Executive Risk SolutionsQuarterly Update | July 2024

Jul 23, 2024

As a follow-up on the lower court proceedings of this case which we covered in our July 2022 Quarterly Update, the U.S. Supreme Court has sided with the Fifth Circuit in holding that the use of Administrative Law Judges (ALJs) to preside over enforcement actions violates the Seventh Amendment right to trial by jury.

The case itself involved the SEC having brought an enforcement proceeding against hedge-fund founder George Jarkesy and the firm he oversaw, Patriot28 LLC, for violation of federal securities laws. Jarkesy was found guilty and issued a civil penalty of $300,000. He challenged the judgment, which resulted in the Fifth Circuit vacating the Order and the U.S. Supreme Court agreeing to hear the case.

Relevant here is that the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act expanded upon the Securities Act of 1933 and the Exchange Act of 1934 by permitting the SEC to seek civil penalties in cases heard before an ALJ. However, likening the anti-fraud provisions of all three statutes to actions alleging common law fraud, the Court reasoned defendants were entitled to have factual matters decided by a jury, rather than an ALJ. The Court rejected the SEC’s contention that the ‘public rights’ exception applied in these proceedings, which permits such cases to be tried without a jury.

Starting from the premise that the Seventh Amendment says that in “[s]uits at common law…the right of trial by jury shall be preserved”, the Court explained this includes all suits which are not of equity or admiralty jurisdiction. Based on the remedies sought being legal in nature (i.e., monetary relief), the Court found these cases to involve private rights rather than public rights.

This case will undoubtedly have major implications and likely result in a tidal wave of prior enforcement proceedings being re-litigated before Article III judges. The SEC will also likely have to re-file all pending enforcement proceedings where civil penalties are being sought in federal court. In addition, the SEC is not the only regulatory agency impacted by this decision. Congress has enacted more than 200 statutes authorizing dozens of agencies to impose civil penalties, meaning that any of which are analogous to common law causes of action will likely need to be filed in federal court.

In short, the effects of this decision are massive. How the SEC and other regulatory agencies respond, and whether they have the manpower to handle current and former cases likely to be challenged, is something that will play out for many years. Coupled with the Loper Bright Enterprises case that overruled the Chevron doctrine, Congressionally created administrative agencies are going to face more legal challenges and their ability to function as intended remains an open question. Securities & Exchange Commission v. Jarkesy, et. al., 2024 WL 3187811 (2024).

Insurance coverage for claims brought under the False Claims Act, aka qui tam suits, present a number of issues for policyholders. The primary one being that such cases are initially filed under seal and the defendants are not made aware of the case until the federal government decides whether to intervene and take over the litigation. As such, months, if not years, can pass before the defendants named in the suit are provided a copy of the Complaint. This obviously presents a problem under claims made and reported insurance programs which mandate notice be provided during the policy period or shortly thereafter for any claims “made” during the policy period.

In this case, the qui tam action was both filed under seal and dismissed before ever being served on the defendant insureds. The qui tam action was first filed in 2012 and a related shareholder derivative suit was filed in 2016. Both cases allege the insured defendants engaged in a fraudulent scheme to market addictive opioids. To complicate matters, the company filed for bankruptcy protection in 2019.

Subsequently, the Liquidating Trustee sought coverage under the company’s D&O insurance for costs incurred in litigating both the derivative action and the qui tam suit. Coverage was denied, which eventually resulted in this litigation which was filed three years after confirmation of the Plan of Liquidation.

The basis of the coverage denial was the policy’s Pending and Prior Litigation exclusion, which specified no coverage would be afforded for any claims brought prior to May 2, 2013. In rejecting the Trustee’s argument that the term “brought” was ambiguous and required the action be both filed and served on the defendants, the court held the date of filing of the qui tam action was when the case was brought. Because the qui tam action was filed prior to May 2, 2013 and was “interrelated” to the derivative suit, coverage was precluded by the D&O program’s Pending and Prior Litigation exclusion. In re: Insys Therapeutics, Inc.; William Henrich, in his capacity as Liquidating Trustee v. XL Specialty Insurance Company, 19- 112921 (JTD) (Bankr. D. Del. May 29, 2024).

The underlying litigation which gave rise to this coverage dispute revolved around investors of Origis Energy suing for fraud. In 2019, oversight of Origis (the Insured) was allegedly diminished, which allowed for the investors’ interests to be purchased for $105 million. A few months later, Origis was sold to a third party for $1.4 billion. The investors initiated litigation, alleging the Insured misrepresented the value of their shares. The Insureds sought coverage under two separate D&O towers. The first tower originally had a policy period of 2021-2022. This program was put into run-off following the $1.4 billion transaction. The second tower had a policy period of 2023-2024. The latter tower contained a prior acts exclusion for claims arising out of conduct pre-dating November 18, 2021.

With the underlying case against the Insured ongoing, defense costs and any settlement or judgment could not be quantified. As such, the insurers relied on the ‘no action’ clause in the 2021- 2022 policy to assert this litigation was premature. The court agreed, consistent with the Delaware court’s strong inclination to hold sophisticated parties to the terms of their bargains “This Court is fully confident that the representatives of this billion-dollar company were well-equipped to understand the policy language and negotiate the necessary changes. Not having done so, Plaintiffs cannot use this litigation to reopen negotiations.” As to the 2023-2024 insurance tower, the Court found the prior acts exclusion to be decisive. The conduct at the heart of the underlying fraud case pre-dated the November 2021 exclusion date, meaning coverage would never attach under the 2023-2024 tower.

The lesson here for insurance purchasers is that coverage litigation cannot be relied upon to bring recalcitrant insurers to heel. The better approach is to have a robust scope of coverage and an understanding of any limitations that might exist within the program (which are hopefully few). A second line of defense is having knowledgeable claims advocates on the broker team that can negotiate and work with insurers, rather than proceeding immediately to litigation. Origis USA LLC v. Great American Insurance Co., 2024 WL 2078226 (Del. Sup. May 9, 2024).

We highlight this case as an extreme example and as our periodic reminder that truth and accuracy in policy applications must be taken seriously. It also stands for the principle that to ensure coverage, an honest dialog between policyholder and broker is essential, such that claims are reported under the proper policy.

This case involved an appraiser and two Real Estate Professional Errors and Omissions insurance policies issued for back-to-back years. During the first policy period, customers filed a consumer complaint against the Insured. This prompted a request by the Indiana Attorney General for materials related to the appraisal in question. Neither of these items were disclosed on the subsequent renewal application.

During the second policy period, the Indiana AG filed a Complaint against the Insured wherein disciplinary sanctions were sought. The insurer denied coverage, taking the position that the consumer complaint filed in the first policy period needed to be disclosed for coverage to attach. Because notice was not provided until the second policy period, coverage was denied for late notice.

In addition, because the Insured answered ‘no’ in response to a question on the renewal application inquiring about any ‘complaint, disciplinary action, investigation or license suspension/revocation by any regulatory authority’ received in the last twelve months, the insurer was entitled to rescind the second policy entirely. “The Court holds that [the Insured] misrepresented material answers to her insurance application, that the proceedings before the REAB were a ‘Disciplinary Action,’ and that because Great American did not breach its duty to defend, it was not estopped from raising the affirmative defense of misrepresentation.”

In the end, the Insured’s legal fees for the disciplinary proceeding were not covered and the second policy was rescinded in full. Again, information contained in insurance applications and representations to the insurers must be accurate. Moreover, if you have a question about whether notice should be provided to your insurer, speak with your broker and/or claims team to ensure a situation like this does not occur. Accent Consulting Group, Inc. v. Great American Assurance Company, 2024 WL 2272126 (S.D. Ind. May 20, 2024).

As plaintiffs seek ways to protect court judgments, insurers have shown a willingness to insure such risks through Judgment Preservation Insurance (JPI). Judgment Preservation Insurance may be used to insure against the risk that a monetary judgment awarded at trial cannot be paid or will not be paid in full because it was overturned or reduced on appeal.

Judgment Preservation Insurance provides bespoke coverage customized to address the specific needs of an insured and the risk associated with the litigation being insured. JPI may provide judgment – only coverage in these instances, meaning that policies may pay out when a judgment previously won by an insured is reduced or overturned on appeal or remand, and that judgment has become final and no longer appealable. JPI insurance does not cover settlement outcomes or protect against the risk a judgment is not collectible, nor does it limit legal costs associated with an appeal or additional proceedings. However, JPI has been a popular risk mitigation tool that allows plaintiffs who win significant monetary judgments at trial to lock in some or all of a trial court’s damages award pending appeals, motion practice or other remaining proceedings.

A recent decision by the U.S. Court of Appeals for the Fifth Circuit (BMC Software v. IBM, 5th Cir., No. 22-20463, decision 4/30/24) underscored the importance of using JPI insurance. A federal judge in 2022 essentially ruled that IBM poached BMC Software’s business with a mutual client and ordered IBM to pay $1.6 billion in damages to BMC. Following the lower court ruling, BMC obtained a judgment preservation insurance tower, insuring the underlying judgment for at least $750 million in total (specific details of the coverage remain confidential). In April of this year, the Fifth Circuit overturned the ruling, siding with IBM and thus triggering the JPI program purchased by BMC.

The BMC/IBM case, albeit on the larger end of the exposure spectrum, represents an example of where Judgment Preservation Insurance effectively provided one party (here, BMC) with a hedge against the risk of a judgment being overturned. As an aside, BMC has indicated it may seek rehearing on appeal, potentially delaying a final adjudication in this matter.

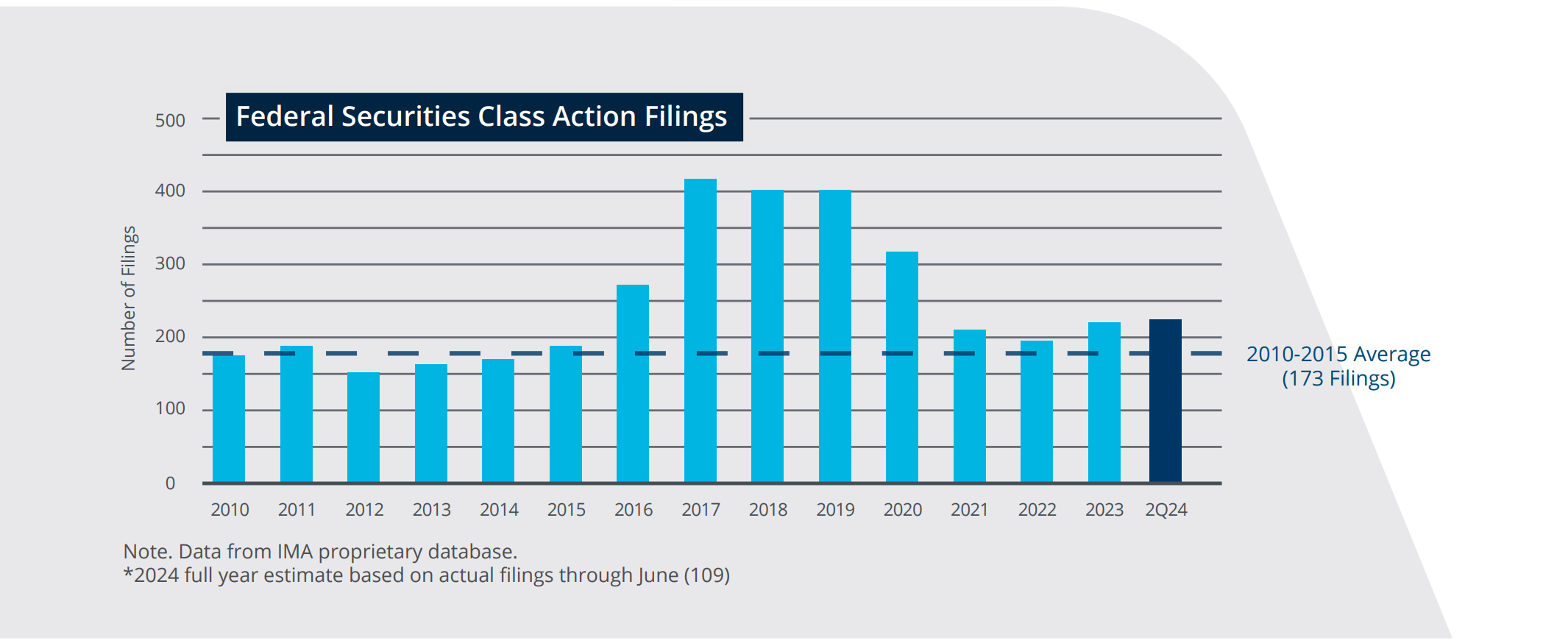

Sources: Cornerstone Research; Stanford Law School ; IMA proprietary database

Brian R. Bovasso

EVP & Managing Director

IMA Executive Risk Solutions

303.615.7449

brian.bovasso@imacorp.com

Travis T. Murtha

Director of ERS Claims

IMA Executive Risk Solutions

Legal & Claims Practice

303.615.7587

travis.murtha@imacorp.com

Justin M. Leinwand

Product Leader

IMA Executive Risk Solutions

303.615.7773

justin.leinwand@imacorp.com

Daniel Posnick

Transactional Liability Leader

IMA Executive Risk Solutions

303.615.7747

daniel.posnick@imacorp.com