Hospitality Markets In FocusInsurance Pricing & Market Update

Q3 2025

Contrary to the optimistic economic forecasts that emerged in Q1 of 2025, the hospitality sector is looking at a more sobering reality for the year. Industry experts and executives predicted that 2025 would mark a turnaround for hotels, restaurant, and casinos, with expectations of increased traffic, sales, and profitability in-house that would drive investment and acquisition activity. However, early optimism has dimmed as economic turbulence and operational challenges reshape the business landscape for restaurants, bars, hotels, and casinos.

Several major hotel companies have downgraded their 2025 RevPAR guidance in Q1 earnings reports, citing ongoing economic uncertainty.1 This trend was further reinforced when CoStar and Tourism Economics downgraded their 2025 and 2026 growth projections for U.S. hotel top-line performance metrics amid “elevated macroeconomic concerns.” These downgrades signal a fundamental shift from the sector’s initial confidence to a more cautious, risk-aware posture.2

Both domestic and international travel to the U.S. is down. U.S. consumers have pulled back on spending, which has had an impact on travel but not as great on dining out. The decline in international travel seems directly related to change in U.S. policies under the current administration contributing to a growing wave of negative sentiment toward the U.S. among potential international travelers. Within the hemisphere, travel to the U.S. from Canada and Mexico has plunged over 25% and while travel from Europe and UK contracted over 11%.3

Restaurants have experienced an uneven year so far, showing signs of growth in sales even with a decrease in traffic,4 yet forecasts predict a bearish outlook for the second half of the year.5 Employment is up, particularly in limited service, quick-service, and fast-casual establishments, while full-service restaurant employment remains below pre-pandemic levels.6 While the uncertainty of tariff policies looms heavily over the industry, analysts and executives still forecast modest growth overall for 2025, expected the increase to take place in Q3 and Q4.7

The hospitality industry remains a high frequency target of cyber-attacks due to the to the large volume of sensitive customer data handled and stored. The average cost of a data breach in the hospitality sector reached $3.36 million in 2023, a 14% increase from 2022. In May, Krispy Kreme released information about a data breach the company discovered in late November 2024. The company reported thatover 160,000 people were affected by the event, with both customer and employee information at risk including social security numbers, financial data, IDs, and health records. Krispy Kreme said the event affected operations at some locations and estimated costs incurred so far to be $14 million, which, the company said will be covered in part by its cyber insurance policy.8 Despite the risks that technology brings, the industry is leaning into AI as a means to enhance customer experience both online and instore. The expectations are brands will employee less workers while relying more third-party businesses to gain improvements in efficiencies for inventory, management, with the eye to reduce costs.9 New technologies may also provide increased security, with AI employed for secure connections and blockchain encryptions for storing data.

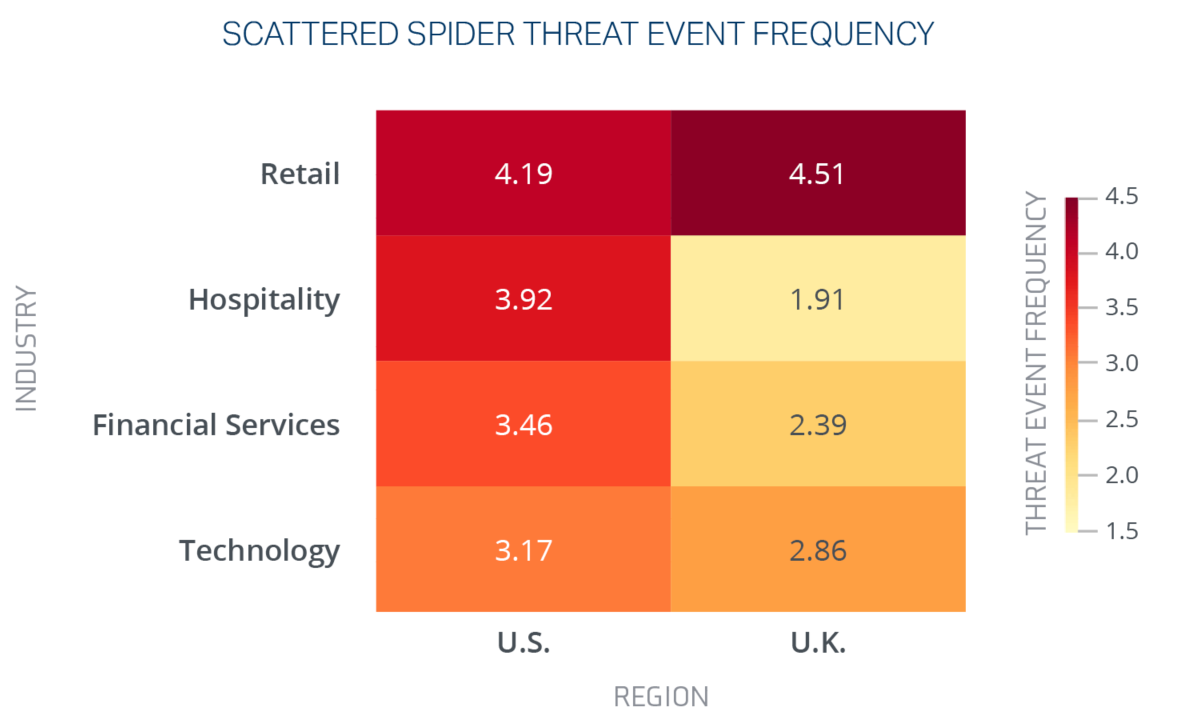

One of many cyber-criminal organizations, ALPHV and its subgroup Scattered Spider exemplify the modern cyber threat: agile, identity-focused, and capable of bypassing even mature security programs through a mix of human manipulation and control evasion. These groups were behind the MGM Resorts and Caesars Entertainment breaches in 2023 and they continue to focus much of their efforts on hospitality companies.

Source: Safe Threat10

| Non-CAT exposed property with favorable loss history | Flat to up 5% |

| CAT exposed property with favorable loss history | Down 15% to 20% |

General Liability

Excess Liability

| General Liability with favorable loss history | Up 5% to 25% |

| General Liability with non-favorable loss history | Up 40%+ |

| Umbrella & Excess Liability | Up 10% to 40% |

Workers’ Compensation

| Workers’ Compensation | Down 3% to flat |

Auto

| Auto with favorable loss history | Up 10% to 20% |

| Auto with non-favorable loss history | Up 20%+ |

Cyber

| Cyber | Down 2.1% to flat |

Nuclear verdicts are surging. In 2024, there were a record 135 cases where verdicts against corporate defendants exceeded $10 million, a 52% increase from 2023, the most since 2009.21 These verdicts totaled $31.3 billion, a which is a staggering 116% increase in one year, with a median award of$51 million, up from $44 million in 2023. Beverage and entertainment industries were among the hardest hit. Meanwhile, Florida saw a decline following comprehensive tort reform, dropping from the second to the tenth position in nuclear verdict rankings.

Decedent was on vacation with his wife. After drinking, he wandered onto the property of the neighboring hotel and attempted to climb through a window. He got stuck and was eventually asphyxiated. Jurors awarded decedent’s family $31.2 million.23

Plaintiff slipped and fell while at a casino. She alleged she ended up suffering from CRPS due to the leg injury sustained from the fall. Jurors awarded plaintiff $15 million.24

A Los Angeles jury awarded the plaintiff $50 million after determining Starbucks was 100% liable when suffering severe burns from a hot tea spill at a Starbuck’s drive-through window. The plaintiff required multiple skin grafts and other medical treatments.25

Partner with your broker early to prepare for any changes to increase greater renewal success.

When placing the specific risk, it is important to work with your broker’s industry experts who understand the business and the market. Collaborating with a team that can best represent your risk and partner with your operations is more critical than ever in this disciplined market.

IMA has a team solely dedicated to managing cyber risks. They offer expert assistance, including coverage analysis, economic loss exposure benchmarking, contract language review, in-depth cyber threat analysis, and strategic development of comprehensive, high-value cyber insurance programs.

Our contract review team adds value to our clients’ overall risk management program by ensuring the indemnity language is market standard and doesn’t expose our clients to unforeseen losses that may not be insurable.

In today’s dynamic business environment, working with a risk consultant is a proactive strategy to minimize exposure and safeguard assets before a loss occurs. Clients should look to partner with a dedicated risk control team who has experience in addressing potential vulnerabilities and enhancing resilience ahead of claims events.

Tim Smith

SVP, National Hospitality Practice Director

Susan Devaughn

Senior Vice President, National Hospitality Program Director

Angela Thompson

Sr. Marketing Specialist, Market Intelligence & Insights

Brian Spinner

Sr. Marketing Coordinator, Market Intelligence & Insights