Understanding Benefits & Tax Implications for Company Owners

· May 9, 2024

Companies are generally permitted to offer employer-sponsored group benefits to owners, and some plans even extend benefits to board members and directors, but there are several things to keep in mind regarding taxation.

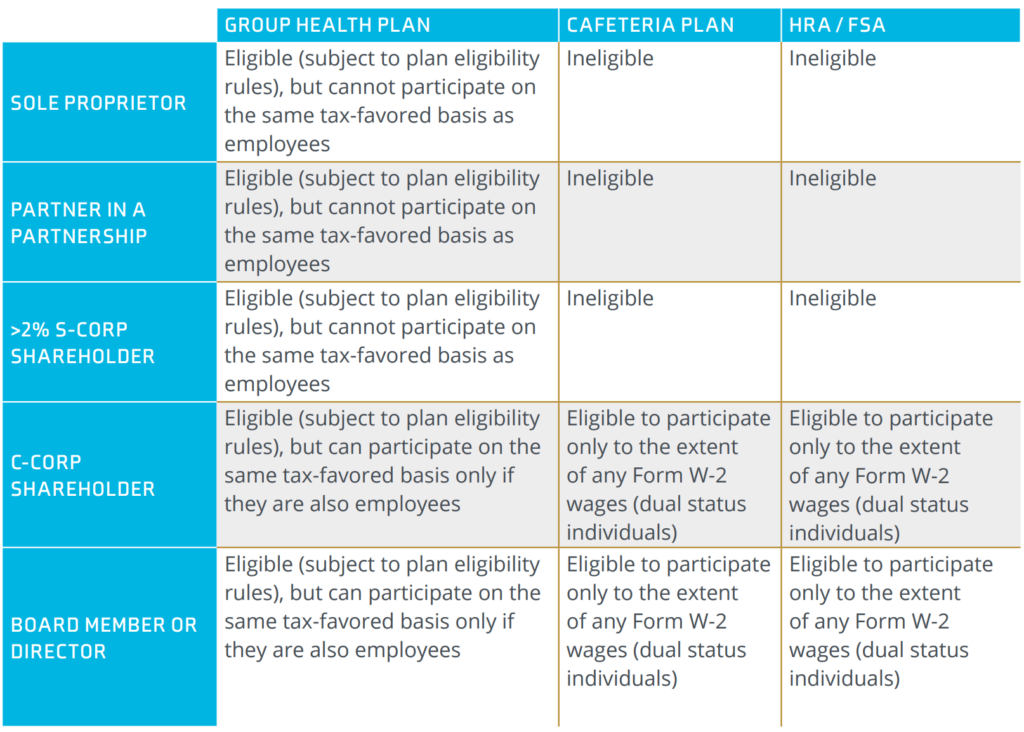

When we use the term “owner,” it can mean lots of things. Below are common examples:

Many owners, board members, and directors are not considered common law employees. This can impact their ability to participate in employer-sponsored benefits and affect the taxation of any benefits received.

Under §4980H (the “employer mandate”), §125 (cafeteria plan), and §105 rules (self-funded), sole proprietors, partners in a partnership, and >2% S-Corp shareholders are not considered employees.

C-Corp shareholders, directors, or board members who are also not providing services as an employee to a corporation are not considered employees either.

Limited liability corporations (LLCs) can take different organizational forms. When there is an LLC involved, it’s important to understand how the entity has chosen to be taxed – i.e. as a sole owner, partnership, S-Corp, or C-Corp.

If non-employees (as described above) are permitted to participate in employer-sponsored benefits, they cannot participate on a taxfavored basis in the same way that benefits are treated for tax purposes for regular employees. In addition, those who are not common law employees cannot participate in a Cafeteria Plan, HRA, or Health FSA.

In general, contributions made by non-employees should be made on an after-tax basis, and contributions made by the employer should be treated as additional taxable compensation. It is up to the owner, board member, or director to work with their tax advisors to determine any tax deductions that may apply because they can vary depending on the structure of the organization and the nature of the contributions.

Non-employees are permitted to make contributions to HSAs if they are otherwise eligible (i.e. enrolled in a qualifying HDHP, no other disqualifying coverage, and not claimed as a tax dependent). Any contributions made by the non-employee should be made on an after-tax basis and then may qualify as a deduction when filing the personal tax return.

The taxation of employer HSA contributions varies slightly depending on the type of owner. See more detail in IRS Notice 2005-8.

Owners, board members, and directors who are not permitted to participate in employer-sponsored benefits on the same tax-favored basis as other employees are not included in benefit discrimination testing. In other words, the employer could choose to offer more generous benefits or contributions to such individuals without running afoul of the nondiscrimination rules.

§125 contains nondiscrimination rules that restrict an employer’s ability to offer benefits on a tax-favored basis in a manner that discriminates in favor of highly compensated and key employees. However, since owners, board members, and directors are generally not permitted to participate in a §125 cafeteria plan, they are not considered in the §125 discrimination testing. Similarly, §105(h) contains rules that limit an employer’s ability to provide self-insured health plan coverage on a tax-favored basis in a manner that discriminates in favor of highly compensated

individuals. Owners, board members, and directors who are not common law employees and not permitted to participate on the same tax-favored basis as other employees are not subject to §105(h) discrimination testing because different tax rules regulate the tax treatment of their benefits.

Plan eligibility rules are often written to include only employees and their family members, although they can certainly be written to include non-employees such as owners, board members, and directors if the carrier is willing to insure such individuals. That being the case, if the employer chooses to offer benefits to such individuals, the employer needs to be careful to handle the taxation of such benefits appropriately based on the type of entity involved.

IMA will continue to monitor regulator guidance and offer meaningful, practical, timely information. This material should not be considered as a substitute for legal, tax and/or actuarial advice. Contact the appropriate professional counsel for such matters. These materials are not exhaustive and are subject to possible changes in applicable laws, rules, and regulations and their interpretations.