Q1: COMMERCIAL AUTO UPDATE

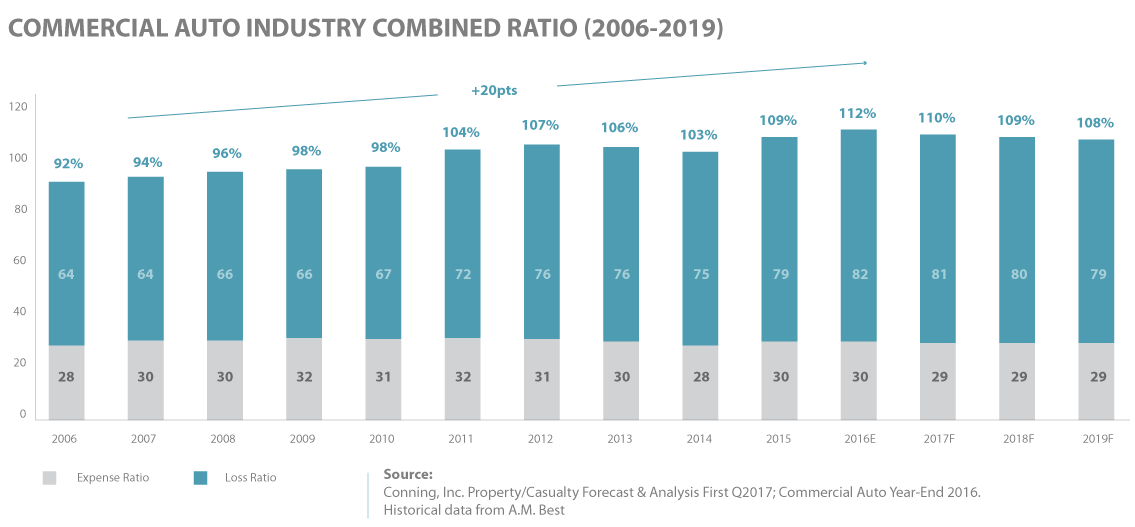

Between 2011 and 2016, commercial auto underwriting losses grew from $744.8 million to $2.9 billion, leading many carriers to raise premiums dramatically, restrict their exposure or exit writing this line of coverage all together.

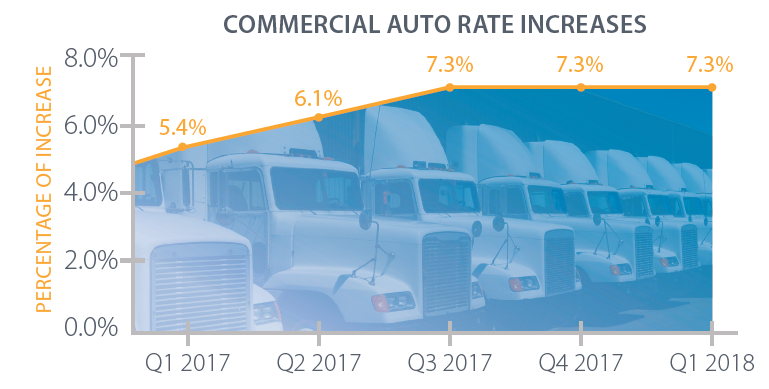

During the same time period, combined auto ratios have steadily climbed, meaning underwriters have yet to find a profitable formula with which to insure auto exposures. Though down from a peak of 112% in 2016, combined ratios remain at 110%, indicating the market can continue to expect rate increases in commercial auto moving forward.