Life SciencesEconomic Overview & Market Update

Q4 2023

In the wake of the pandemic, life sciences companies were challenged to pivot to adopt new technologies and rethink existing operating models to sustain growth and deliver innovation at speeds unseen in the industry. As a result of the evolution of technology in this sector, the Food and Drug Administration (FDA) has taken significant strides in 2023 to modernize the 510(k) program and evolve guidance to incorporate technological advancements. All 510(k) submissions, unless exempted, must be submitted electronically using their eSTAR platform, which went into effect October 1, 2023. The FDA published final guidance regarding cybersecurity measures and quality system consideration concerning medical devices specific to using the 510(k) pathway.

The FDA also issued final guidance on the Informed Consent Process in 2023. The final guidance aimed to bring the process into the twenty-first century by acknowledging that new technologies may be used to obtain informed consent as an alternative to paper consent forms. The FDA is also encouraging researchers to use technology and innovative visual methods in the informed consent process to aid in educating and communicating with trial participants.

While the FDA continues to modernize its processes and update guidance for the industry, technological innovation is outpacing regulatory bodies and lawmakers’ ability to keep pace. 2023 marked explosive growth in artificial intelligence (AI) technology and applications related to accelerating research and development, drug discovery and development, and data sharing. The uptick in the number of companies adopting this AI technology has created additional regulatory hurdles and concerns within the industry. Navigating the complexities of ever‑changing technologies, supply chains, and workforce stability remained a top concern for life sciences companies.

The U.S. biotechnology sector in 2023 was a $119.3 billion industry; the industry forecasts growth by a modest 5% over the next two years, due partly to tightened access to investment capital, increased government oversight, and greater overseas competition.1 Each global markets segment this report covers is projected to have their own substantial market size growth.

AI technology has created additional regulatory hurdles and concerns within the industry.

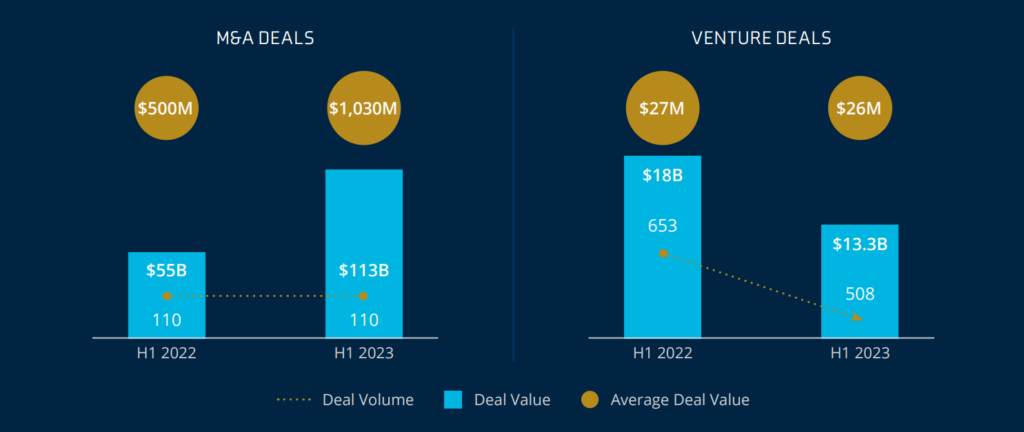

In 2023, pharmaceuticals drove merger and acquisition (M&A) deals significantly higher than anticipated, even as M&A deal volume fell flat across many sectors in the life sciences vertical. Pharmaceuticals accounted for 49% of deal volume and over 75% of total deal value.

The medical device and diagnostic segment saw modest growth through the first half of 2023, with M&A deal value up 4% to $7.8 billion. Venture funding activity, however, declined by 45% year over year. The diagnostics sector drove the decline of venture activity as demand for COVID-19 tests and related diagnostic products fell after the pandemic peak.

2023 saw limited M&A activity within the digital health space due to a lack of transparent monetization and over-saturation from the explosive growth the telehealth segment experienced during the pandemic. However, venture capital in this segment accounted for one-third of money raised in the first half of 2023 and expect to see an increase in investment in this space continuing into 2024 due to heightened interest in artificial intelligence and next-generation digital health.2

Following the first successful launch of mRNA technology in COVID-19 vaccines, the market anticipates a rise in therapies utilizing this science. Prior to 2020, mRNA manufacturing had yet to keep pace with innovation. Significant advancements in personalized medicine have been made since that time using mRNA and the development of advanced technologies like mRNA printers to bring vaccines and made‑to‑order treatments to larger patient populations.

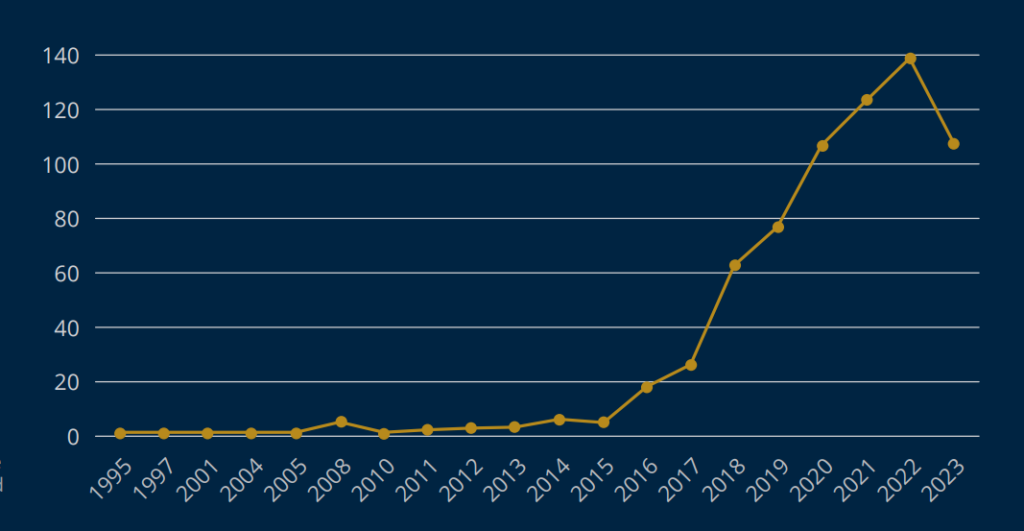

The FDA had approved over 520 artificial intelligence and machine learning algorithms for medical use at the beginning of 2023. The first FDA approval for artificial intelligence for a medical purpose occurred in 1995, with only 50 other algorithms approved over the next 18 years. An overwhelming majority of the algorithms, over three hundred, were approved between 2019 and 2022. Dramatic acceleration in this space has created regulatory and logistical challenges for the FDA but a wealth of opportunity for the life sciences sector. With a wide range of applications, AI platforms are expected to see expansive growth in 2024 and beyond, with uses ranging from administrative operations to personalized medicine, drug discovery and development, disease diagnosis, and health risk prediction and remote monitoring capabilities. The AI market size globally for healthcare was estimated to be $15.1 billion in 2022 and is expected to surpass around $187.95 billion by 2030, growing at a CAGR of 37% during the forecast period of 2022 to 2030.3

In anticipation of accelerated development of AI, the FDA launched its Digital Health Center of Excellence in 2020 and began development of draft guidance relating to this technology. The FDA is prioritizing guidance on the use of artificial intelligence in 2024 and is anticipated to release draft guidance within the fiscal year relating to market submission recommendations for a predetermined change control plan for AI/ML-enabled device software functions.4

The life sciences industry saw the implementation of many key elements in the FDA’s Technology Modernization Action Plan that was developed in 2019. Key internal initiatives for the agency were implementing virtual data storage, problem-specific software development, and evolving solutions for efficient data exchange. The FDA focused on these areas to not only promote innovation regarding how the agency uses software in its work but also across the biomedical ecosystem.

Looking ahead to 2024, the FDA will focus on the modernization of the clinical trial process.

In 2023, the 501(k) clearance process moved to a wholly digital platform, now requiring all submissions, unless exempted, to be electronically filed. In addition to technological updates on the filing process, the agency also released final guidance for medical device companies regarding their cybersecurity responsibilities, recognizing the increased potential and evolving nature of cyber security threats. The new guidance, aimed at premarket medical device submissions, requires device makers to submit a cybersecurity plan and additional information as required by the PATCH Act that was signed into law at the end of 2022.

Looking ahead to 2024, the FDA will focus on the modernization of the clinical trial process. In October 2023, the Center for Drug Evaluation and Research (CDER) announced that it is soliciting public comments to understand the state of innovation in both clinical conduct and trial design, requesting feedback on the barriers and facilitators to incorporating innovative clinical trial approaches in the drug development process. CDER, in partnership with Duke Margolis Center for Health Policy, will host a public workshop on March 19 and 20, 2024, regarding this topic.5

Innovations and opportunities are always on the horizon as the biopharma, life sciences, and Medtech sectors continue to grow at a rapid pace. The commitment of the FDA to bridging the gap between scientific advancements and the technologies needed to translate advancements into new treatments and therapies will aid in accelerating the drug development process and bringing new treatments to market.

Climate change has been the largest contributing factor to the hardening property market in the last few years.

Increasing demand for life sciences companies to carry environmental and pollution liability coverage due to litigation involving the use of ethylene oxide.

In 2023, ever-changing regulations worldwide meant continuous evolution in coverage, claims and legal responses.

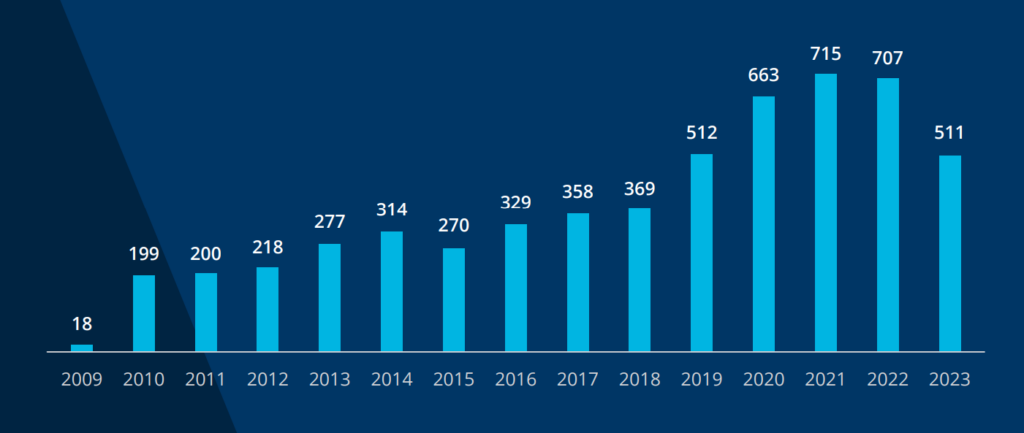

Between 2009 and 2022, 5,150 healthcare data breaches involving 500 or more records have been reported to the United States Department of Health and Human Services Office of Civil Rights.

Partner with your broker early to prepare for any changes to increase renewal success.

It is important to collaborate with your broker’s industry experts who understand the business and the market for placing the specific risk. Collaborating with a team that can best represent your risk and partner with your operations is more important than ever during this disciplined market we are experiencing.

IMA has a team solely dedicated to managing cyber risks. They offer expert assistance, including coverage analysis, monetary loss exposure benchmarking, contract language review, in-depth cyber threat analysis, and strategic development of comprehensive, high-value cyber insurance programs.

Our contract review teams add value to our clients’ overall risk management program by ensuring the indemnity language is market standard and does not expose our clients to unforeseen losses that may not be insurable.

IMA invests heavily to deploy specialty niche teams concentrating on innovative technology, green energy initiatives, and advanced manufacturing. As every client is different, our Sustainability Advisory team provides clients with education, advice, and access to tools and best practices to advance their sustainability resilience and showcase their ESG performance for insurance underwriters.

Krista Hartin

VP, Life Sciences Segment Leader

Katy Mc Gehee

Sr. Advisor and Consultant, Life Sciences Specialty

Angela Thompson

Sr. Marketing Specialist, Market Intelligence & Insights

Soraya Marashi

Communications Specialist, Copy Editor