Reminder to File and Pay PCOR Fees by July 31

Each June we provide a reminder for employers to ensure the Patient Centered Outcomes Research (PCOR) fee is filed and paid by July 31 on IRS Form 720.

- Insurance companies file and pay this for their insured medical plans, but employers whose insured plan is integrated with a health reimbursement arrangement (HRA) need to file and pay

separately for their HRA. - Employers with self-funded plans are responsible to file and pay on their own.

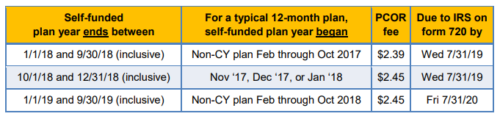

Below is a table of fees and due dates. Since the fee is based on plan year END date, we also offer an idea of when such ordinary 12-month plan years would begin, but be aware that short plan years need to be calculated based on the plan year end date (not start date) at the full rate (no pro-rating). Good news is since a large portion of employers have a calendar year plan, this July may be the last time to file and pay! Employers with a plan year ending between 1/1/19 and 9/30/19 will have to file and pay once more in July 2020, but everyone else is done after this summer’s filing. We are certainly happy to walk our IMA Benefit clients through more detailed instructions as needed on the counting methods, recordkeeping, etc.

IMA will continue to monitor regulator guidance and offer meaningful, practical, timely information.

This material should not be considered as a substitute for legal, tax and/or actuarial advice. Contact the appropriate professional counsel for such matters. These materials are not exhaustive and are subject to possible changes in applicable laws, rules, and regulations and their interpretations.