2020 was a year full of global perils ranging from COVID to man-made and natural disasters. Pandemic outbreaks are now among the top business risks globally, while political risks and violence have returned to the ranks of the top global perils for the first time in three years in the Allianz Risk Barometer 2021.

- Business interruption was the top-ranked global peril,

- The pandemic outbreak was second, which was the biggest climber, up 15 positions to second place,

- Cyber incidents ranked a close third.

All three risks and many others in this year’s top 10 are interlinked, demonstrating the growing vulnerabilities and uncertainty of a highly connected world.

Suggestions for Businesses Going Forward:

Business continuity planning needs to become more holistic and dynamic, with companies taking an approach that develops alternative or multiple suppliers and invests in digital supply chains. Organizations need to develop a network of interconnected supply chains that is monitors conditions in real-time and improves supplier selections. Companies also need to remember there are still traditional business interruption events that can occur.

Global Business Peril Stats and Examples:

Insurance industry losses from natural catastrophes and man-made disasters globally amounted to USD 83 billion in 2020, according to Swiss Re Institute’s preliminary sigma estimates. This makes it the fifth-costliest year for the industry since 1970. Losses were driven by a record number of severe convective storms (thunderstorms with tornadoes, floods and hail) and wildfires in the US. These and other secondary peril events around the world accounted for 70% of the USD 76 billion insured losses from natural catastrophes.

Instances Around the World

- In the US, a record number of severe convective storms caused devastation throughout the year, likely leading to record annual losses in the country for this peril.

- Australia and Canada suffered significant losses from hail damage in 2020. In January, hailstorms in southeastern Australia caused insured losses of over USD 1 billion, while Canada experienced its costliest-ever hail event in Calgary in June, which led to losses of USD 1 billion.

- Further secondary perils included severe floods in several provinces along the Yangtze River in China from May, causing industry insured losses of roughly USD 2 billion.

- Winter storms hit northern Europe in February, causing flooding, power outages and transport disruption, with more than USD 2 billion combined insured losses.

- In May, cyclone Amphan in the Bay of Bengal caused economic losses of USD 13 billion, the most destructive tropical cyclone India has ever experienced.

Insured losses are expected to be just a fraction of the economic losses due to the region’s low insurance penetration. These catastrophe loss estimates are for property damage and exclude claims related to COVID-19.

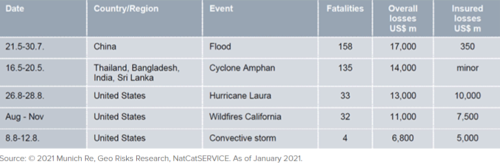

Below is a breakdown of the top five world costliest natural catastrophes by overall losses:

Overall, the 2020 calendar year was an eventful and risky for the insurance industry globally. Refer to the “Reinsurers Raise Rates Across the Board” article for see the effects of the global perils.

https://www.iii.org/fact-statistic/facts-statistics-global-catastrophes