IMA Compliance Alert

Oct 30, 2017

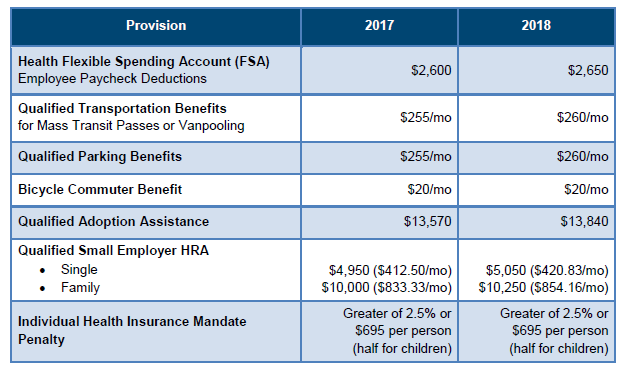

IRS Revenue Procedure 17-58 includes indexing of several values for 2018. Below we summarize the changes most likely to be of interest to employers.

As we projected in our last bulletin, the flexible spending account (FSA) salary reduction limit is increasing $50. Plan years beginning on/after January 1, 2018 may allow salary reductions up to $2,650. Remember that short FSA plan years must pro-rate that limit.

Qualified small employer health reimbursement arrangements (QSEHRAs) were created in December 2016 by Congress to allow certain small employers that don’t wish to sponsor health benefits to give employees tax-free money to purchase their own health coverage. We discussed the many rules that must be followed in our bulletin following passage of that law. The allowed tax-free amounts are indexing $200 for individuals and $250 for families in 2018.

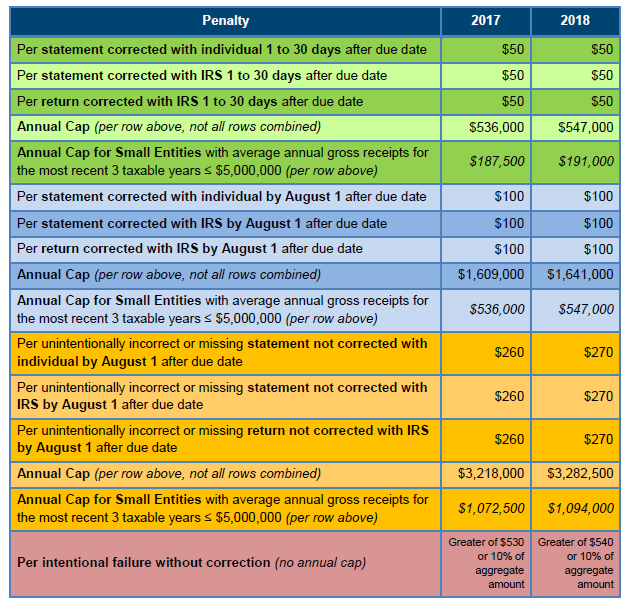

Penalties on tax forms (W-2/W-3, 1094/1095, 1099, etc.) index every year as well.

IMA will continue to monitor regulator guidance and offer meaningful, practical, timely information.

This material should not be considered as a substitute for legal, tax and/or actuarial advice. Contact the appropriate professional counsel for such matters. These materials are not exhaustive and are subject to possible changes in applicable laws, rules, and regulations and their interpretations.