Executive Risk SolutionsQuarterly Update | January 2026

Jan 27, 2026

Coverage litigation focused on whether a particular claim is related to a prior event or claim is becoming increasingly common – and problematic. As highlighted here, the financial consequences of an excess insurer taking a different position than underlying insurers on an insurance program can be dire for policyholders.

In 2017, two shareholder lawsuits were initiated and tendered to the then applicable directors’ and officers’ liability (D&O) policies. The primary insurer as well as the first excess insurer accepted coverage and eventually paid their policy limits. The second excess insurer denied coverage, claiming the 2017 litigation was barred by the prior notice exclusion.

The backstory here began in 2013 when the policyholder’s accounting methods were questioned. Investigations from regulatory agencies ensued and a ‘notice of circumstances’ was submitted under the insured’s 2014-2015 D&O program. The notice described accounting irregularities outlined in a letter published by an investment firm. Two years later, the policyholder ended up disclosing that its financials were unreliable and would need to be restated, which brought about the shareholder lawsuits mentioned above. The allegations at the heart of both cases were the restatement of earnings for 2014 to 2016.

Following the denial of coverage by the second excess insurer, the policyholder filed this declaratory judgment action seeking reimbursement of amounts incurred in defense of the shareholder suits. The federal district court for Delaware upheld the denial of coverage, relying on the Delaware Supreme Court’s recent decision In re Alexion Pharmaceuticals, Inc. Insurance Appeals, 339 A.3d 694 (Del. 2025). That case held “the proper analysis is whether the securities lawsuit is meaningfully linked to any of the wrongful acts disclosed in the 2015 notice.” (It just so happens the relevant notice was tendered in 2015 in this case as well as Alexion.) Having found a ‘meaningful link’ between the conduct described in the notice of circumstances and the shareholder lawsuits, the prior notice exclusion in the 2017 excess policy acted to bar coverage.

The end result here was a claim only being partially paid despite there being no gap in coverage. With the primary and first excess insurers on the 2017 D&O program having paid their limits, coverage under the 2014 D&O program (including the second excess layer) would not be triggered. Unfortunately, by seeking to preserve coverage under the 2014 program through a notice of circumstances, but then pursuing coverage under the 2017 program made up of different insurers, the policyholder was left holding the bag when the claim was deemed factually related to the earlier notice.

The best way to prevent situations and losses like this are to work closely with your broker on whether and when to report a claim or circumstance to an insurer. And, once that is done, to review any subsequent claims with an eye towards whether there is any meaningful link to wrongful acts identified in the prior notice.

In addition, maintaining a stable lineup of insurers on a program is another defense. Without any insurer on the tower being able to argue a claim arose before their ‘time on risk’, this problem could have been avoided. Amtrust Financial Services, Inc. v. Liberty Insurance Underwriters Inc. 2025 WL 2720960 (D. Del. September 24, 2025).

A recent case out of the Southern District of Texas offers us another opportunity to emphasize the pitfalls of submitting a ‘notice of circumstances’ under claims made liability policies, as well as who is entitled to the proceeds thereof.

In this case, two former executives of an entity seeking bankruptcy protection asked the court to authorize payments under D&O insurance for defense expenses. The Trustee appointed to oversee the bankruptcy objected, claiming the insurance and proceeds thereof were assets of the estate. The Trustee submitted a letter to the D&O insurer on December 14, 2023, purportedly providing notice of a Claim and potential Claims. That notice was the basis upon which the Trustee asserted the D&O policy proceeds should not be accessible by the former executives.

After holding the policy was an asset of the estate, the court took up the issue of whether the Trustee’s 2023 notice was valid in creating an interest in the policy proceeds. While it provided full details of wrongful acts and potential damages, it failed to identify potential claimants or the manner in which the insureds first became aware of the wrongful acts. As such, the court found the notice failed to meet policy requirements for advising the insurer of potential future claims.

“[B]ecause the Trustee failed to show she placed the Insurer on notice of any Claims made against any of the Debtors implicating Side C Coverage – and because such notice was required to obtain Side C Coverage – the Trustee has failed to show that any Debtor has a covered Claim under the Policies’ Side C Coverage resulting in the estate having no interest to the Proceeds of the Policies under Side C Coverage.”

The court also rejected the Trustee’s position that any potential recovery against the former executives that would be paid from the policy proceeds creates a ‘limited circumstance’ under the bankruptcy code rendering the proceeds property of the debtor’s estate. In essence, the Trustee’s prosecution of claims against the former executives does not convert the proceeds into property of the estate. In addition, the court found the automatic stay halting any ongoing litigation against the debtor upon the commencement of the bankruptcy proceedings was inapplicable to the former executives, allowing the insurer to assess coverage and advance defense costs per the policy terms. In re: Mountain Express Oil Co., 2025 WL 3030303 (Bankr. S.D. Tex. October 29, 2025).

Another case involving objections from an excess D&O insurer did not turn out in its favor. A lawsuit was filed naming an insured company along with several individual executives. The claim was tendered under their D&O policy and accepted for coverage. The lawsuit eventually settled for $42,750,000. Because the lawsuit did not involve the insured’s securities, no coverage existed for the insured entity. Under the primary policy’s terms, an allocation of covered and uncovered losses was therefore required. The insured reached agreement with the primary insurer to pay eighty percent of defense costs incurred and subsequently settled with the first and second excess insurers after initiating arbitration over the dispute.

The third excess insurer took a hard line approach, even going so far as to argue the policyholder’s subsidiary lacked standing to assert claims under the policy. The arbitration panel ultimately determined the total loss to be $55,963,951, comprised of $42,750,000 in settlement proceeds along with $13,213,951 in defense costs. Even after finding New York’s ‘relative exposure’ rule to be the proper framework under which the settlement should be assessed, it found the insurer liable for the entire $10,963,951 outstanding. The insurer fought confirmation of the award in federal court. In a lengthy opinion that paints a troubling picture of the excess insurer’s conduct, Judge Engelmayer of the Southern District of New York rejected nearly all of the insurer’s arguments in support of vacating the award. Finding the settlements reached with the underlying insurers to be protected settlement communications, the third excess insurer was not allowed to use those agreements as evidence of proper allocation or course of dealing.

“The panel held that using best efforts means doing a reasonable job to accomplish an allocation, and held that Flex (the insured company) had done so in its dealings with Allianz.” It further rejected the insurer’s argument that the same offers of compromise extended to underlying carriers must be made to the excess insurers. “[A]t various times after its interim deal with XL [the primary insurer], Flex offered 80%, 75% and 65% allocations to settle. And, the panel found, Flex had communicated fully with Allianz as to key developments…The panel therefore found that Flex had acted reasonably and met the best efforts requirement of [the policy] to try and determine a fair and proper allocation.” Moreover, because the insurer had not met its burden of proving what amount of the settlement should be excluded from coverage, the policyholder was awarded the full amount sought. The court went on to authorize an award of costs against the insurer for advancing frivolous arguments. Flextronics International, Ltd. V. Allianz Global Corporate & Specialty SE, 2025 WL 3168187 (S.D.N.Y. November 13, 2025).

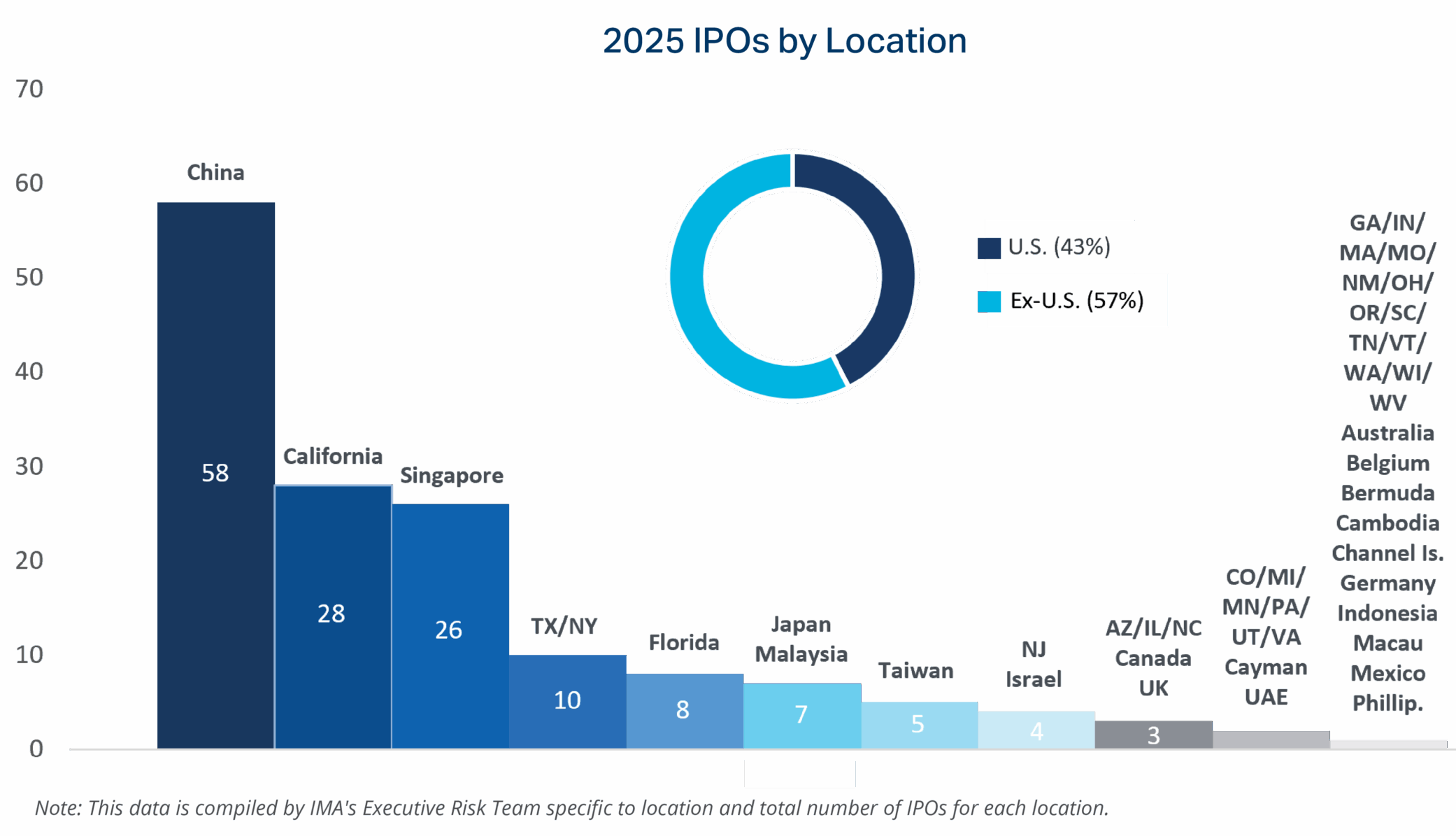

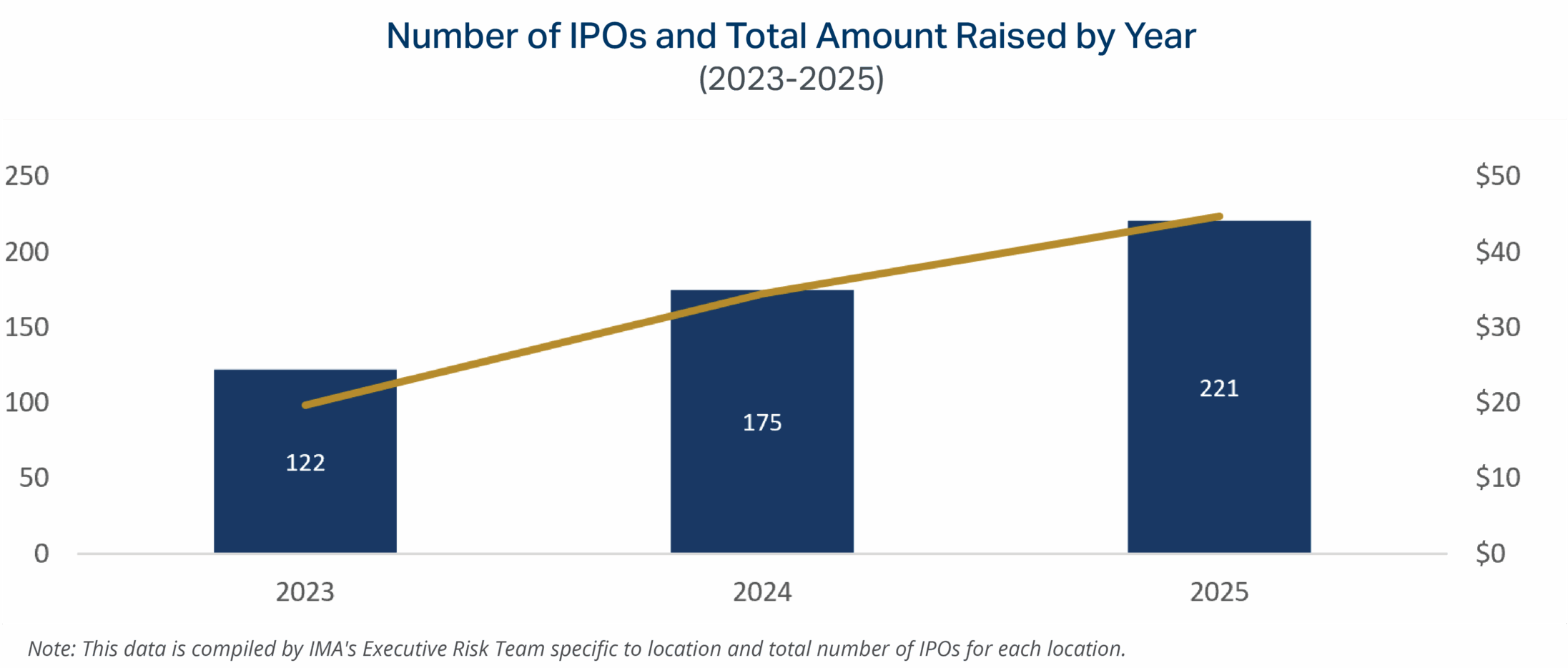

2025 was a fairly active year for new public company formations, with 221 companies going public via an Initial Public Offering (IPO) or direct/uplisting on a U.S. exchange (excluding SPACs). More than half of these companies are based outside the U.S., with 26.2% based in China. This is the third year in a row of increasing IPO activity.

In addition to a 26.3% year-over-year increase in the number of IPOs, 2025 also saw a nice increase in the amount of funds raised in these offerings, with an average amount raised in excess of $200 million per IPO.

Early indications suggest 2026 may be another strong year for IPO activity. We will continue to monitor this and provide updates as appropriate.

Brian R. Bovasso

Executive Vice President &

Managing Director

IMA Executive Risk Solutions

303.615.7449

brian.bovasso@imacorp.com

Travis T. Murtha

Director of ERS Claims

IMA Executive Risk Solutions

Legal & Claims Practice

303.615.7587

travis.murtha@imacorp.com

Justin M. Leinwand

Product Leader

IMA Executive Risk Solutions

303.615.7773

justin.leinwand@imacorp.com

Daniel Posnick

Transactional Liability Leader

IMA Executive Risk Solutions

303.615.7747

daniel.posnick@imacorp.com