Q4 2019

Pricing Update

RATES CONTINUE TO INCREASE AT CLOSE OF 2019

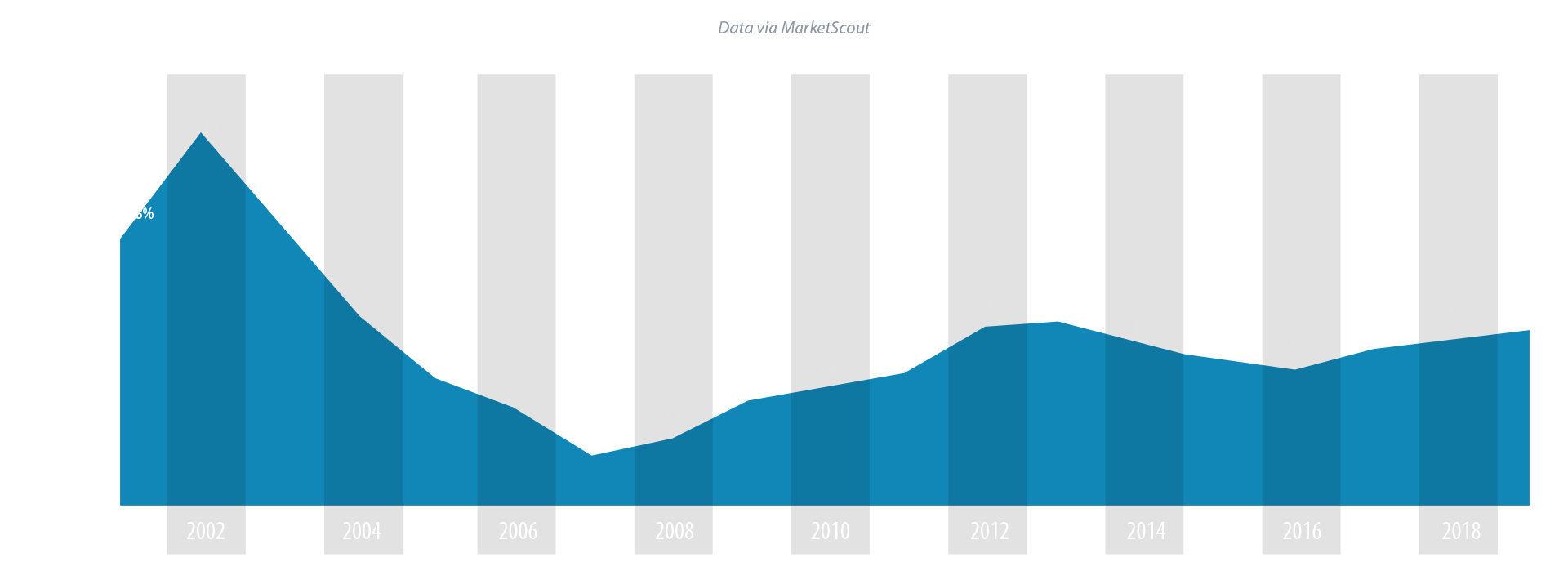

In the U.S., 2019 saw the largest average premium rate increase since 2013. Average increases originally began in the second half of 2016 driven primarily by massive increases in commercial auto but the rest of the market has evolved dramatically in the last 3 years as well.

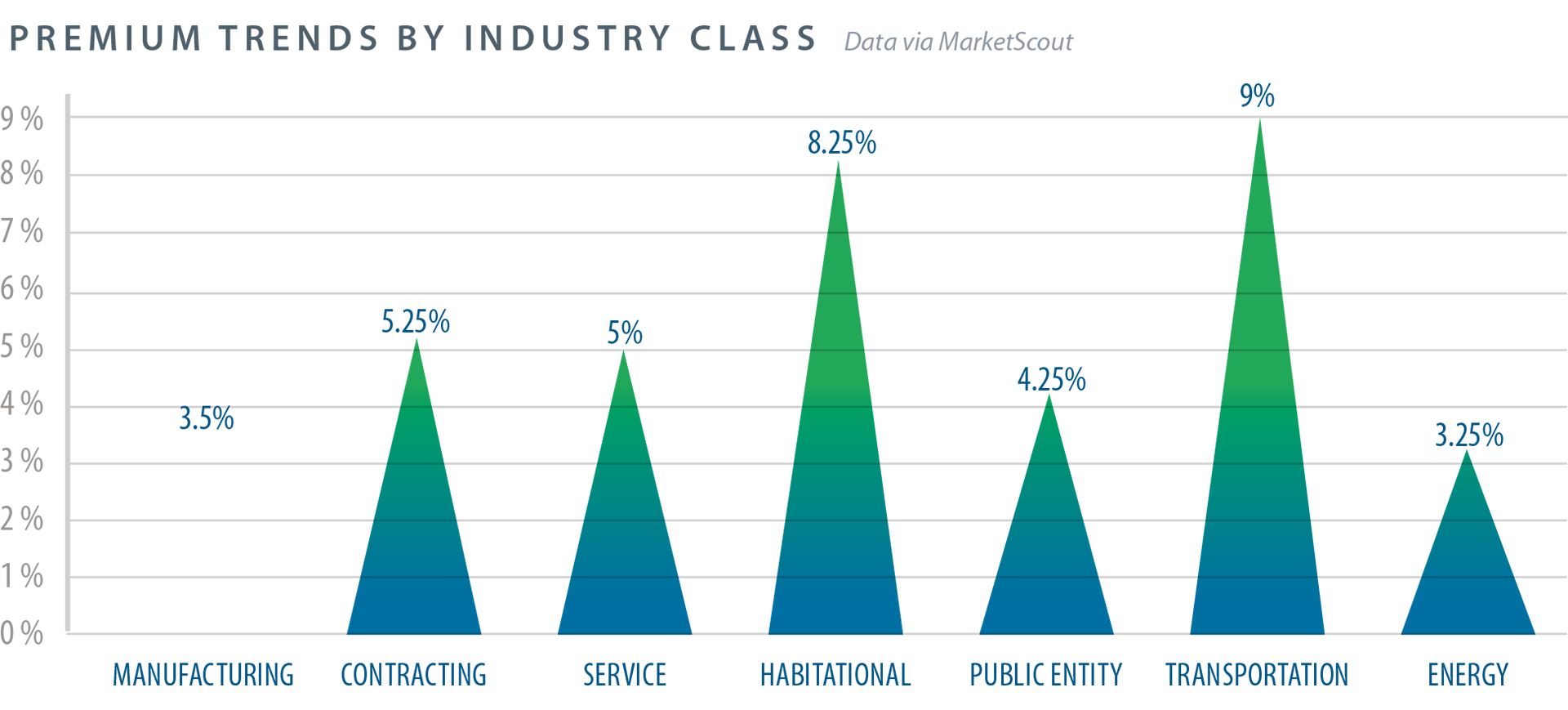

CAT and storm losses in the midwest and southeast resulted in huge, sometimes 3 digits, percentage renewal increases for many habitational risks, a more litigious securities environment has pushed D&O renewals toward minimum double-digit rate increases, and 'nuclear' jury verdicts punched through limits driving umbrella costs higher.

These factors, combined with many others seem poised to contribute to a hard insurance market overall through 2020.

Q4 2019 PREMIUM TREND BY COVERAGE CLASS

Actual rate increases are predicated on specific loss experience per company

| RATE CHANGE BY COVERAGE CLASS | |

|---|---|

| Commercial Property | +5.25% |

| Business Interruption | +5.0% |

| BOP | +3.5% |

| Inland Marine | +4.0% |

| General Liability | +4.25% |

| Umbrella/Excess | +5.5% |

| Commercial Auto | +8.0% |

| RATE CHANGE BY COVERAGE CLASS | |

|---|---|

| Workers' Compensation | -1.0% |

| Professional Liability | +6.0% |

| D&O Liability | +8.25% |

| EPLI | +4.25% |

| Fiduciary | +3.5% |

| Crime | +3.25% |

| Surety | +2.0% |

For the first time in recent memory, average rate increases for ‘jumbo’ insureds (those paying over $1 million in premium) led all account sizes, reversing the previous trend of the largest insureds being somewhat sheltered from rate increases seen by smaller companies.

In the fourth quarter of 2019, D&O and Professional liability rate increases spiked dramatically, significantly impacting the overall average. The surge in D&O pricing has been caused by a combination of factors, with the largest two being litigation risk rising to an all-time high and profit pressures decreasing carriers’ willingness to undercut premium.