COMMERCIAL INSURANCE RATES REMAIN STEADY

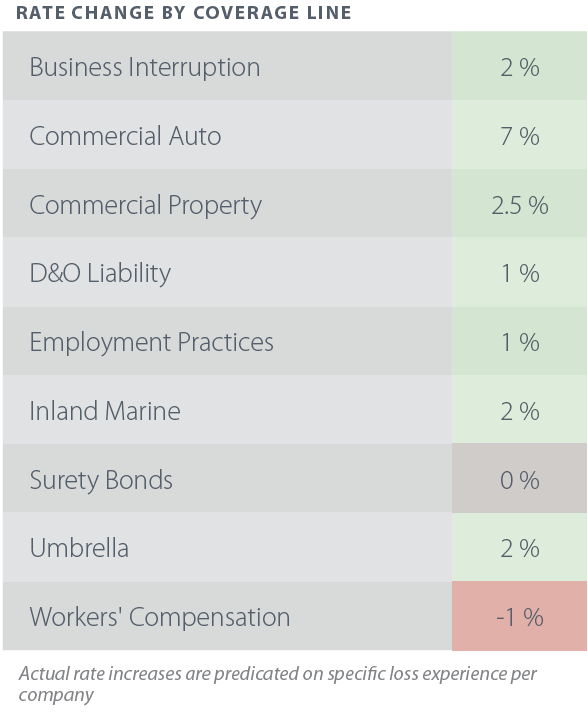

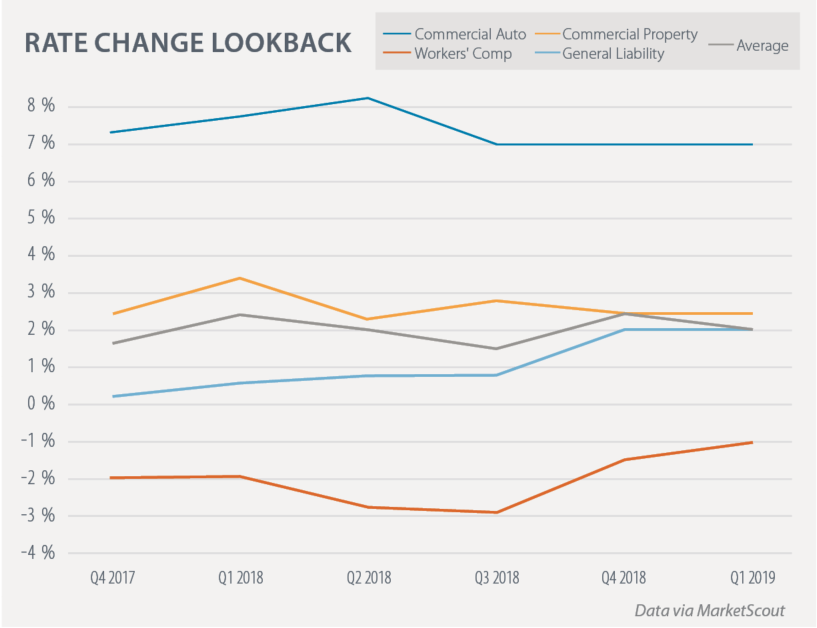

Premium pricing was up nearly across the board in the first quarter of 2019, with workers’ compensation (down 1%) and surety (flat) being the only two outliers. Overall, premium pricing jumped 2% on average compared to a year ago, led again by commercial auto (7%) and commercial property (2.5%). At -1%, workers’ compensation saw the smallest decrease in premium rate over the last two years, indicating that market may finally be hardening.

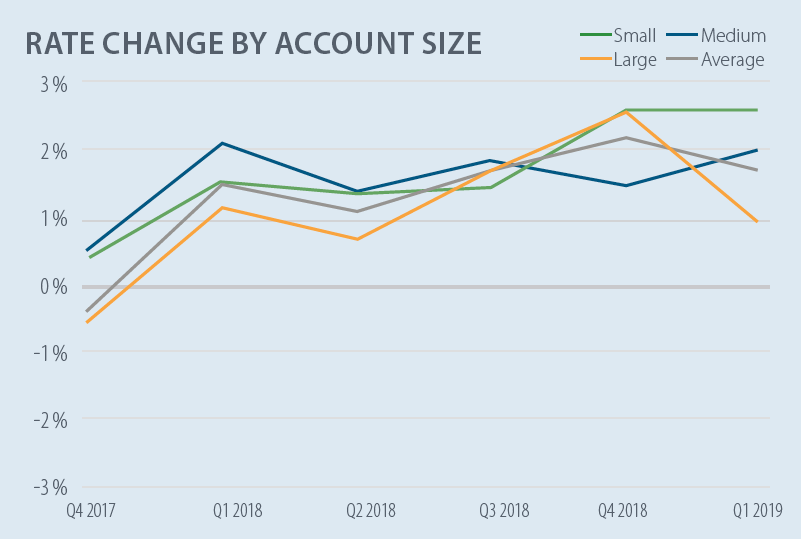

Small businesses (those paying less than $25,000 in premium) were hit hardest by rate bumps in Q12019, averaging a 2.5% increase. Conversely, businesses paying over $250,000 in premium saw only modest increases, averaging 1%.

Data via MarketScout

Lloyd’s increased focus on profitability has led to higher reinsurance premiums for energy carriers, costs which are being passed onto insureds. This, coupled with a small number of market withdrawls in the upstream energy market and increased carrier willingness to walk away from unprofitable business overall has caused the energy market to harden faster than average with 2.5% premium rate increases reported for Q12019.

Data via MarketScout