Insurance Marketing

Services and Structure

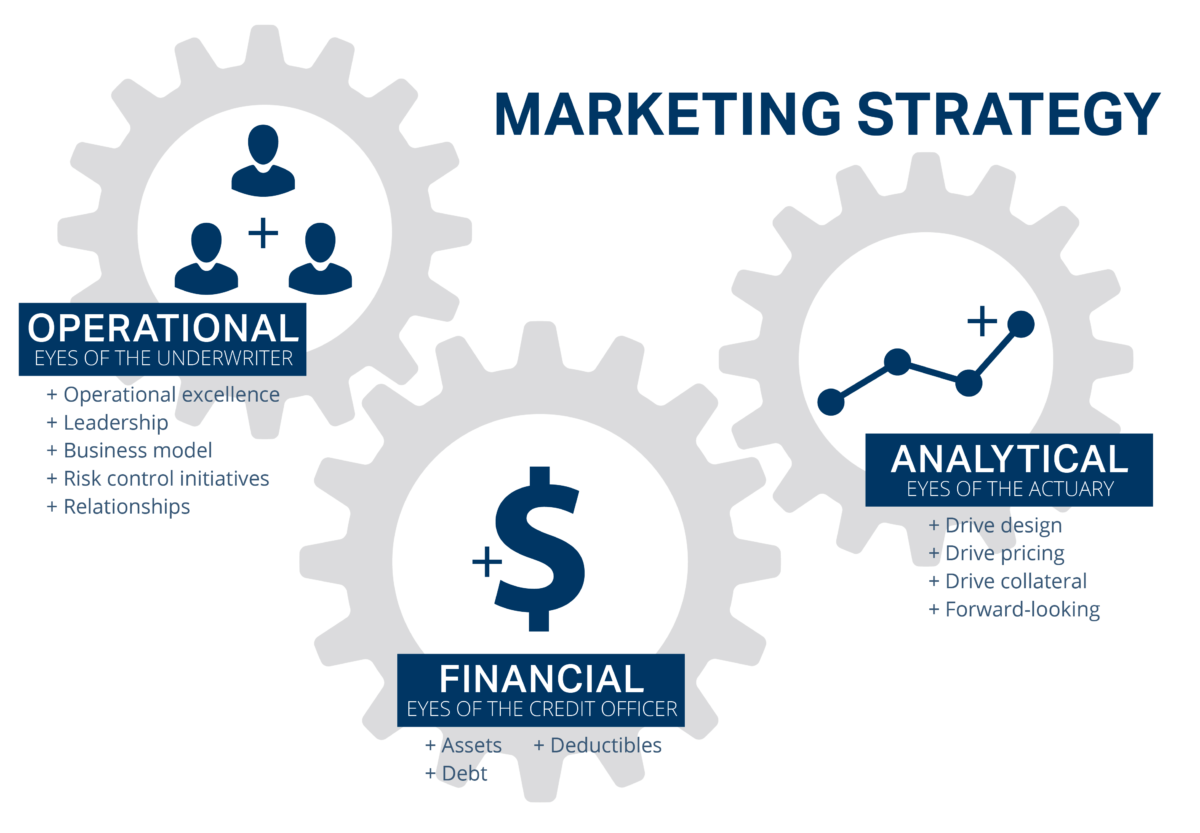

In the absence of information, carrier underwriters will always default

to the most conservative underwriting decision, which rarely benefits

the insured. IMA’s insurance marketing strategy helps eliminate

uncertainties and ambiguities, allowing underwriters to be more

aggressive when pricing risk and extending coverage.

Insurance by Industry | Real Estate | Insurance Marketing Services and Structure

THE CLIENT-BROKER-CARRIER RELATIONSHIP IS A THREE-WAY PARTNERSHIP

The formation of a working relationship between the parties enhances the insured’s ability to address risk in the most effective and efficient manner.

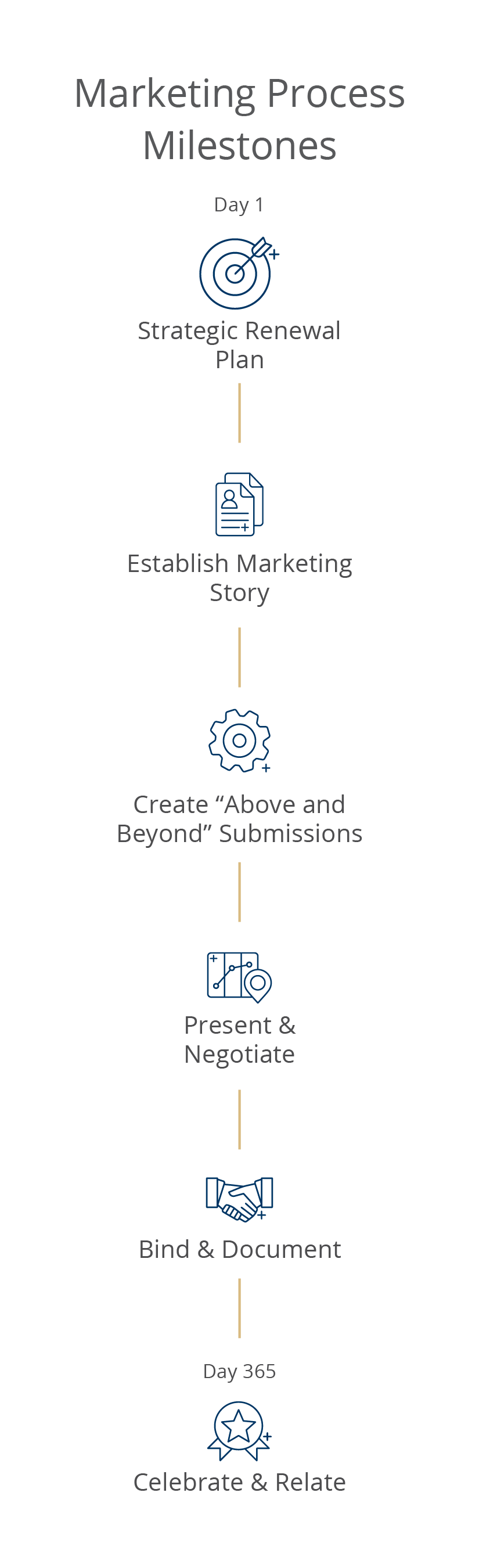

MARKETING IS A 365-DAY-A-YEAR PROCESS

IMA challenges every program in terms of carriers, coverages, retentions, limits and alternative financing options in order to constantly refine and optimize a client’s risk and exposure.

IMA constantly evaluates their insurance carrier partners and service providers with strict adherence to an internal due diligence and ongoing annual compliance process.

Each company/insurer must meet or exceed the standards set forth in the categories listed below:

+ Market reputation

+ Excellent partnership history with IMA

+ Financial strength rating requirement (e.g., “A” or better with major rating agencies)

+ Financial size requirement (e.g., Size “XV” of $2B in surplus)

+ Appropriate state licensure

+ Review of existing or future litigation