Manufacturing Outlook:The Impact of New Administration Tariffs

Mar 4, 2025

The implementation of tariffs by governmental administrations can be a tool to protect, even boost, domestic industries, but they can also cause significant financial and operational difficulties to downstream, and ancillary companies. The manufacturing industry and sub-industries are particularly sensitive to the disruptive effects of tariffs as increased pricing ripple through each stage of the manufacturing process with disruptions manifesting in various forms, such as increased costs, supply chain uncertainties, and market competitiveness challenges. This article explores the multifaceted impact of tariffs on manufacturing companies, providing insights into potential risks and strategies for mitigation.

Ad Valorem Tariffs: The most common type of tariff that is levied as a percentage of the value of the imported goods or services. For example, 10% tariff on automobiles.

Specific Tariffs: Charged as a fixed fee per unit or weight of imported goods. For example, $5 on a pair of pants.

Compound Tariffs: A combination of ad valorem and specific tariffs.

Protecting Domestic Industries: Shielding local manufacturers from foreign competition. This can protect primary manufacturers, but harm downstream businesses and ancillary industries.

Revenue Generation: Providing a source of government revenue. A tariff is a tax paid by the business who imports raw materials and products. Companies offset tariff costs through higher consumer prices, which can reduce overall sales and result in lower generated revenue.

Trade Retaliation: Responding to unfair trade practices by other countries. Imposing tariffs can lead to retaliation that could lead to a trade war that affects manufacturers, downstream and related industries, and customers.

Scenario: Introduction of tariffs on steel and aluminum imports. Past and current tariffs on these products were enacted under the Section 232 of the Trade Expansion Act of 1962, which allows for adjustment to imports allowed so they do not threaten or impair national security.1

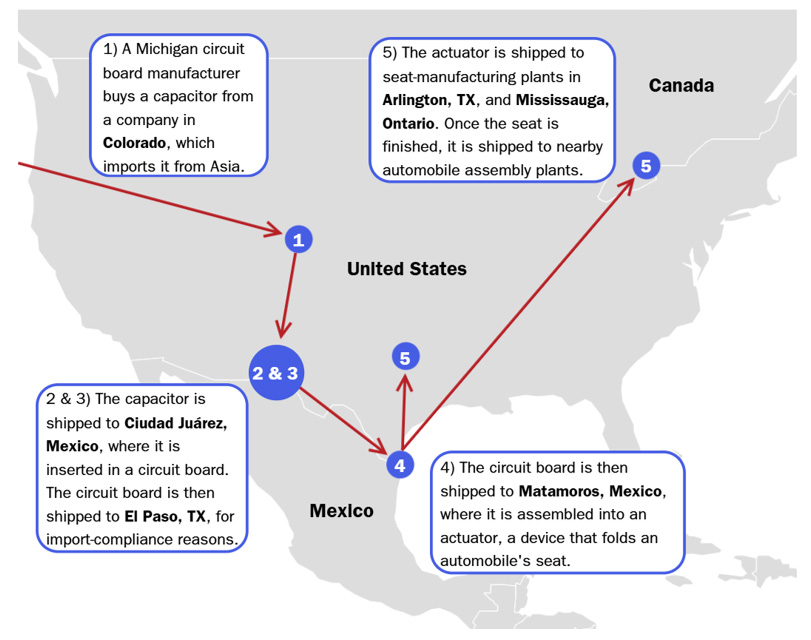

Impact: Increased costs for raw materials, leading to higher vehicle production costs and reduced profit margins. The North American automotive supply chain is interwoven across the United States, Canada, and Mexico that an engine, transmission, or other automotive component might cross the borders as much as seven or eight times before ending up in a finished vehicle.2 A 2023 U.S. International Trade Commission report stated the 2018 steel and aluminum tariffs imposed by the United States on Mexico and Canada disproportionately harmed six U.S. motor vehicle and parts manufacturing sub-industries and the Center for Automotive Research calculated the tariffs cost U.S. light vehicle manufacturers almost $500 million per year.3 Tariffs also negatively impacted domestic automakers, with Ford Motors reporting $750 million revenue drop in 2018 due to tariffs and GM reporting a $1 billion dent in profits.4

Response: The 2018 tariffs were forewarned in advance, which allowed companies to plan and adjust their strategy well in advance.5 Some companies opted to source materials domestically, while others sought to pass on costs to consumers. Companies with existing contracts were better able to withstand increased prices due to tariffs. Other companies stockpiled products and materials, but the upfront costs and storage limitations made this a short-term solution.

Source: Bloomberg 20196

Directors and officers (D&O) liability insurance can be activated if a company’s leadership fails to adequately plan for the impact of tariffs, potentially leading to financial harm, regulatory scrutiny, or shareholder lawsuits. Key considerations:

Trade Credit Insurance: If tariffs disrupt supply chains or business relationships, resulting in customer defaults, this coverage could help mitigate financial losses.

Business Interruption Insurance: If tariffs cause operational delays or supply shortages, leading to lost revenue, depending upon policy provisions, this coverage might be applicable.

Errors & Omissions (E&O) Insurance: If a company provides consulting or advisory services (e.g., financial, legal, or trade advice) and miscalculates the tariff impact, it could be liable for professional negligence.

Companies should proactively assess their D&O coverage terms to ensure they include tariffrelated risks. Reviewing policy exclusions and engaging with insurers early can help mitigate potential claim denials. If your operations are particularly exposed to tariff risks, you may need customized risk management strategies.

New administration tariffs pose significant challenges to manufacturing companies, affecting costs, supply chains, and market competitiveness. By understanding the nature of these disruptions and implementing strategic responses, manufacturers can mitigate the adverse effects and navigate the complexities of a tariff-impacted environment. Proactive planning, supply chain diversification, and effective cost management are essential to maintaining resilience and sustaining growth in the face of new tariffs.