COVID-19

Impact to Health Plan Claims

COVID-19 will likely accelerate this already hardening marketplace.

Initial projections suggest that, while it is certainly a public health emergency and efforts to flatten the curve to slow the spread are necessary, it may not be catastrophic from a claims cost perspective.

COVID-19 Impact to Health Plan Claims

The coronavirus crisis has developed into one of the most impactful public health emergencies in decades. it’s early to truly understand exactly how this will impact self-insured and fully-insured plans, carriers in the commercial market are developing estimates based on available data to date, and many plan sponsors will be paying attention over the next few months to understand how their self-funded and fully-insured plans will be impacted.

Initial projections suggest that, while it is certainly a public health emergency and efforts to flatten the curve to slow the spread are necessary, it may not be catastrophic from a claims cost perspective.

Factors Influencing COVID-19 Claims Impact

COVID-19 Infection rate

It is still unclear where overall COVID-19 infection rates will land, and if social distancing practices will keep overall infections to a relatively low number, or simply spread them out to reduce burden on the health system.

Adding to the lack of clarity are assumptions regarding “true” infection counts thus far. Due to the speed of infection spread and the characteristics of the illness that leave many with no symptoms or very mild symptoms, infection counts may be significantly higher than the number of confirmed cases. If true, this impacts cost projections as well as assumed hospitalization and mortality rates.

Demographics

One clear piece of data is that older individuals, especially those over age 70, are the hardest hit by the illness. While true, this should not be confused with a belief that younger individuals are immune to severe cases. In a report published on March 16, 2020, researchers at the Imperial College of London assumed hospitalization rates of 1.2% for those aged 20-29, 3.2% for those aged 30-39, 4.9% for those aged 40-49, with hospitalization rates increasing significantly there after to 10.2% for ages 50-59, 16.6% for ages 60-69, 24.3% for ages 70-79, and 27.3% for ages 80+. For those who end up in the hospital, the report assumes that ICU rates increase drastically by age as well.[1] While 3-5% hospitalization rates for ages 30-49 is a small portion of overall cases, it’s significant for an age group that typically has few hospitalizations to begin with.

[1] https://www.imperial.ac.uk/media/imperial-college/medicine/sph/ide/gida-fellowships/Imperial-College-COVID19-NPI-modelling-16-03-2020.pdf

Timing and non-essential claims avoidance

We expect a significant decrease in certain claims beginning in March 2020, extending through at least the end of April 2020, as non-essential services are either delayed or redirected. If forecasts are correct, that will give way to significant COVID-19 claims activity in April through June. What comes next depends on how widespread COVID-19 is, and how long infections last. We expect that many non-essential procedures that were delayed will not be avoided entirely, and many will still happen later in 2020 or into 2021.

Since COVID-19 infections tend to happen in clusters, specific geographies and employers will have lower infection rates. In those cases, decreased claims for avoided non-essential procedures could outweigh increased COVID-19 claims costs, and many employers may see a decrease in costs overall in 2020.

Chronic conditions and smoking/vaping

In addition to age, another clear indicator of increased risk of severe COVID-19 illness is the presence of chronic conditions. In a report issued by the CDC on March 31, 2020, for those aged 19-64, individuals with a chronic condition, or current or former smokers, were about three times more likely to be hospitalized, and four to five times more likely to require ICU admission, as those without underlying chronic conditions.[1]

A February study in the New England Journal of Medicine estimated that smokers were over twice as likely to be hospitalized due to COVID-19.[2] While data isn’t available yet to distinguish between smoking and vaping as it relates to COVID-19, it is likely that the impact of either is a significant indicator for hospitalization, especially for younger people.

[1]https://www.cdc.gov/mmwr/volumes/69/wr/mm6913e2.htm?s_cid=mm6913e2_w

Case clusters and geographic differences

Specific geographies will be hit harder than others, and specific employers may have an outbreak among their workforce. It’s easy to imagine a scenario where the U.S. population has a 10-20% infection rate, while a specific single-site workforce can have a greater than 50% outbreak.

Putting it Together: Claims Projections

While COVID-19 is certainly a public health crisis, early indications suggest it won’t be a catastrophic claim event for most health plan sponsors.

We expect the following average claims impacts based on COVID-19 infection rate:

- 10% infection rate: 0.0% to 2.0% claims increase

- 25% infection rate: 4.0% to 5.0% claims increase

- 40% infection rate: 4.5% to 6.5% claims increase

These averages are estimated impacts to overall claims, compared to a “typical” year, and do not include standard annual trend assumptions. Several health insurance carriers have announced the elimination of member cost-sharing for COVID-19 claims, or an option to eliminate cost sharing. We estimate that this will produce an additional 0.2% to 0.5% claims increase on average.

Specific impacts to any plan will be reliant on the share of members greater than age 50, and incidence of chronic conditions. Infection rates are likely to be highly variable within geographies and even companies, depending on local outbreaks.

At lower overall infection rates, cost impact is mitigated by avoidance of non-essential care. While some non-essential care will only be delayed and not outright avoided. In more severe infection rate scenarios, costs will be mitigated by further avoidance of non-essential care, and in some cases, diversion or rationing of some care.

COULD PLANS EXPERIENCE A COST DECREASE?

For those following estimates of claims cost impact to self-insured health plans, you may be wondering whether avoided non-essential medical services due to COVID-19 might actually make plan costs go down for your self-insured plan. If this is a major pandemic how could that be the case? Note that our estimates suggest preparing for a claims increase on average, but to illustrate this possibility, let’s look at a hypothetical timeline of how claims might play out.

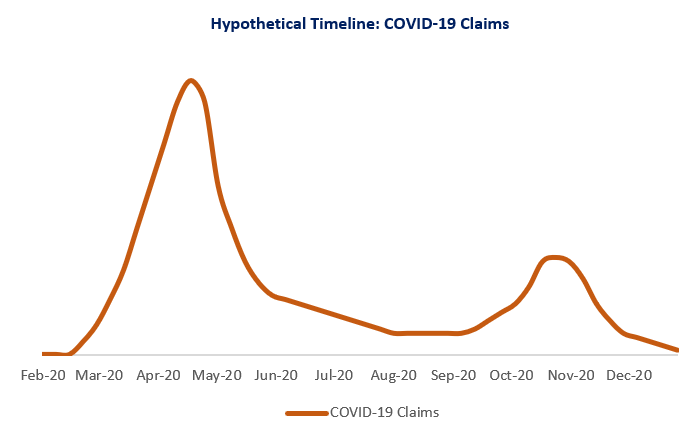

Many experts have pointed to a first large wave of COVID-19 cases in April, with a decrease in the summer and a second, smaller wave in the fall. This might look like the following:

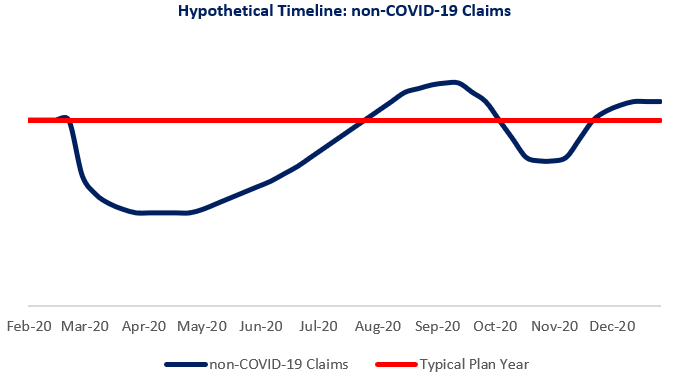

At the same time, everyone is being advised to avoid non-essential medical services. This has already resulted in a decrease in claims in March and April for many physician and surgical services, and diverted other services to other mediums, such as telemedicine. In that case, all non-COVID-19 claims might look like the following, compared to a typical plan cost year.

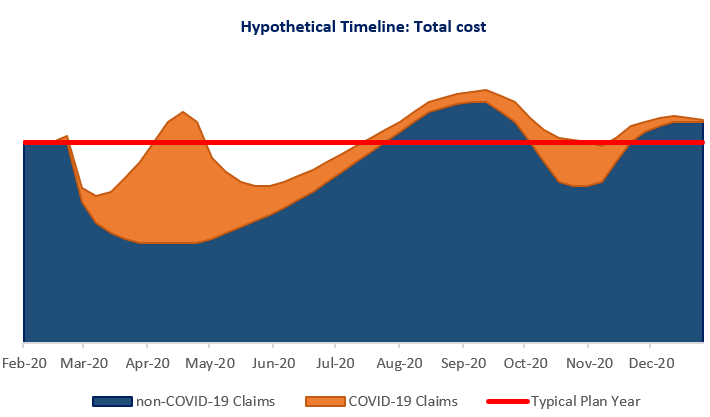

Putting the two together, it’s possible that overall costs may look something like this:

In our example, claims are higher than a typical year during the peak of COVID-19 claims, and again when non-essential services are made up later in the year but are lower when non-essential services are being delayed. If the total claims reductions (sections below the red line) are greater than the total excess claim periods (sections above the red line), then plans would see a decrease in overall claims.

Since the risk of serious illness is significantly higher for those who are older and have chronic conditions, and since COVID-19 trends to be transmitting in clusters, that some groups will have lower COVID-19 related costs and may have claims decrease overall.

What comes next?

Employers can mitigate their risk by encouraging their employees to follow local and national public health recommendations such as social distancing and hygiene habits to the extent possible.

As employers begin to return to work, diligence should be placed on mitigating risks of outbreaks which can have severe impacts not only on claims costs but business operations. Encouraging employees to continue following public health guidelines after returning to work, and to use sick leave when they have symptoms to reduce the chances of an outbreak will be imperative.

With regards to both self-insured and fully-insured health plans, COVID-19 claims will remain a significant topic in the upcoming months. A robust effort to understand the impact of COVID-19 on your health plan, and consideration of those impacts into the future, will be necessary to effectively manage health plan costs.

This material is for general information only and should not be considered as a substitute for legal, medical, tax and/or actuarial advice. Contact the appropriate professional counsel for such matters. These materials are not exhaustive and are subject to possible changes in applicable laws, rules, and regulations and their interpretations.