Executive Risk SolutionsQuarterly Update | October 2025

Oct 20, 2025

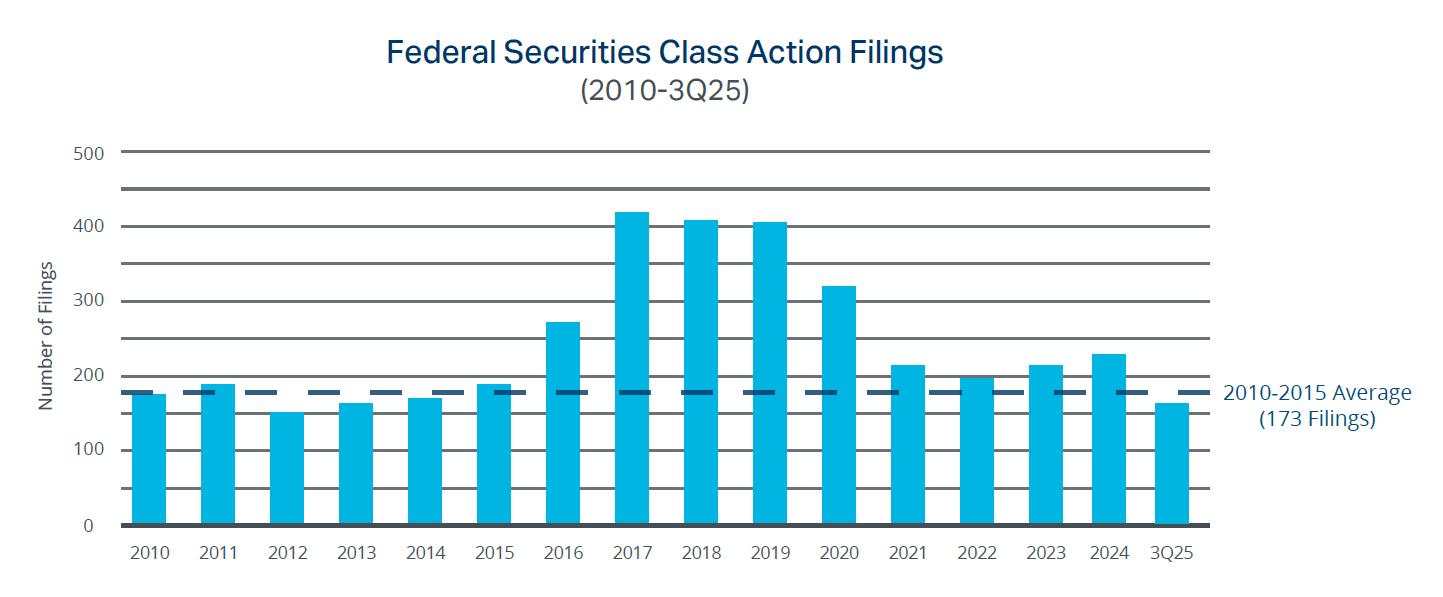

Under the new administration, significant changes are being proposed for what is required of publicly traded companies. If some of the changes end up being adopted, it will have significant consequences in the professional liability insurance markets, the legal profession, and the courts. In September, the Commission voted 3-1 in favor of reversing the longstanding but unwritten policy prohibiting companies seeking to go public from mandating shareholder disputes be resolved through arbitration. The announcement was made via a policy statement, rather than a formal rule, meaning it was not subject to public notice or comment. While it is presently unclear how many companies would seek to take advantage of this policy change, we can expect a lot of interest from companies seeking to reduce their litigation exposure.

The policy change would prevent shareholders from filing suit through a class action and would instead force each shareholder to arbitrate claims against an issuer on an individual basis. In doing so, it will naturally deprive the courts of their ability to interpret statutory law and the duties obligated by common law through the issuance of opinions and judgments which form the body of caselaw under which the legal and securities markets operate.

It would also force shareholders to pay legal fees and private arbitration fees upfront, as well as depriving them of evidence presented by other shareholders asserting claims against the issuer. In addition, the conduct complained of and actions at the heart of any such disputes would no longer be in the public domain, meaning regulators, elected officials, and equity markets will have no access to the information and evidence presented, depriving them of the ability to seek alternative investments or craft laws and regulations in response to emerging schemes.

The effect it may also have on law firm revenues of both the plaintiff and defense bars could be astronomical alone, not to mention how it will alter the directors’ and officers’ (D&O) insurance market. Insurers would likely see loss ratios decrease; however, the need for such insurance at all and the pricing thereof would certainly be subject to market correction. In conjunction with the proposed rule change allowing public companies to switch quarterly earnings reports to a semi-annual schedule, we very well may see some noteworthy changes in the public company space over the next year.

In distinguishing a Claim from a Securities Claim under a public company D&O policy, the Delaware Superior Court found in favor of the insurance carriers that denied coverage for legal fees incurred after a Tolling Agreement was executed with the Securities and Exchange Commission (SEC). The SEC opened an investigation of the insured (Clear Channel) in 2018 and requested a Tolling Agreement be executed to extend the applicable statute of limitations for the conduct being investigated. Eventually, a settlement was reached in 2023 and the insured company sought to recover over $26 million in legal fees it incurred in connection with the settlement. The insurance carriers took the position that while a tolling agreement did meet the definition of a Claim, it did not qualify as a Securities Claim for a Wrongful Act, with the latter being required for any company coverage to exist.

The court explained that the policy structure rendered Securities Claims as a limited subset of Claims, meaning not all Claims are Securities Claims.

While the Tolling Agreement undisputedly qualified as a Claim, the definition of a Securities Claim explicitly carved out investigations of the insured organization. “The definitions of Claim and Securities Claim are different by design. The Policy covers ‘the Loss of an insured individual resulting from a Claim, but coverage for the Loss of an insured entity is limited to a Securities Claim.’” The court went on to hold the tolling agreement did not include an allegation of wrongdoing that would satisfy the Wrongful Act language included as a requirement for a Securities Claim. “Even if the Tolling Request is a Securities Claim, it still would not trigger coverage. Under the Policy, AIG agreed to pay for Clear Channel’s losses arising from any Securities Claim for any Wrongful Act… The Tolling Request does not meet this requirement.” Clear Channel Outdoor Holdings, Inc. v. Illinois National Insurance Co., et. al., 2025 WL 1796542 (Del. Super. June 30, 2025).

Following the dismissal of a suit brought by the former CEO seeking coverage under a D&O policy issued to his former employer, the Eleventh Circuit Court of Appeals upheld the lower court’s decision to deny coverage under a D&O insurance program.

Jeffrey Scott was terminated from his role as CEO, President and Secretary of the insured company (Gemini Financial Holdings, LLC) in October 2019. He then threatened legal action via letter and the company responded in writing accusing him of misconduct, demanding the preservation of documents along with return of company property. Scott then submitted the correspondence as a ‘Notice of Claim’ under the company’s D&O insurance program.

The insurance carrier denied coverage, taking the position the correspondence provided failed to contain a demand for any sort of legal relief. “[T]he letters Gemini sent do not request monetary payment or legal remedies. Instead, they assert a cause for Scott’s termination and outline expectations for his post-employment conduct. Viewed in the light most favorable to Scott, these letters are anticipatory posturing for a future dispute – an intention to review certain workplace conduct by Scott. But they are not present demands for relief.” As such, the court found the letters failed to qualify as either a Claim or a Notice of Circumstances since they mostly reflected his demands against the former employer, not vice versa.

Because of differences in the way each insurer and policy permits policyholders to provide notice of potential future claims, typically referred to as notice of circumstances likely to give rise to a future claim, a thorough conversation with your broker and claims teams is the best practice. Insurers typically require additional information beyond simply the identity of a claimant and the date the insured first became aware of the situation. Many carriers require additional information regarding potential causes of action and the anticipated wrongful acts to be alleged for any such notice to be accepted. Scott v. Certain Underwriters at Lloyd’s, 2025 WL 2443382 (11th Cir. August 25, 2025).

In this case, the Ninth Circuit Court of Appeals affirmed the district court’s judgment finding an arbitration award was restitutionary in nature, and thus uninsurable. The claimant in the underlying arbitration brought claims against a company (Cuff) and its CEO (Deepa Sood) to whom loans were made. Claims alleging intentional misrepresentation and fraudulent concealment were rooted in the fact that the CEO failed to advise the lenders that a critical supply contract had been terminated. The loans in question were never repaid, and arbitration was filed to recoup those amounts.

A three-judge arbitration panel found unanimously for the claimant/lender and awarded the total amount lent plus prejudgment interest and arbitration fees jointly against the CEO and company. Claimants then sought recovery of the award from the bankrupt company’s D&O insurance.

In dismissing the case, the district court held that the restitutionary award made by the arbitrators was uninsurable in California. “The arbitration panel made clear that it was awarding, and that Tandem was suing to recover, ‘the loans Tandem advanced.’ Cuff and Sood were thus being asked to return something Cuff wrongfully received, and that remedy is more properly characterized as restitutionary rather than compensatory in nature…In substance, the panel held that Cuff and Sood were required to restore to the plaintiff that which was wrongfully acquired.” Because the arbitration award constituted restitution, California law barred it from being covered by a liability insurer. Tandem Fund II, L.P. v. Scottsdale Insurance Co., 2025 WL 2206112 (9th Cir. August 4, 2025).

In what could end up being a seminal case for cyber insurance policy language, the New Mexico Court of Appeals recently found in favor of a policyholder that experienced a breach which eventually gave rise to a social engineering claim. Both the trial court and appellate court found the term “for a security breach” to be ambiguous, thereby entitling the insured to coverage for a $4 million dollar loss.

The policyholder, a healthcare insurer, only became aware of unauthorized access to its systems after receiving an invoice purportedly from a vendor but instead was from a hacker. A payment of $4,415,833.11 was made as a result of the fraudulent invoice and the funds were never recovered. A claim was subsequently tendered under the cyber liability policy; however, the insurance carrier issued a declination of coverage. The insurer took the position the fraudulent invoice did not trigger third party liability coverage and even if it did, the “loss of money” exclusion also barred coverage. Specifically, the insurer argued the loss was not a claim ‘for a security breach’ but rather a breach of contract between the insured and its vendor. The denial was then challenged in court via this case.

From a coverage standpoint, it is interesting that the New Mexico courts held the loss flowed from the security breach and was therefore a covered loss.

The insurer’s argument that the word “for” should be interpreted more narrowly than “arising out of” or “resulting from” was rejected by both courts. “Although Beazley seeks to define ‘for a security breach’ as meaning ‘as a direct result of a security breach,’ it does not use that far clearer phrase in the provision at issue.” Practitioners in the liability arena will recognize this wording as what is required under crime policies. Courts have interpreted ‘resulting directly from’ to require a heightened correlation, more exacting than the but-for causation standard. The appellate court also upheld the lower court’s analysis that the stolen funds were not in the insured’s possession, rendering the loss of money exclusion inapplicable. Instead, the funds were in the custody of the policyholder’s banking institution. The term “care, custody or control” was noted to be an established legal phrase denoting exclusive physical dominion over property.

Given the widespread use of the term “for a security breach” in cyber policies, we expect this ruling will cause a lot, if not all, cyber liability insurers to take a hard look at their policy language and potentially begin using language like that in crime insurance policies where direct loss is required. Kane v. Syndicate 2623-623 Lloyd’s of London d/b/a Beazley USA Services, Inc., 2025 WL 1733046 (N.M. Ct. App. 2025).

This case presented the question of whether conduct taking place after a “prior acts” exclusion date gave rise to a separate claim. The court was also asked to interpret obligations of the insurance carriers under a provision for advancement. The insured filed a declaratory judgment action against insurers in two separate towers, seeking coverage under both. The first tower (which was led by Great American) was placed into run-off, with an extended reporting period through November 2027. The second tower (which was led by Bridgeway) contained a prior acts exclusion, barring coverage for acts taking place before November 18, 2021. The Amended Complaint, which had been accepted for coverage under the first tower, contained allegations regarding claimants’ access to information within the possession of the insured that took place after November 18, 2021. The insureds took the position this constituted a separate Claim. The trial court disagreed, finding in favor of the insurers.

On appeal, the Supreme Court of Delaware upheld the lower court’s findings. “The court held that the insureds had not established that the specific allegations they relied upon constituted a ‘Claim’ as defined in the Bridgeway policy. Instead, the court viewed those allegations as little more than an aside in a lengthy complaint that asserted a number of Claims – but only Claims for pre-November 2021 Wrongful Acts.” As such, the insured’s attempt at obtaining coverage under two separate insurance towers for one lawsuit was rejected.

The policyholder also raised issues on appeal regarding the “no action” clause and its effect on advancement and allocation provisions in the primary policy of the first tower. The insureds argued that, if enforced, the no action clause would render the advancement provisions meaningless. With the no action clause being ruled on narrowly by the Superior Court, and having affirmed there was no coverage under the second insurance tower, the appellate court remanded the case for the trial court to address allocation and advancement issues under the first tower. As always, using a broker who understands every provision in a complex insurance policy and is capable of negotiating better language than that typically offered by insurers is your best protection from finding yourself in a situation like the above. Origis USA LLC v. Great American Insurance Co., 2025 WL 2055767 (Del. July 23, 2025).

Brian R. Bovasso

Executive Vice President &

Managing Director

IMA Executive Risk Solutions

303.615.7449

brian.bovasso@imacorp.com

Travis T. Murtha

Director of ERS Claims

IMA Executive Risk Solutions

Legal & Claims Practice

303.615.7587

travis.murtha@imacorp.com

Justin M. Leinwand

Product Leader

IMA Executive Risk Solutions

303.615.7773

justin.leinwand@imacorp.com

Daniel Posnick

Transactional Liability Leader

IMA Executive Risk Solutions

303.615.7747

daniel.posnick@imacorp.com