D&O Filings and Other Developments

D&O Filings

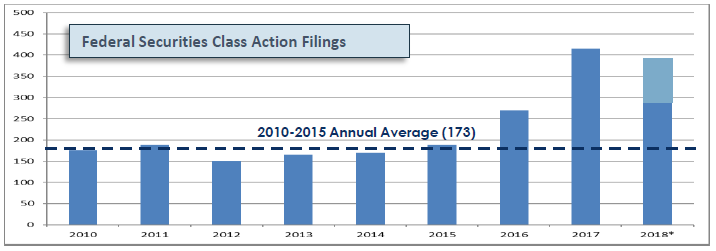

As we previously reported, 2017 D&O filings were up 54% over 2016 and at their second-highest level ever (highest = 2001)

- In 1H2018, filings continued at an elevated level, with 204 D&O Class Action Federal Securities Claims having been filed

- The elevated filing pace has continued through the first three quarters of 2018, with 292 claims having been filed

- Filing rates through September imply an annualized number of 390 D&O Class Action Federal Securities Claims

- An annual total of 390 filings would exceed the 2010-2015 annual average of 173 filings by 125%

- At this rate, approximately 1 in 10 public companies are being sued for securities fraud

Other Developments and Considerations

With D&O litigation remaining elevated, carriers are beginning to push for small rate increases on primary and low excess layers

- Primary and low excess layer price increases have been most noticeable for small cap companies

- Excess layer pricing remains noticeably more competitive than primary layer pricing, particularly in certain sectors

Despite the recent pricing adjustments on primary and low excess layers, overall pricing remains near a 15-year low

- Furthermore, already broad policy coverage terms continue to expand

A development we are watching closely is the rise in third-party litigation financing, and its impact on D&O litigation

- From 2013 to 2017, litigation financing has increased approximately 400%, and in the first week of October 2018,

London-based litigation financier Burford Capital Ltd. alone raised $250 million to support ongoing efforts in the space

Another trend we are watching closely, and one that is possibly related to the prior note on litigation financing, is the continued

increase in the number of D&O claims being brought by “emerging” law firms (i.e., those newer to the securities litigation space)

- As a result, dismissal rates (which are already near an all-time high) are elevated for claims brought by these firms

- As these firms mature, it will be interesting to see if dismissal rates revert (i.e., drop) back to the historical mean

*Projected 2018 filing total based on number of suits filed through September

Sources: Cornerstone Research; Stanford Law School

KEY CONTACTS

Please be advised that this communication is an educational and informational resource only. The views and statements expressed herein are not to be construed as legal advice from the authors or IMA and such communication is not protected under the attorney client privilege. Recipients should seek specific legal advice from competent legal counsel of your choice.