Q2 2020

Pricing Update

COVID-19 CONTINUES TO IMPACT INSURANCE RATES

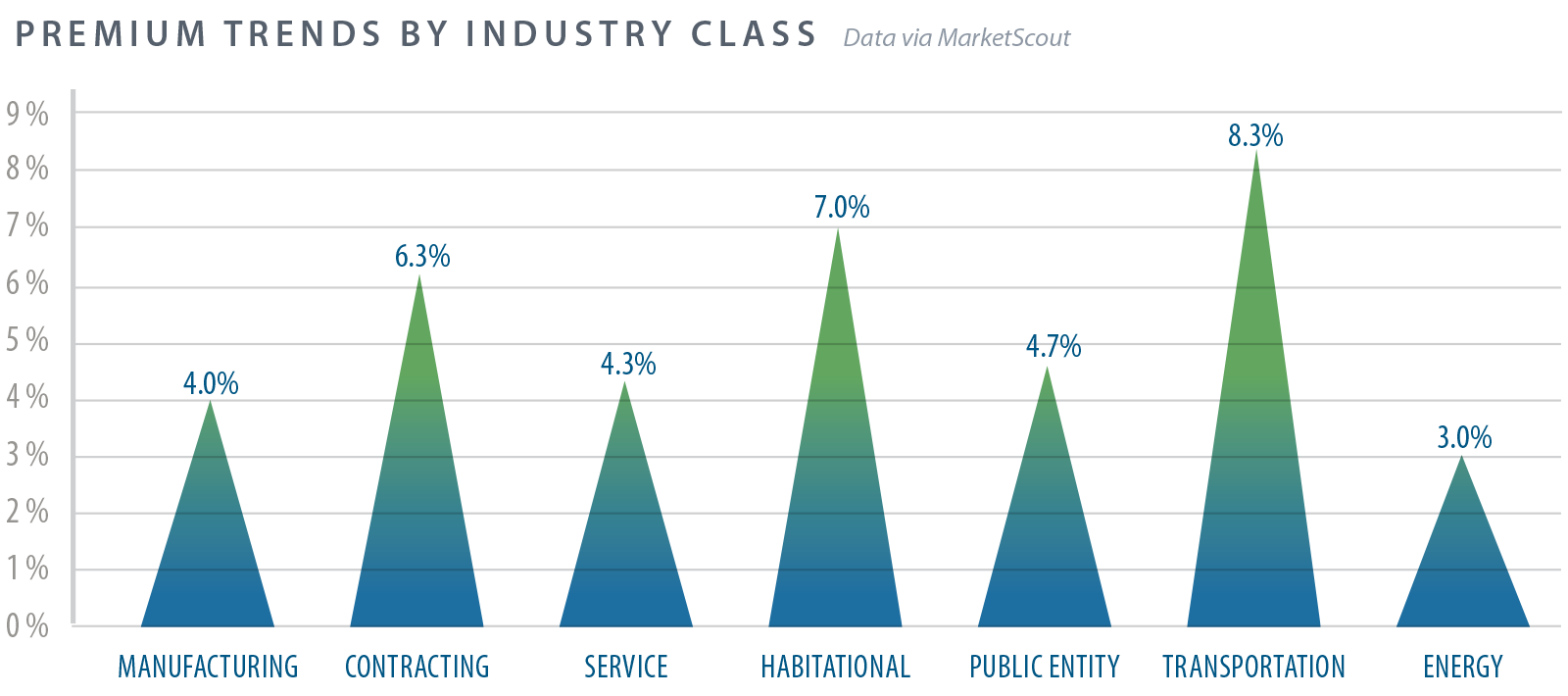

Premium rates increased 4.8% in the second quarter of 2020, another significant increase following an already difficult Q1. Significant difficulties have arisen in all markets due to the COVID-19 pandemic, but especially hard hit have been public and private D&O, business interruption, property and umbrella/excess liability markets, which have all seen rate increases that far outstrip the average.

While the full effects of COVID-19 have yet to be fully realized or understood, the most recent estimates predict $40B to $100B in covered losses due to the pandemic. Lloyds alone estimates their syndicates will pay up to $4.3B in COVID-19 related losses. This wide range, and its associated uncertainty, are causing carriers from every corner to reduce limits and increase rates and deductibles. Essentially, American companies are facing an insurance environment not seen since the aftermath of the terrorist attacks of September 11th, 2001.

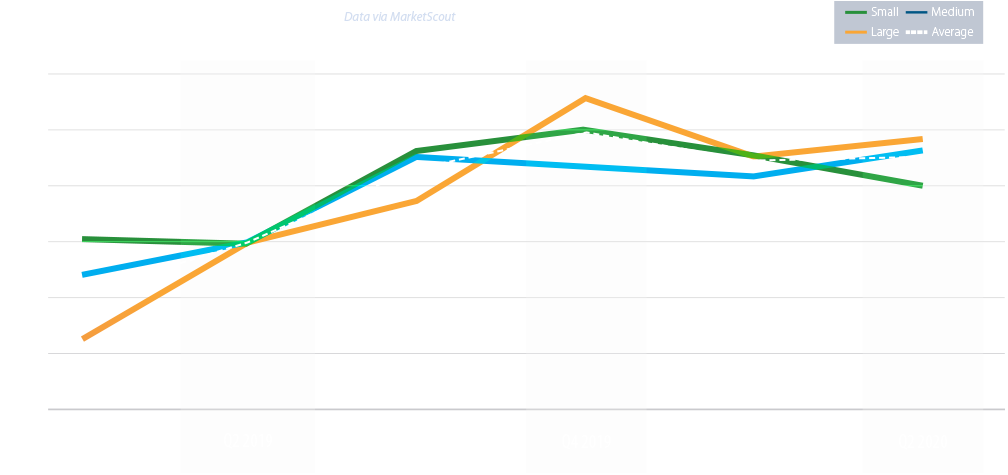

Q2 2020 PREMIUM TREND BY COVERAGE CLASS

Actual rate increases are predicated on specific loss experience per company

| RATE CHANGE BY COVERAGE CLASS | |

|---|---|

| Commercial Property | +5.0% |

| Business Interruption | +6.0% |

| BOP | +4.6% |

| Inland Marine | +4.6% |

| General Liability | +4.3% |

| Umbrella/Excess | +4.0% |

| Commercial Auto | +5.3% |

| RATE CHANGE BY COVERAGE CLASS | |

|---|---|

| Workers' Compensation | 0.0% |

| Professional Liability | +6.7% |

| D&O Liability | +9.3% |

| EPLI | +5.0% |

| Fiduciary | +2.6% |

| Crime | +4.0% |

| Surety | +1.3% |

Directors & Officers

Average premium increases for D&O moved upward at 9.3% this quarter and are not expected to stop. This average increase belies the situation many public firms are facing where triple-digit increases in premium rate, increased deductibles and decreased limits have been a rule rather than an exception. Class action securities litigation, already at record-level activity, will almost certainly increase during the second half of the year as bankruptcies from COVID-19 drive unprecedented lawsuits, further putting upward pressure on D&O pricing.

According to AmWins, when a D&O quote is provided to the insured there is “little to no room for negotiating terms and conditions” causing “many insureds to buy fewer limits”.

Umbrella & Excess Liability

The most significant market hardening so far in 2020 has been in umbrella and excess liability. These changes can be attributed to social inflation – or rising liability claim awards – manifesting in higher attachment point requirements and reductions in carrier capacity. As carriers exit the market or draw down their capacity, insureds are starting to see less competition, a higher level of underwriting discipline, a shortage of available limits and cost increases.