Digital RiskEconomic Overview & Market Update

Q4 2024

The digital assets, blockchain, web3, DeFi, and metaverse sectors experienced significant developments in 2024 that have reshaped the risk landscape and highlighted the urgent need for tailored insurance solutions. As these industries continue to mature, their rapid growth has also exposed new vulnerabilities, bringing attention to the critical role that insurance must play in mitigating risks. This year has seen major regulatory shifts, technological advancements, and high-profile incidents, directly impacting how insurance is structured and priced for companies operating in this space.

Key Industry Events Impacting the Insurance Market

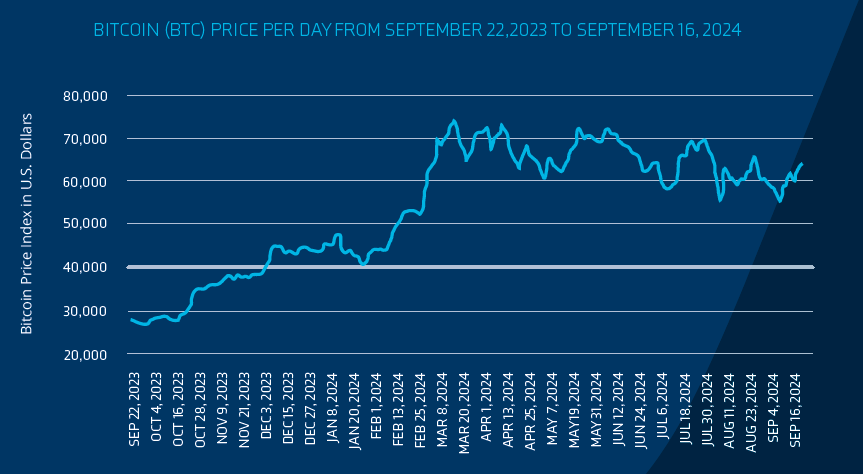

Following a few turbulent years, two long-awaited events helped spark a Bitcoin rebound. In January, U.S. regulators approved 11 Spot Bitcoin ETFs, and on April 19, Bitcoin halved to 3.125BTC. The day after it halved, Bitcoin’s value reached $73,844, nearing its all-time high of $75,830 set on March 14, 2024.

Unfortunately, Bitcoin’s early-year momentum did not carry through into the year’s second half. While Bitcoin stabilized in 2024, it did not sustain its first-half momentum. Bitcoin’s value has hovered between $55,000 and $65,000 since April, and the Spot ETFs have underperformed. However, cryptocurrencies may realize improved growth in 2025 now that the Fed has begun lowering interest rates. The past 10-year history of crypto and interest rates shows a correlation between the two.1 Still, market growth may be what defines crypto in 2024.

Source: Statista.com. accessed September 23, 2024.2

Stability in the price of Bitcoin offers insurers increased confidence in the industry at large, particularly for BTC mining companies. While property insurance rates remain higher than average for this industry, they continue to decrease compared to past years. This line of insurance tends to be the most expensive overall, so a reduction in rates is a positive development. Additionally, the D&O insurance market has continued to stabilize and maintain favorability for buyers. For larger publicly traded BTC miners, the wave of class actions and new regulations could impact this line of coverage in terms of pricing and coverage capacity.

Key insurance considerations:

The blockchain industry continues toward wider market adaptation, and advancements in interoperability continue to be vital in realizing the broader use of this technology. As solutions mature to allow data transmission throughout blockchain decentralized ecosystems that are secure, scalable, fast, and collaborative, more and more developers are creating apps for use in everything from finance to Internet of Things.3 Blockchain as a service is an evolving opportunity for companies who want to utilize this technology without managing the service in house.

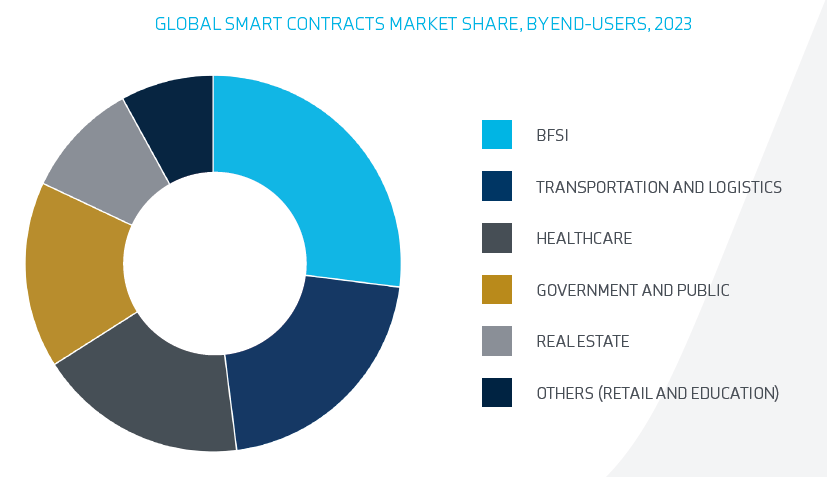

Smart contracts technology realized significant growth in 2024 and is expected to continue over the next several years. Its market is projected to be $2.14B in 2024 and reach $12.55B in 2032. Improving interoperability is driving the current growth, and several industries, including finance, healthcare, and logistics, are already adopting smart contracts. Prospects for its applications are expected to improve for most private industries and government agencies.

While the market for non-fungible tokens, or NFTs, continues to drop in the near term, there is hope that this technology will rebound and become an integral part of web3.4

Source: Medium. May 20, 20245

As web3 and blockchain become more mainstream, finding insurance for companies in this sector has become easier than in previous years. Costs are still elevated for many of the critical lines of insurance, but new markets are interested in providing options for this industry – which will help drive the cost down over time. Smart contract failure is a unique aspect of this space and not all carriers offer affirmative coverage for this exposure. Having a detailed audit of all smart contracts a company utilizes helps insurers underwrite the exposure and will aid in the balance of premiums and pricing.

Key insurance considerations:

The DeFi ecosystem continues to mature, presenting new opportunities for innovation as the use of technology fits into the broader financial ecosystem. Traditional financial institutions are recognizing the potential of DeFi and integrating it into their operations.6 While DeFi was originally a way to allow peer-to-peer digital financial transactions safely, it is now capable of offering everything from basic savings accounts to providing access to a broader range of traditional investment opportunities.7 One reason for this adoption is the improving technology around crypto bridges, helping blockchains interact with each other and improving interoperability that allows users to transition assets to level 2 networks.

There is an increased focus on security measures and regulatory compliance around DeFi, emphasizing the importance of safeguarding DeFi ecosystems. Enhanced security protocols, audits, and adherence to evolving regulatory frameworks are critical factors for sustaining the growth and adoption of DeFi.8

This remains a difficult sector for insurance. Only some insurance companies are willing to take on this risk, especially for larger players in this segment. Often, finding the capacity for the total amount of risk to transfer is a challenge. Many of the larger companies in DeFi and CeFi have developed captive insurance options, as traditional risk transfer is limited.

Key insurance considerations:

While expectations for the growth of the Metaverse have diminished over the past couple of years, it still projects to be a substantial market – around $1.6T by 2030. Investments into AI technologies might have taken dollars and focus away from the Metaverse in 2023. Still, AI technologies from content creation to customer experience are expected to eventually propel a large part in the virtual world’s real-world growth.9 Yet, with AI playing an important role in building out the Metaverse, it also brings all of AI’s problems, such as security and user biases.

There is growing agreement that there should only be a singular Metaverse, one space with a set of standards to ensure interoperability. Nearly three dozen companies, consortia, and developer organizations launched the Metaverse Standards Forum to ‘foster the development of open standards for the metaverse’.10

Metaverse and gaming companies should expect a challenging underwriting process, though options are available. User data protection and safety are paramount, so companies should highlight their efforts there. IP and copyright protection is also of significant importance. As this industry creates standardizations, it will become easier to evaluate – as the current decentralized nature combined with hundreds of different protocols makes it difficult for insurers to underwrite adequately.

Key insurance considerations:

The insurance landscape for digital risk continues to mature. Even as technologies evolve, data that helps underwriters create customized products to fit each sector and an organization’s needs is becoming available. While new insurance options continue to open, underwriters are looking for control thresholds to be met.

It remains critical to be as transparent as possible with your broker and the insurance marketplace to unlock the best combination of coverage and cost. Brokers specializing in this space understand how to translate complex technology into simple terms that the market can understand.

Keys to success with upcoming insurance renewals/placements include:

Start Early

Insurance placements in this space can take longer than other industries, often substantially so. To expedite the process, provide full information, completed application, and any requested supporting data.

Highlight Controls and Executive Experience

Insurers’ chief concerns for digital risks include cyber and board oversight. Having a solid cybersecurity program will impact coverage availability and affordability.

Work with Experts

The marketplace for digital risk remains fragile. To navigate it effectively, it’s crucial to understand how your insurance broker can leverage their market and industry expertise to represent your needs. Poor coverage design is unlikely to perform correctly in the event of a claim.

As the digital asset and blockchain industries continue to mature, so too will their insurance options. Until then, preparing for the complex process of obtaining the right insurance program is essential for long-term protection.

Garrett Droege

SVP, Director of Innovation + Digital Risk Practice Leader

Angela Thompson

Sr. Marketing Specialist, Market Intelligence & Insights

Brian Spinner

Sr. Marketing Coordinator, Market Intelligence & Insights