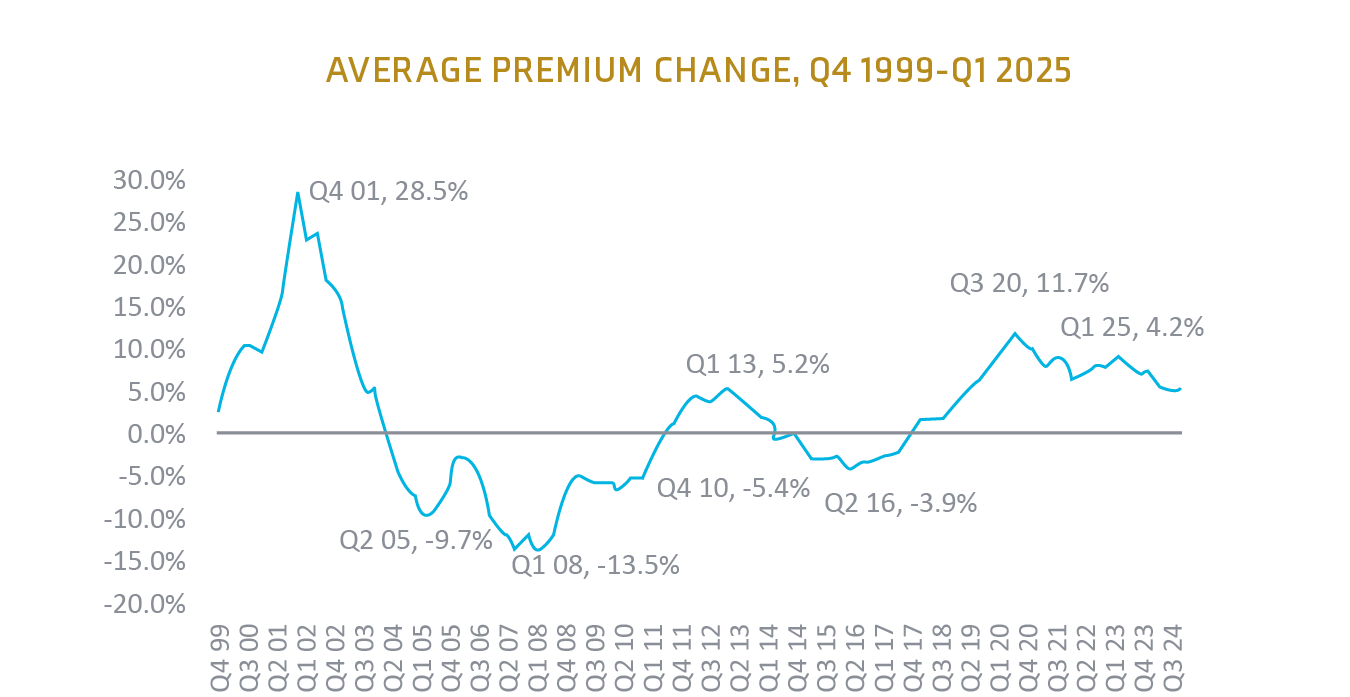

The first quarter of 2025 saw a softening of market conditions as most lines of business experienced lower premium increases and some recorded decreases. While premiums across all account sizes rose an average of 4.2%, marking the 30th consecutive quarter of increases, this was a notable 22% decrease from Q4 2024, when premiums increased 5.4%.1 Due to increased competition and flexibility from underwriters, medium-sized accounts slowed the most, growing just 3.6%, a 42% decrease from Q4 2024.

Catastrophic (CAT) losses continue to rise, with 2024 global losses of $137B on par with the 5% to 7% growth rate seen since 2017.2 North America accounted for nearly 80% of losses in 2024 due to the region’s exposure to secondary perils such as floods, wildfires, earthquakes, and convective storms, which are primary drivers of coverage losses.3 The year began with the CAT Los Angeles wildfires, with losses currently estimated at $40B, of which $30B is in residential claims. Swiss RE estimates this would generate around a 200% loss ratio for homeowners’ insurers in California. There have been several outbreaks of severe convective storms this winter and spring, including one occurrence that spawned an E3 tornado that touched down in St. Louis on May 16, killing five people and causing damage to 5,000 buildings.4

In April, Georgia passed comprehensive tort reform with two bills, SB 68 and SB 69,5 which will significantly impact organizations doing business in the state, filing lawsuits in the state, and third- party funding of lawsuits.

This legislation follows similar laws enacted in several other states and mirrors the comprehensive statutes passed by Florida in 2023. Over the past few years, states have been taking up the issue, and the outcomes vary according to state legislature prerogatives, political atmosphere, and timing.

Along with Georgia and Florida, Indiana and West Virginia enacted cap limits and other tort reforms. At the same time, Colorado and New Hampshire increased damage caps in 2025. But the progress is more muddled than successful, as several states have plodded through legislation sessions without enacting any legislation, whether limiting or raising caps or whose governors successfully vetoed bills. The results in Florida should buoy the hopes of tort reform advocates, as the state saw a marked decline in nuclear verdicts since enacting its legislation.

Source: S&P Global P&C Industry6

The U.S. property and casualty industry 2024 reached its lowest net combined ratio in over a decade, posting a net combined ratio of 96.5%, its best annual performance since 2013.7

This is a significant improvement from 2023, when the industry’s realized a combined ratio of 101.6%.

The improvement comes from better underwriting results in personal lines, which saw a 10% year- over-year improvement. By contrast, commercial lines decreased slightly in the same period.

Overall, improvement in underwriting may fluctuate as the impacts of tariffs create a challenging environment for the P&C insurance industry, driving higher costs, evolving risks, and market changes while presenting opportunities for innovation and adaptation.

| Middle Market | Down 5% to Up 8% |

| Large / National / Shared & Layered Accounts | Down 10% to 35% |

Source: CIAB Commercial Property/ Casualty Market Index Q1 202512

General Liability

| General Liability | Up 4.2% to 9% |

Workers’ Compensation

Auto

| Workers’ Compensation | Down 2.6% |

| Auto | Up 10.4% |

Excess Liability

| Umbrella & Excess Liability | Up 9.5% |

Cyber

Directors & Officers (D&O)

| Cyber | Down 2.1% to Flat |

| D&O Liability | Down 1.7% |

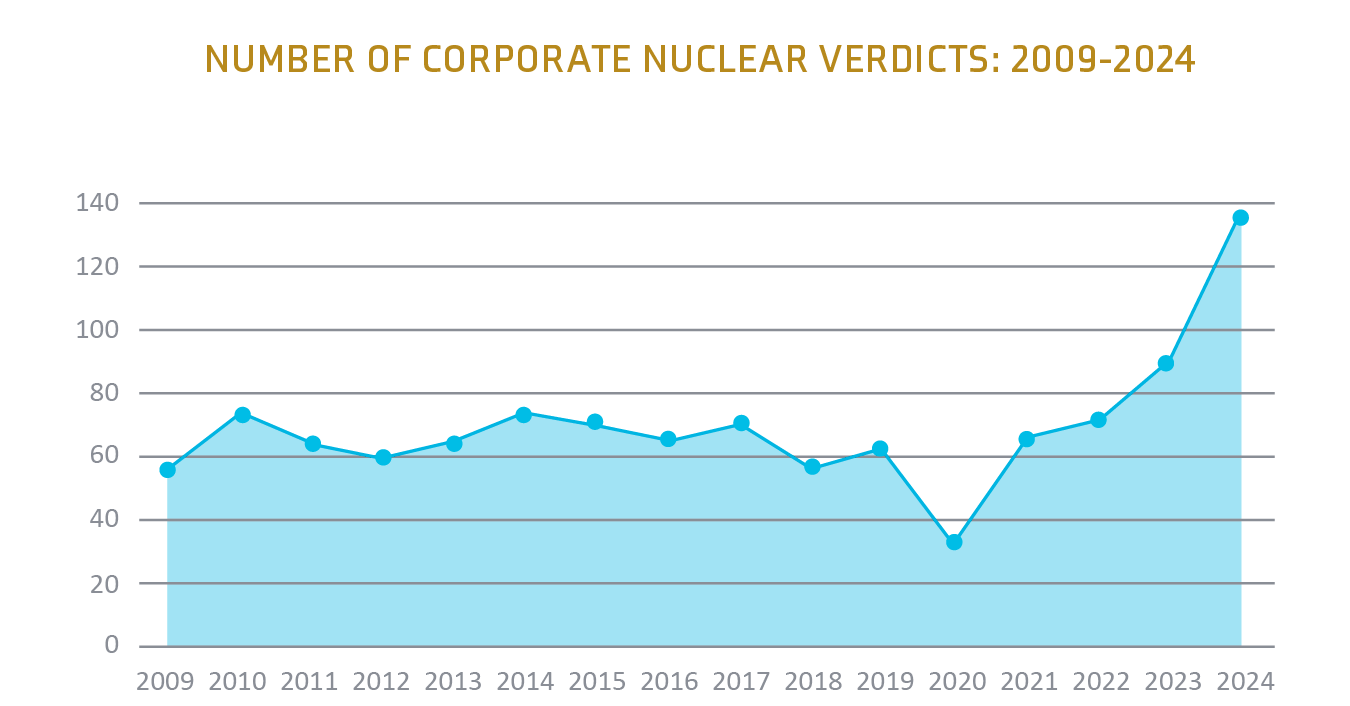

In 2024, nuclear verdicts—those exceeding $10 million—against corporate defendants surged to a record high of 135 cases, marking a 52% increase from 2023 and the highest number since 2009.21 These verdicts totaled $31.3 billion, a staggering 116% increase in one year. The median verdict climbed to $51 million, up from $44 million in 2023. A wide array of industries were impacted by beverages, movies, entertainment, fertilizers, and agricultural chemicals, among the hardest hit. These verdicts spanned 34 states and 77 courts, with Nevada leading due to significant product liability cases. Meanwhile, after comprehensive tort reform, Florida saw a decline, dropping from the second to the tenth position in nuclear verdict rankings.

Source: Marathon Strategies Corporate Verdicts Go Thermonuclear23

Partner with your broker early to prepare for any changes to increase renewal success.

It is important to work with your broker’s industry experts who understand the business and the market when placing the specific risk. Collaborating with a team that can best represent your risk and partner with your operations is more critical than ever in this disciplined market.

When placing the specific risk, it is important to work with your broker’s industry experts who understand the business and the market. Collaborating with a team that can best represent your risk and partner with your operations is more critical than ever in this disciplined market.

Our contract review team adds value to our clients’ overall risk management program by ensuring the indemnity language is market standard and doesn’t expose our clients to unforeseen losses that may not be insurable.

Jason Patchen

SVP, National Director of Carrier Relationships

Margie Yamat

VP, Corporate Marketing Manager

Erik Wargo

EVP, Head of Property

Sonja Gunther

SVP, Workers’ Compensation Specialist

Donna MacConnell

SVP, Managing Director Claims – Contractual Risk

Angela Thompson

Sr. Marketing Specialist, Market Intelligence & Insights

Brian Spinner

Sr. Marketing Coordinator, Market Intelligence & Insights