Q4 Insurance Market Update: Residential Construction

OVERVIEW

The insurance marketplace is undergoing more substantial upheaval than it has experienced in over twenty years. This update will highlight the changes to the overall market and how those changes have impacted residential coverage, with an emphasis on attached for sale projects.

State of the Residential Insurance Marketplace

The following are key takeaways from The Council of Insurance Agents & Brokers’ Commercial Property/Casualty Market

Report Q3 2020 (July 1 – September 30):

Evidence the market continued to harden was apparent in Q3 2020, with premiums increasing by an average of 11.7% across all-sized accounts, marking the 12th consecutive quarter of increased premium pricing across all-sized accounts. As with the previous quarter, the impact was most apparent for large and medium-sized accounts, which recorded increases of 15.3% and 12.7%, respectively. On the other hand, small accounts experienced an average increase of 7.1%, slightly lower than the 7.3% increase in Q2 2020.

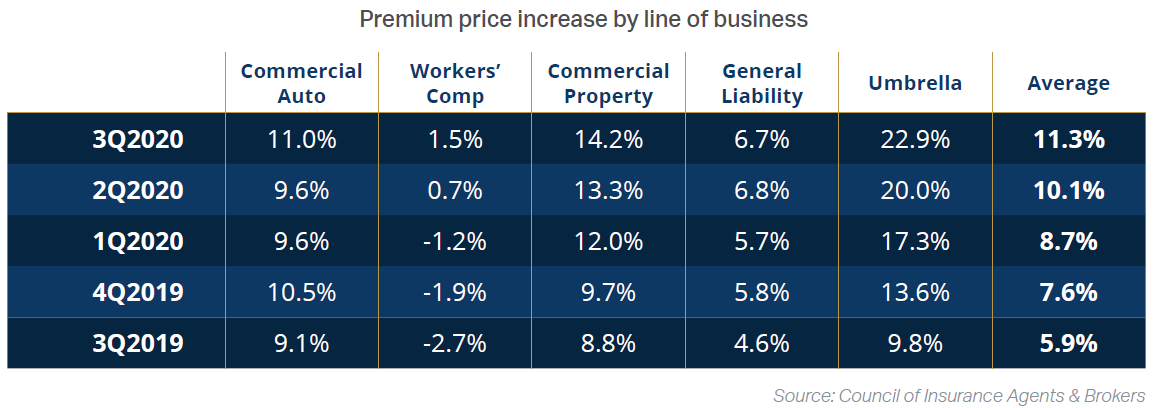

Premiums continued to increase for all lines of business in Q3 2020, Workers’ Compensation included. Umbrella and D&O premiums increased by far the most in Q3 2020, at 22.9% and 16.1%, respectively, followed by Commercial Property with an increase of 14.2%.

Underwriting capacity was down for the most troubled lines in Q3 2020, with 90% of respondents reporting capacity was down for Umbrella, nearly 60% of which said capacity had significantly decreased.

Results from COVID-19 related questions suggested the pandemic’s impact was still being felt in Q3 2020. Most respondents said the pandemic impacted pricing, availability of coverage, renewals and underwriting trends. They also reported increased claims activity for Business Interruption and Workers’ Compensation.

One of the side effects of increasing rates is that more business is being placed with Excess & Surplus carriers. Indeed, according to MarketScout, Surplus Lines placements in Q2 2020 are up 9% over the same period in 2019. This switch to the Surplus Lines marketplace is having a significant impact on residential insurance as most residential coverage is placed there as well.

What is driving these increases?

An increase in claims combined with a decade of pricing competition has caused insurance rates to spike. While it is difficult to get good statistics on jury awards, most agree that the average size of awards and the frequency of large awards are both increasing.

While there are myriad reasons for these increases, most observers agree that there are three main drivers:

+ Mistrust of corporations – Corporations are perceived as being behind much of the inequity in our society. A “Robin Hood” mentality exists in the jury boxes and large awards are a means of redressing wrongs.

+ Litigation Funding – Litigation funding involves third parties that invest in lawsuits by paying the parties or lawyers in exchange for an interest in the proceeds obtained in the lawsuit. According to a 2018 study by American Lawyer, the number of these firms could double.

+ Jury sentiment favoring plaintiffs – Only one in five respondents to the Edelman trust survey in 2019 felt that “the system” is working for them. This sentiment leads to a desire to change the system and the courtroom is a way to achieve this change.

Most civil matters are settled out of court, but jury behavior influences the outcome of settlements as well. As most judgments are ultimately paid by insurance carriers, one should expect these forces to drive insurance pricing upward for the foreseeable future.

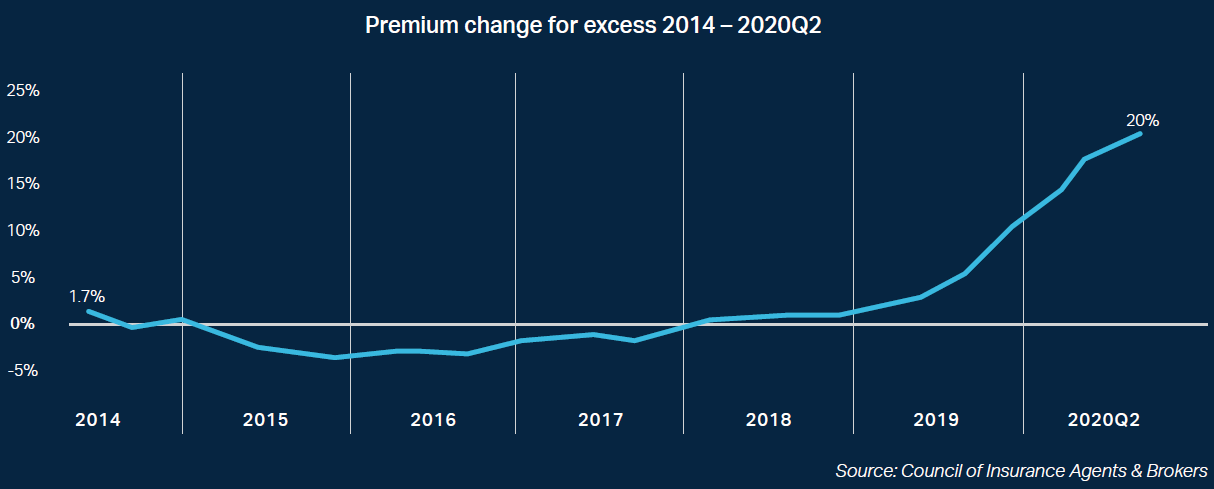

As the size of awards and settlements increase, the Excess/Umbrella market has borne the brunt of the change. As noted in the previous table, the pricing for primary liability is increasing at a modest rate, but umbrella pricing has ballooned. Why? As claims get larger, excess carriers have more limits exposed and, historically, excess pricing has not reflected the potential losses that we see today. Consequently, excess carriers are increasing rates more quickly to catch up.

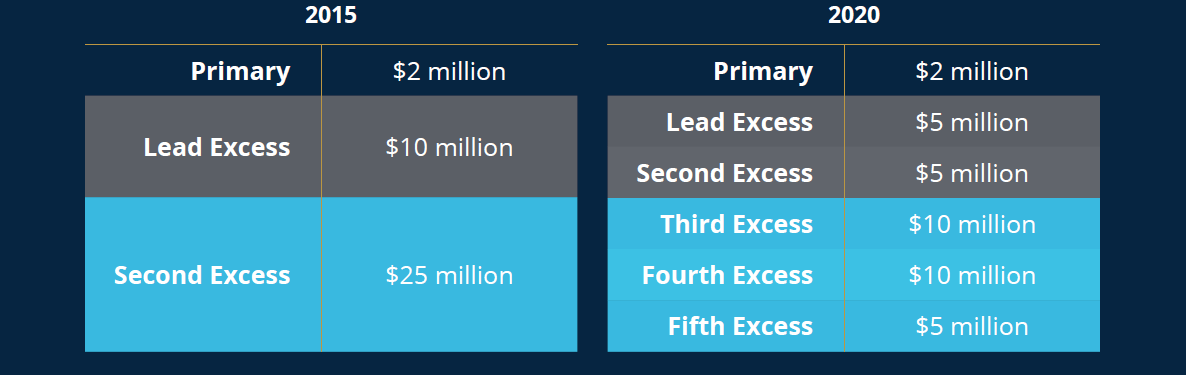

In addition to increasing rates, excess carriers are less willing to take on risk. This can be seen in smaller excess layers and more carriers required to fill out the coverage tower.

Historically, excess layer pricing was 60% – 70% of the previous layer. Relativity between layers has increased to 100% in some cases, which is impacting pricing further up the tower.

There is also the impact of carriers reducing or eliminating SIR credits in the excess layers. As excess carriers see their lines paying an increased number of claims, they are less likely to give premium relief to companies that take on more risk via the SIR.

What is the effect on pricing for residential projects?

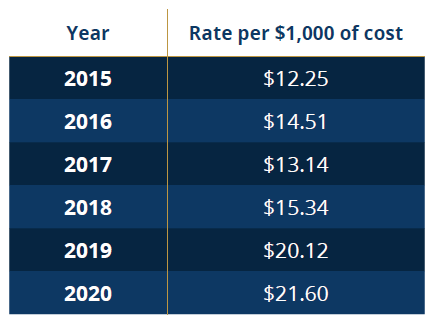

It is not surprising to see the rates for residential construction insurance have increased at a pace that exceeds overall market pricing trends. Residential coverage has historically always been more challenging to secure than commercial due to consumer protections for homeowners. Indeed, the cost for coverage of attached for-sale housing – the most difficult of residential placements – was on the rise well before the overall market started to increase.

Apart from the usual market factors driving rate increases, the general lack of capacity in the marketplace is significantly impacting rates. To wit, in 2015, there were no fewer than six carriers that could provide coverage for a typical condo or townhome project. In 2020, that number has more realistically dropped to two or three.

Conclusion

In 2018, a “hardening market” – a period of increasing rates – was predicted to last into 2020. The uncertainly unleashed by COVID-19 could extend the hardening market by years. If there is any silver lining, it is the fact that an environment of increasing rates will inevitably draw opportunistic capital. For example, after several difficult years Lloyds of London is looking to add $15 billion of new business in 2021. New capital is flowing into Bermuda. Two new carriers entered the residential marketplace in 2019. The situation will likely remain in flux for some time, but we can remain confident that the insurance marketplace will continue to provide new alternatives.

Please be advised that this whitepaper is an educational and informational resource only. The views and statements expressed herein are not to be construed as legal advice from the authors or IMA and such communication is not protected under the attorney client privilege. Recipients should seek specific legal advice from competent legal counsel of your choice.