Unlocking Insights:Effective Data Collection Methods for Risk Management | Part 3

Feb 5, 2025

Effective data management relies on integrity and a reliable data collection tool. Whether you’re using an off-the-shelf risk management information system (RMIS) or a custom-built solution, it’s essential to fully understand how your system functions and manages data flow.

The claims reporting process involves sending data to a third-party administrator (TPA) or carrier and, in many cases, receiving crucial claims information in return. This includes confirmation of receipt, claim numbers, financial details, and standardized coding for causes, injuries, body parts, and OSHA flags. As claim codes are updated regularly, ensure your system has a process for timely updates to maintain accuracy and compliance.

To evaluate your current process, map out each step from the initial incident to the final claim closure. Understand all the various steps in the process to be in a better position to be able to suggest changes and efficiencies.

Some of the most common methods of capturing incidents include:

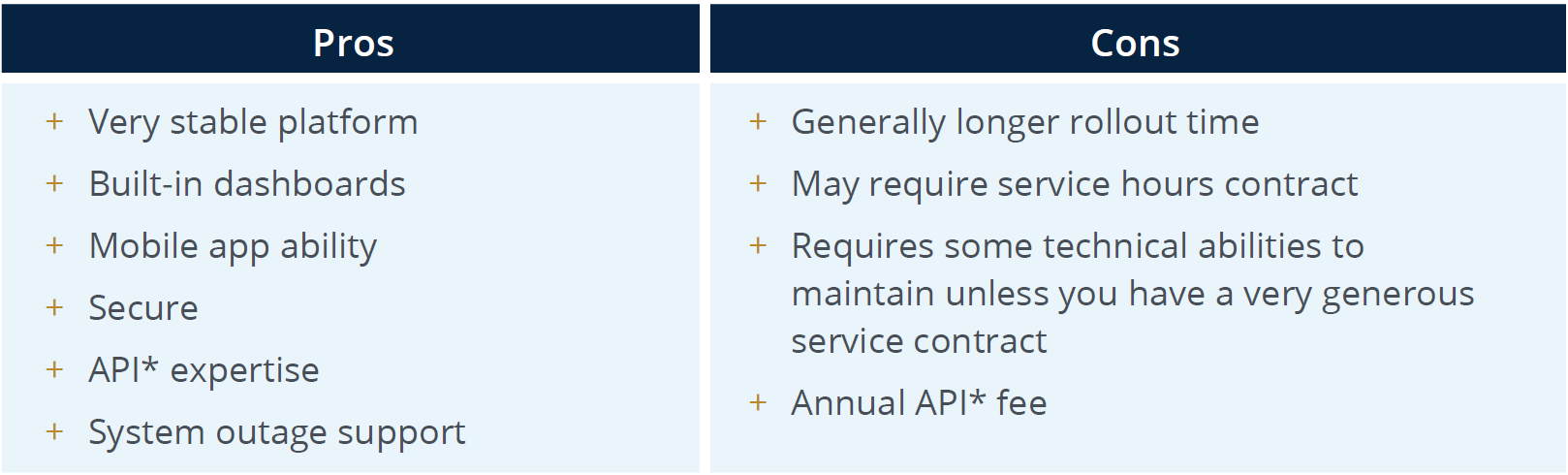

Several reputable software companies offer off-the-shelf RMIS solutions. These programs are typically robust, customizable, and equipped with additional features—some of which you may not require. Plan responsibly for future needs, but make sure to fully utilize the features you’re paying for. Choose a provider that aligns with your current requirements and capabilities. *API stands for application programming interface, which is a set of rules that allow software applications to communicate with each other. APIs are a way for developers to integrate data, services, and capabilities from other applications. An example would be establishing an API feed between your RMIS system and your HR system to pull down employee demographic when an incident occurs.

*API stands for application programming interface, which is a set of rules that allow software applications to communicate with each other. APIs are a way for developers to integrate data, services, and capabilities from other applications. An example would be establishing an API feed between your RMIS system and your HR system to pull down employee demographic when an incident occurs.

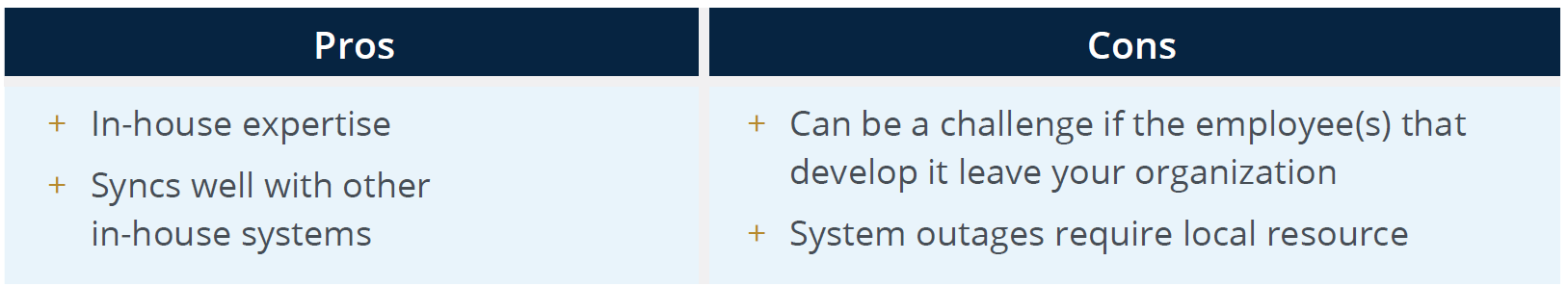

In-house systems, often developed by your programmers or tech-savvy team members, can be an excellent option—especially if that expertise remains within your organization. These custom-built solutions are typically tailored to integrate seamlessly with other tools and systems already in use.

Maybe you can’t justify the expense of a third-party software program and maybe you don’t have the in-house resources to be able to build your own. Leveraging your carrier or TPA’s resources for claims data management can be an excellent solution when you are operating on an extremely limited budget. However, it is vital to ensure this claims intake process captures all necessary information.

Each method of data collection has various pros and cons, making the right fit for each organization different.

Regardless of the method you choose, here are a few things to keep in mind:

By focusing on these areas, you can build a strong foundation for your data collection program that helps you create a stronger safety culture.

It is impossible to list every factor to consider, and there is a lot to think about in the information above. The key takeaway is to extract your data monthly, examine it closely, and ensure it’s clean. Pulling it out of the system in Excel allows you to easily sort by key fields to understand how it’s being populated. As you find errors, you can actively fix them in your system and put tools into place to prevent them from reoccurring.

Set the standard by leading through example, allowing other companies to measure themselves against you rather than comparing yourselves to them.