The Novel Coronavirus begins to Impact the D&O Marketplace

Prior to the COVID-19 pandemic, and as we previously reported in the last Quarterly Update, the D&O insurance marketplace for U.S. public companies was already becoming increasingly challenging in the second half of 2019, with upward pressure on pricing and, to a lesser extent, retentions (which are also known as deductibles). These are developments that would generally be associated with a “hardening” insurance marketplace, and this trend continued into the first two months of 2020. In certain areas, it was even more pronounced – IPOs, distressed companies, and companies in certain industries, such as Life Sciences.

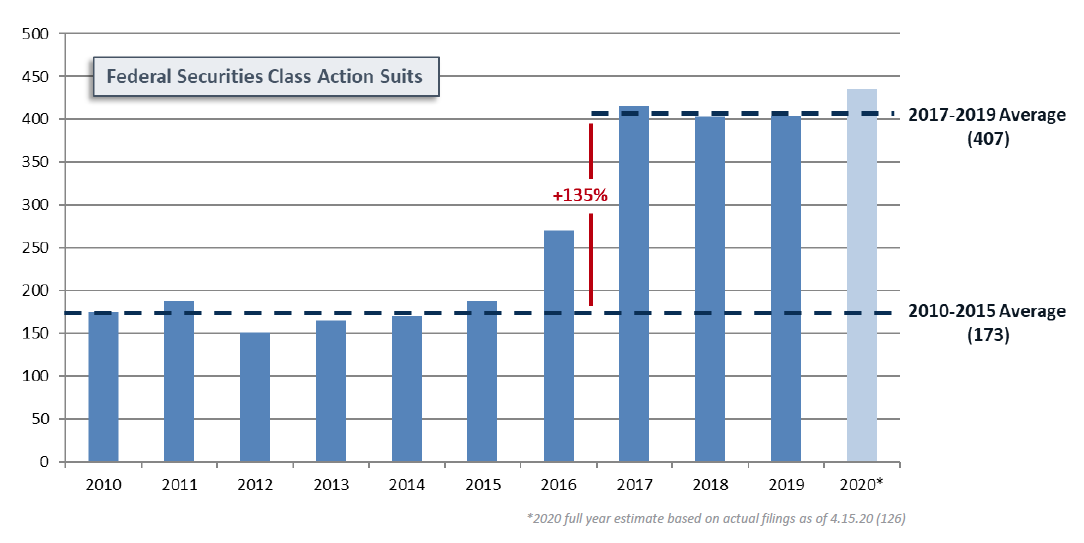

There are several reasons behind the hardening D&O marketplace, including a recent trend of increased state court filings, but the primary reason has been a continued high level of federal securities class action – or, SCA – litigation. As you will see in the chart included later on in this update, SCA litigation has been elevated for the last three years, with a 2017 to 2019 annual claim average of 407 filings. By comparison, the 2010 to 2015 annual claim average was 173 filings, and, with limited exceptions, this level was fairly consistent prior to 2010, meaning that the 2017 to 2019 average represented a 135% increase over “historical” norms.

In response to this elevated filing activity, many D&O insurers decided to either take a “wait and see” approach or to actively reduce their market share in 2019, with an increasing number willing to take a hard line on D&O placements. As a result, only two of the top ten largest D&O insurers grew their market share in 2019 based on direct written premium, with the others either maintaining or decreasing their market share. Again, this was by design due to the challenging marketplace conditions.

This underwriting approach continued into the first two months of the new year, with litigation levels remaining elevated, and the D&O marketplace becoming more challenging by the week. Industry discussions at the time focused on how severe the hard market would become, and how long it would last, but what no one expected was such a rapid, further hardening of the D&O marketplace due to the economic impact of a global pandemic.

As we are all now well aware, COVID-19 has become the most significant worldwide development in 2020. For U.S. companies, it began primarily as a supply chain concern, before it quickly began to impact many other areas of business. From an insurance perspective, much of the attention has rightfully been on “business interruption” insurance, but we are now seeing other areas of insurance come into play as a result of the broad impact this is having across the economy.

Unfortunately, but not unexpectedly, it did not take long for the first D&O claim to be brought against a U.S. public company as a result of the coronavirus. In fact, on March 12, two claims were filed – one against Norwegian Cruise Line Holdings Ltd. for allegedly misleading sales tactics, and the other against Inovio Pharmaceuticals, Inc. based on statements its CEO made regarding the company’s development of a COVID-19 vaccine.

The allegations contained within both of these claims were rather specific, and at the time it was still in question as to whether this pandemic would have a broader impact on the management liability (including D&O) marketplace. Unfortunately, it did not take long for this question to be answered.

On April 7, shareholders filed suit against Zoom Video Communications, Inc., a company many had not even heard of prior to March of this year, but one that most people are now familiar with The interesting thing about this claim is that Zoom happens to be a company that is benefiting from the current shutdown, with a YTD stock price increase of over 100%, yet shareholders still made the decision to file suit over alleged privacy and security weaknesses related to the company’s services.

Another noteworthy lawsuit is the April 6 wrongful death suit filed against Walmart Inc following the death of an employee from COVID-19 complications. Although not a D&O claim, this could have important implications in the D&O space given the recent trend toward “event driven” litigation, with shareholders increasingly willing to allege some type of oversight failure by directors and officers of the company.

As we think about D&O litigation in the coming months, there could very well be additional claims that are a direct result of COVID-19 such as those that have been brought against Norwegian and Inovio. However, we would not be surprised to see more claims brought as an indirect result of COVID-19 such as the claim against Zoom.

As companies deal with the fallout associated with the economic impact COVID-19 has had and will likely continue to have, they will undoubtedly put forth statements regarding their operations, financial condition and flexibility, and general ability to get back to some semblance of normality. Plaintiffs’ attorneys may call into question the accuracy of these statements and use them as the basis for D&O litigation It is also quite possible that this plays out over an extended period of time.

Furthermore, as we have already seen in the Energy space, there will likely be a noticeable increase in the number of companies facing insolvency as a result of COVID-19 and its impact on their business. Whether it is litigation brought by trustees, creditors or other interested parties, an increase in bankruptcy filings could also impact future D&O litigation rates.

Lastly, it would not be a surprise to see an increase in regulatory investigations – for instance, by the Securities and Exchange Commission – as companies work to regain their footing and navigate the “new norm’ in the months ahead.

What this means for the D&O marketplace over the long term remains to be seen. However, what was already a challenging marketplace at the beginning of the year has become slightly more difficult over the last several weeks. Fortunately, most of the dire predictions mentioned in various publications, such as the addition of a “COVID-19 Exclusion” or “Bankruptcy Exclusion” to D&O policies, have not come to fruition In addition, D&O coverage remains as broad as it has ever been, and any exclusionary language that could come into play with any COVID-19 related D&O claim, such as the “Bodily Injury” exclusion, tends to be quite narrow in nature, with several carve backs that benefit the insured.

Another important D&O policy provision to keep an eye on will be the “reliance clause” which details the amount of information the insurer is allowed to rely upon in its underwriting of the policy. Going forward, as companies deal with the ongoing impact of COVID-19 and try to find the right balance of information to publicly disclose, without having an existing playbook to offer the proper guidance, it will be important to limit the D&O insurers’ ability to rely upon a company’s public filings, most notably those with the SEC.

However, we are still in the early days, and the impact this has on the D&O marketplace long term is something that we will continue to monitor very closely and discuss with clients in advance of any renewal.

For those with an upcoming D&O renewal, please know the renewal process will likely take much longer than prior renewals, and it will be important to start early. Now more than ever, a detailed plan for marketing the company to insurance underwriters will be a necessity, with a particular emphasis on the company’s financial flexibility and ability to weather the current storm. Cash position, cash burn and opportunities to raise additional capital, if necessary, will be of great interest to D&O underwriters.

In addition to this, two additional items will be crucial to a successful D&O renewal in the current climate. One, structuring a D&O program with insurers that have shown a long term, consistent approach in the marketplace, particularly with regard to their ability and willingness to pay claims, is paramount. Now is not the time to partner with newer entrants in the marketplace. Although the typical D&O policy is written on an annual basis, the typical D&O claim can take 3 years to play out, so it is important to partner with insurers that will be around for the long term This will also increase the likelihood of a predictable claim resolution, should a claim arise.

The second important factor for a successful D&O renewal will be to work with an experienced representative who can effectively navigate the current D&O marketplace Ideally, someone who has also worked through a prior hard market Working closely with an experienced and knowledgeable representative will absolutely make a difference in today’s marketplace.

CASES OF INTEREST

Delaware Supreme Court Upholds Corporate Provision Limiting Shareholder Litigation to Federal Court

On March 18, 2020, the Delaware Supreme Court issued a welcome decision which has the potential to limit the effects Cyan v Beaver County Employees Retirement Fund has wrought on public companies. By way of background, in the 2018 Cyan opinion the U.S. Supreme Court held that state courts retain concurrent jurisdiction over securities class actions alleging violations of the Securities Act of 1933. As a result, public companies have been forced to defend a multitude of suits in multiple jurisdictions.

One of the ways companies had attempted to avoid this possibility was through adoption of charter or bylaw provisions that required any claims under the 33 Act to be brought in federal court Initially, and prior to the Cyan opinion, the Delaware Chancery Court found said federal ‘forum provisions’ invalid. However, in an opinion reversing the Court of Chancery, the Delaware Supreme Court has now unanimously held the charter provisions designating federal courts as the exclusive forum for 33 Act claims to be facially valid and enforceable.

This decision has major implications for an issuer’s ability to better manage cases brought under the 33 Act and prevent claimants from avoiding application of procedural protections found in the Private Securities Litigation Reform Act of 1995. It also provides a mechanism by which cases may be consolidated for efficiency, which is impossible for cases brought in state court. Because the legality of federal forum provisions had remained in doubt, widespread adoption never occurred. But that is all now likely to change, and it will be interesting to see if Delaware corporations adopt federal forum provisions en masse. Salzberg v. Sciabacucchi, 2020 WL 1280785 (Del March 18 2020).

Massive Securities Class Action Settlements Continue Apace with Signet Jewelers Joining the Fray

In 2016, Signet Jewelers and its directors and officers were sued over two distinct sets of allegations. The first related to disclosures about its lending program through which financing was provided to customers. The second arose from allegedly misleading statements about an ongoing employee arbitration case wherein rampant sexual harassment was alleged within the company. Shareholders alleged the board misleadingly minimized the matter as only involving ‘store level’ employment practices, when in fact allegations against executives, including the CEO, existed. Following the denial of the defendants Motion to Dismiss in 2018, a settlement of $240,000,000 was announced in March 2020.

While it is difficult to allocate how much of the settlement relates to either set of allegations, the size of the figure itself is noteworthy along with the fact that it falls into the category of event driven litigation impacting D&O insurance policies. It follows settlements announced in the first quarter of 2020 of $350,000,000 by First Solar, $149,000,000 by Equifax, and $187,500,000 by Snap. The Wells Fargo derivative settlement, which has a cash value of $240,000,000 also fits this trend. Collectively, the impact on D&O insurers is significant, especially when viewed in conjunction with the hardening, or already hard, market where companies have been faced with double-digit premium increases.

D&O Filings and Settlements

D&O Filings

As we have previously reported , D&O Federal Class Action Securities Claims have been elevated for four straight years.

• The 2019 annual total of 404 filings exceeded the 2010-2015 annual average of 173 filings by 134%.

• Accounting-related cases increased noticeably in 2019, representing 42% of total filings (versus 35% in 2018).

In 1Q2020, filings started out slower than the last few years (93) but increased rapidly in March (which has continued into April).

• Filings through April 15 imply an annualized number of 435 filings, which would be an 8% increase over 2019.

• At this rate, approximately 1 in 10 public companies are being sued for securities fraud.

D&O Settlements

74 Federal Class Action Securities Claim settlements were approved in 2019 (a five year low), versus 78 in 2018.

- With a median time of 3+ years from filing to settlement, we would not be surprised to see an increase

in the number of 2020 settlements based on the recent elevated filing levels that began in 2017.

Average settlement size remained approximately the same in 2019 ($27.4 million) versus 2018 ($27.6 million)¹

Settlement sizes for other D&O claims (i.e., derivative claims) have also been increasing, as have defense costs.

Dismissal rates are still in the mid 40s, meaning around 45% of filings are dismissed.

¹2018 average settlement size does not include one settlement which totaled $3 billion

Key Contacts

Brian R. Bovasso

Managing Director

IMA Executive Risk Solutions

303.615.7449

brian.bovasso@imacorp.com

Travis T. Murtha

Director of ERS Claims

IMA Executive Risk Solutions

Legal & Claims Practice

303.615.7587

travis.murtha@imacorp.com

About IMA

IMA Financial Group is a privately held, diversified financial services firm focused on protecting client assets and creating exceptional value for our clients around the world. Our diverse team of experienced and talented professionals shares an unwavering commitment to excellence.

IMA Executive Risk Solutions is our world-class team of 20+ professionals focused on providing thoughtful advice, a unique legal perspective, a broad range of executive risk insurance solutions, and excellent service to our valued clients. Our professionals have deep experience handling complex executive risk exposures for a variety of clients – from pre-IPO start-ups to multi-billion dollar corporations.