Executive Risk SolutionsQuarterly Update | January 2024

Feb 22, 2024

In March of 2022, the Securities and Exchange Commission (SEC) indicated its intent to issue climate rules requiring publicly listed companies to disclose certain climate risks. Perhaps most notably, the so-called Scope 3 emissions that account for greenhouse gases released in the atmosphere from a company’s supply chain would have to be disclosed if deemed “material” or if the registrant had set reduction targets. However, this month, Congressional hearings before the House Financial Services subcommittee revealed that any such rules would likely face legal challenges. This comes after private meetings between industry representatives and the SEC revealed fierce opposition to the proposed rules. While the agency believes the proposed rules are important information for investors in making investment decisions, significant opposition has arisen, arguing the rules would be unduly burdensome. Even some climate advocates have expressed concerns about the logistical challenges of accurately calculating Scope 3 emissions.

Following recent U.S. Supreme Court decisions striking down the Environmental Protection Agency’s rules under the Clean Power Plan and the Department of Education’s rules regarding forgiveness of student loans, the SEC has seemingly recognized any such rules are vulnerable to legal challenges. This also comes after the Court heard oral arguments regarding the authority of the National Maritime Fisheries Services to issue binding rules. These cases can all be tied together under the Chevron doctrine, whereby courts are supposed to defy agency statutory interpretations. The SEC’s rule-making authority will likely face further legal challenges if the Court strikes down the Chevron doctrine. As a result, the SEC may wait until the Court issues an opinion on the legality of the Chevron doctrine before issuing its proposed Scope 3 emissions rules.

In mid-December 2023, the Supreme Court of Delaware reversed a lower court ruling that upheld coverage for claims brought following a spinoff transaction that resulted in bankruptcy and creditor lawsuits. The crux of the decision involved whether state law fraudulent transfer claims brought by the bankruptcy trustee were derivative claims or direct actions. The Superior Court held such claims to be derivative. The Delaware Supreme Court disagreed, rendering the $95 million settlement and $24 million in defense costs excluded from coverage under the D&O insurance for which coverage had been sought.

In 2008, Verizon spun off certain landline assets to a new entity named FairPoint. Unable to service its outstanding debt, the new entity filed for bankruptcy protection eighteen months later. Under the reorganization plan, a litigation trust was created to resolve creditors’ claims. Fraudulent transfer claims were then pursued in North Carolina state court to recoup over $2 billion Verizon had received from the spinoff transaction. Verizon subsequently agreed to pay $95 million to the trust to settle the case. Coverage for $24 million in defense costs and the settlement were pursued under two separate insurance towers. One tower was explicitly procured for the spinoff transaction, while the other tower was Verizon’s own D&O insurance. Both primary layer policies contained an identical definition for “Securities Claims.” Coverage was denied under both programs, and this litigation ensued.

In explaining the reversal, the Delaware Supreme Court was forced to address another insurance dispute between Verizon and its insurers where a similar question of contract interpretation had recently been decided on appeal. In the Idearc insurance case, the Superior Court found fraudulent transfer claims to qualify as Securities Claims. The Supreme Court also reversed in that case, finding that the fraudulent transfer claims were not brought under laws regulating securities, as was required in the Securities Claim definition. In the FairPoint case, the Superior Court took pains to distinguish that the definition of Securities Claims was not the same as in the Idearc case. It reasoned that a clause at the end of the definition adding the phrase “relating to a Securities Claim as defined in subparagraph (1) above” meant Verizon did not need to meet the ‘regulating securities’ requirement pronounced in the Idearc opinion for coverage to apply.

The error identified by the Supreme Court here was not whether fraudulent transfer claims arise from laws regulating securities but that such claims are not derivative in nature. “Fraudulent transfer claims are direct, not derivative, because the creditors suffered the harm caused by the fraudulent transfer, and the remedy benefits the creditors, not the business entity.”

As such, the claims did not meet either definition of Securities Claim. They were not brought under laws regulating securities or brought derivatively by shareholders. The Court further found that the language speaking to bankruptcy in the policy did not expand the definition of a securities claim.

Verizon’s decision to settle the FairPoint case and seek insurance coverage for the settlement and defense costs ended up costing far more than expected, with neither the transaction-specific policies nor the Verizon D&O program affording coverage.

This is certainly not the desired result from a policyholder perspective, especially given that policies were explicitly procured for the transaction and claims that might arise.

However, it is yet another example of – and further support for – our often-stated assertion that words matter. Unfortunately for Verizon, better policy language exists that most likely would have afforded coverage for any costs related to both the Idearc and FairPoint disputes. Perhaps for Verizon, the third time will indeed be the charm.

In re FairPoint Insurance Coverage Appeals, 2023 WL 8658850 (Del. Supr. December 19, 2023).

This case asked the Delaware Superior Court to determine whether an investigation of a public company by the SEC met the definition of a Securities Claim in the company’s D&O insurance program. Similar to the case above, it was also tied to a different case the Court was forced to address in its decision.

The insured, Hertz Global Holdings, Inc., initially brought suit in Federal Court in New York against its primary and first excess D&O insurers, both of whom issued policies with limits of $15 million. Defense costs incurred by Hertz totaled approximately $27 million. After a finding of no coverage was given by that Court, a settlement (the terms of which are not provided) was reached while the case was appealed to the Second Circuit Court of Appeals. Hertz then initiated a separate case in Delaware state court against its second excess insurer. Without elaborating on the issue of exhaustion of the underlying policies, Hertz claimed it was owed the second excess insurer’s total policy limits.

The insurer initially sought to have the New York federal court enjoin any other litigation until the appeal was decided. In refusing to do so, the Court opined that the issue of collateral estoppel was for the Delaware court to determine.

On motions for summary judgment, the Delaware Superior Court found that collateral estoppel applied because the second excess policy followed the primary layer policy, precluding Hertz from re-litigating the issue of coverage for the entity. Collateral estoppel did not preclude Hertz from seeking coverage for Insured Persons because the New York federal court only made that determination as an alternative holding. However, with no subpoenas being issued in the investigation and the letter initiating the investigation being addressed to the company (and not to any insured persons), the Court needed help finding it was not a Claim against Insured Persons. The Court also rejected attempts to tie the defense costs incurred in the investigation to other litigation for which coverage was presumably not in dispute.

When an insured faces litigation and investigations for which coverage remains unclear or subject to an allocation of covered and uncovered costs, working with a skilled broker whose claims experts can assist in negotiating a favorable result with the insurers is of utmost importance.

Hertz Global Holdings, Inc. v. Alterra American Insurance Co. n/k/a Pinnacle National Insurance Co., 2023 WL 8716803 (Del. Sup. December 18, 2023).

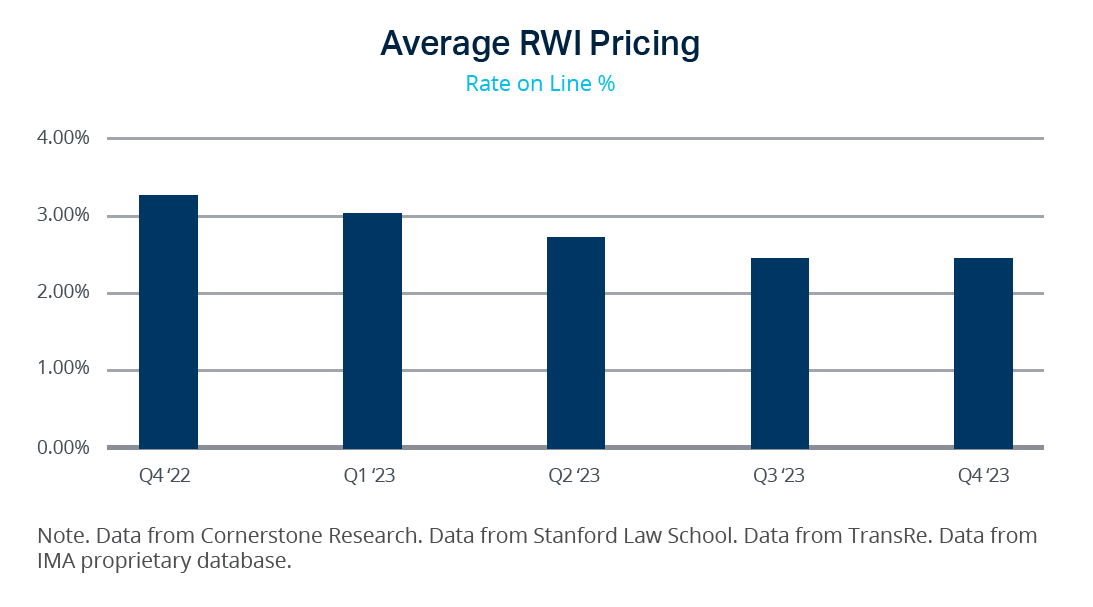

At the end of 2023, several prominent RWI carriers, including AIG, Liberty, and Euclid, released claim studies, much of which are consistent with IMA’s internal data. A review of this information helps understand the current landscape of RWI claims but can also be used as a tool to underscore the value of using RWI policies in M&A transactions.

One key takeaway is that claims frequency continues to be consistent, with roughly 20% of bound RWI policies resulting in a notice of claim. The most common alleged breaches include financial statements/ accounting, compliance with laws, material customers and contracts, employment, and IT-related. Compliance with law breaches arise more frequently in smaller transactions, which may be attributable to lesser internal controls at the target company. Intellectual property and tax breaches are alleged more frequently for more significant deals, likely because of their greater complexity in portfolios and schemes.

Several leading carriers indicate that roughly 60% of their loss dollars paid stemmed from deals with purchase prices under $250 million, supporting the need for RWI policies in the small to mid-market space. Additionally, they report that approximately 50% of claims paid were noticed initially more than 12 months post-close. Without an RWI policy, buyers would typically have no recourse for such claims following a traditional seller indemnity release at 12 months post-close.

To be noticed is the question of whether carriers are paying RWI claims. AIG reports that it has spent more than $1.4 billion in claims since it began underwriting RWI in 2003, with Euclid reporting that it has paid $561 million since launching in 2016. Liberty offers that it has paid or reserved 100% of initial loss amounts paid in 43% of its claims and more than 50% of the amount claimed in 82% of its claims.

Brian R. Bovasso

EVP & Managing Director

IMA Executive Risk Solutions

303.615.7449

brian.bovasso@imacorp.com

Travis T. Murtha

Director of ERS Claims

IMA Executive Risk Solutions

Legal & Claims Practice

303.615.7587

travis.murtha@imacorp.com

Daniel Posnick

Transactional Liability Leader

IMA Executive Risk Solutions

303.615.7747

daniel.posnick@imacorp.com