CASES OF INTEREST

Perils Abound in SPAC-Land

With over 600 Special Purpose Acquisition Company (SPAC) IPOs completed since January 2020 (308 of which took place in the first half of 2021), a number of questions remain about their viability and the risk exposure present in such deals. The explosion of popularity in this model for taking a company public has attracted the interest of regulators, plaintiff’s firms and investors alike.

For those unfamiliar, a SPAC is a shell company which raises money in a public offering and then acquires a private company which will form its core business. The acquisition of a private company target is referred to as the de-SPAC transaction, and acts as a shortcut for private companies looking to access public equity markets without having to go through the typical registration process and road-show. The SPAC will then typically have 18-24 months to acquire a target business, otherwise the investments of shareholders are returned.

Given the recent uptick in SPAC formation (with 46 in 2018, 59 in 2019 and 248 in 2020), there is increased pressure to consummate the de-SPAC process. This has resulted in multiple SPACs bidding against one another and driving up the valuation of target companies. As one might expect, this has resulted in increased scrutiny, and quite inevitably, claims.

Because of the unique nature in which a SPAC is created, the claims being filed are correspondingly different than your typical securities class action. Rather than just the directors and officers of the resulting entity being sued, potential defendants also include the SPAC itself and the private company target. With the SPAC insurance being placed into run-off and a new D&O program incepting upon consummation of the de-SPAC transaction, insureds must be prepared for the possibility of multiple insurance towers being implicated (depending on the allegations made by shareholders or regulators).

The complexity of such claims and parties involved is on full display in the case of Churchill Capital Corp III (the SPAC) and MultiPlan Corporation. Litigation has now been filed in both state and federal courts related to the transaction. The (Delaware) state court litigation was filed against directors and officers of Churchill, related entities owned by the SPAC sponsor who performed advisory services, and the SPAC sponsor itself. The allegations primarily focus on breach of fiduciary duty rather than federal securities laws. Moreover, the alleged gravamen of the suit centers around alleged conflicts of interest between the SPAC sponsor and directors on one hand, and the public investors on the other. In short, the complaint alleges the defendants acted in their own financial interests to the detriment of investors and goes further in asserting the basic SPAC structure itself is “conflictladen” which “invites fiduciary misconduct.” The complaint expressly requests the Delaware court clarify that SPACs are subject to the same level of fiduciary duties applicable to all Delaware corporations. Interestingly, claims are not presently being asserted against the successor entity or its executives.

The foregoing example stands in contrast to other numerous cases currently pending which name the successor entity in addition to directors and officers of the SPAC. Such cases have typically been filed under federal securities laws and focus on the financial disclosures that follow the de-SPAC transaction. Another potential avenue involves publication of revenue projections before the de-SPAC SPAC transaction takes place. While traditional IPO prospectuses shy away from such disclosures, SPACs appear to be operating under the belief that forward looking statements are protected under safe-harbor provisions of federal law. Recent statements by John Coates, the Acting Director of the SEC Division of Corporate Finance, question the validity of such beliefs. His public statements make it clear that any material misrepresentations in any registration documents filed as a part of a de-SPAC transaction may trigger Section 11 liability. He went even further by explicitly saying anyone acting under the belief SPACs are subject to some lesser liability standard than traditional IPOs is uncertain at best.

In conclusion, the increasing popularity of SPACs is only likely to bring heightened scrutiny from regulators and plaintiff’s firms alike. The contours of claims and litigation vary widely compared to typical IPO or securities class actions and anyone involved in this space should keep a very close eye on regulations coming down the pike.

Settlement Constituting Disgorgement Found Insurable under Delaware Law

Earlier this year, a Delaware court was asked to answer whether amounts constituting disgorgement were prohibited by Delaware public policy. Following an investment fund’s acquisition of a company that resulted in the bankruptcy of underperforming assets, the bankruptcy estate filed suit against the fund and its managers. Claims for fraudulent conveyance, breach of fiduciary duty and related business torts were asserted by the estate.

The fund’s D&O insurers refused to defend or indemnify it against the claims, asserting the $120 million settlement was uninsurable as a matter of public policy by way of it constituting disgorgement or restitution for ill-gotten gains. Coverage litigation ensued between the entire insurance tower and the fund.

The crux of the dispute turned on whether Delaware or New York governed the insurance policies. The insurers took the position New York law applied and barred coverage for the settlement payment. This is in spite of the fact that the policies explicitly included language whereby the law most favorable to the insured would apply in coverage disputes. Despite having agreed to this language, the insurers argued the clause was unenforceable because it frustrates New York public policy. While the policies also included an exclusion for ill-gotten gains, it required a final adjudication for the exclusion to be triggered. The settlement agreement, naturally, did not admit any wrongdoing.

In rejecting the insurer’s arguments, the court found the ‘law most favorable’ provision enforceable and that Delaware law did not bar insurance coverage for settlements representing restitution or disgorgement. “In Delaware must Delaware, public policies against insurability must be pronounced by statute, not by judicial fiat.” As such, the settlement was deemed insurable under Delaware law.

While the insureds prevailed here, the more troubling aspect of this dispute is the apparent disconnect between the insurer’s underwriters and claims personnel. By agreeing to particular language in a heavily negotiated policy, it is extremely disconcerting for an insurer to then take the position after the fact that such a provision is legally unenforceable. It may not be full blown ‘bait and switch’, but this sort of conduct is certainly something to keep in mind during negotiations with insurers.

Sycamore Partners Management, L.P. v. Endurance American Insurance Company, 2021 WL 761639 (Del. Sup. Ct. February 26, 2021).

Run off Language Requires Precision

Two recent cases highlight the pitfalls that can occur when negotiating tail/run-off language on liability policies. The first was described by the judge as a sprawling insurance coverage dispute involving one transaction, two alleged federal securities law violations, three policy towers, seven motions and thirteen parties. Following a merger, litigation was brought related to the proxy statements filed in conjunction with the deal and post-closing financials of the resulting entity. Shareholders of the surviving entity alleged wrongful conduct by executives both before and after consummation of the deal.

Despite extensions of coverage having been negotiated that encompassed prior acts and successor-in-interest language, all three towers of insurance sought to deny coverage for the resulting claims.

The claims surrounding pre-closing conduct settled for $45.6 million with the post-closing claims resolving for a payment of $62.4 million. The insurers raised a variety of coverage defenses, ranging from the applicable state law and interrelated claims provisions, to prior acts and bumpup exclusions.

In its ruling, the court first held that Delaware law governed the coverage dispute. Next, it held the pre- and post-closing allegations were not ‘fundamentally identical’ as required and therefore did not trigger the prior acts exclusion. The court also rejected arguments focused on the word “solely” in the successor-in-interest provision. Lastly, over the objection of the insurers, the bump-up provision was held to be an exclusion based on it limiting coverage in particular circumstances. Under the analysis applicable to exclusions and, relying on the exact words contained therein, the court again rejected the insurers position.

In the second case, claims were asserted by the bankruptcy trustee following a spinoff transaction. In essence, the trustee sought to void transfers undertaken as part of the spinoff as fraudulent transfers which led directly to the bankruptcy. Insurers of the two relevant entities declined coverage, taking the position that the matter did not meet the definition of “Securities Claim” within the policies. Interestingly, despite both policies being issued by the same insurer, the definition of a Securities Claim differed.

Without going into too much detail, the insurers argued the notes were not securities, the claims were direct rather than derivative and done on behalf of creditors (as opposed to the bankruptcy estate). The court disagreed on all points.

It found the trustee to be a security holder and the notes issued as part of the spinoff to be securities. It further found the insurers’ position would absolve them of coverage obligations for Securities Claims after a bankruptcy filing in spite of policy language directly to the contrary. Because the relief sought would increase the value of the estate, it also found the claims to be derivative in nature. As a result, the court held the $24 million in defense costs to be covered. Whether the $95 million paid to settle the case is also afforded coverage remains to be seen.

The foregoing cases provide exceedingly costly examples of the importance of each word in a D&O policy. The importance is heightened in a transactional setting where parties attempt to identify who is responsible for what after closing if claims arise. Absent clear language evidencing the intent of the parties, coverage disputes are almost guaranteed. While the insureds prevailed in both cases here, keeping such matters out of litigation entirely would be a far better outcome.

Northrop Grumman Innovation Systems, Inc. v. Zurich American Insurance Co., et. al., 2021 WL 347015 (Del. Sup. Ct. February 2, 2021); Verizon Communications Inc. v. National Union Fire Insurance Company of Pittsburgh, PA, et. al., 2021 WL 710816 (Del. Sup. Ct. February 23, 2021).

OTHER DEVELOPMENTS AND CONSIDERATIONS

M&A and Representations & Warranties (R&W) Insurance

After a sharp drop-off in M&A transactions (and by correlation, R&W insurance submissions) in the first half of 2020 due to the impact of COVID-19, deal flow spiked dramatically in the second half of the year and that steady pace has carried over into 2021. While an M&A upswing is projected to continue in areas like technology, consumer products, pharma and financial services, other sectors like oil & gas may expect some differences. Increased investor interest in renewable energy is expected to have a positive impact on both M&A activity and tax credit considerations in 2021.

R&W insurance should be considered as an impactful risk transfer tool considering these market dynamics, projected increased due diligence expectations in areas from operational to IP, and expected regulatory scrutiny.

In an increasingly competitive M&A landscape, R&W insurance provides corporate/strategic buyers, private equity firms and other stakeholders with a risk mitigation solution for uncertainties surrounding the M&A process. When contemplating any M&A and considering R&W insurance, the following should act as your guide:

- Contact your broker early in the process. To obtain the most value out of the R&W process, this means around the LOI phase in the transaction. This provides for a better opportunity to align deal terms with the R&W policy provisions.

- Policy Terms matter. Limits placed are typically 10% of target’s Total Enterprise Value. Pricing currently averages 3 to 4%, which is expressed as a percentage of the limits placed. Self-Insured Retentions on average are 1% of TEV. For example, in a $100M TEV transaction: $10M Limit, $1M Self Insured Retention, $300K to $400K Premium.

- The Process. Be prepared to provide financials, draft purchase agreements and any confidential investment memorandums to underwriters at the outset. From there, you should expect underwriters to thoroughly be involved in the deal itself, as they will be given data room access, copies of diligence and advisor reports and be provided with the opportunity to ask any further questions during an underwriting call.

Tax Credit Incentives for Carbon Sequestration

Internal Revenue Code 1986 §45Q provides a tax incentive centered around the development and use of carbon capture technology & facilities. Recent IRS guidance outlines statutory requirements for qualifying for these credits and determination of the credit amount. Tax credit insurers may provide an avenue for balance sheet protection through risk transfer that may afford comfort to project developers or tax equity investors as to qualification and recapture risk, and also support required indemnities of tax equity investors independent of sponsor’s or counter party’s financial strength. In conjunction with 45Q, IRS Notice 2020-12 includes safe harbors that (1) provide guidance for certain partnership structures, and (2) moreover do not prohibit the tax equity investor from procuring insurance unrelated to the CCS project.

D&O Filings, Pricing and Outlook

D&O Filings

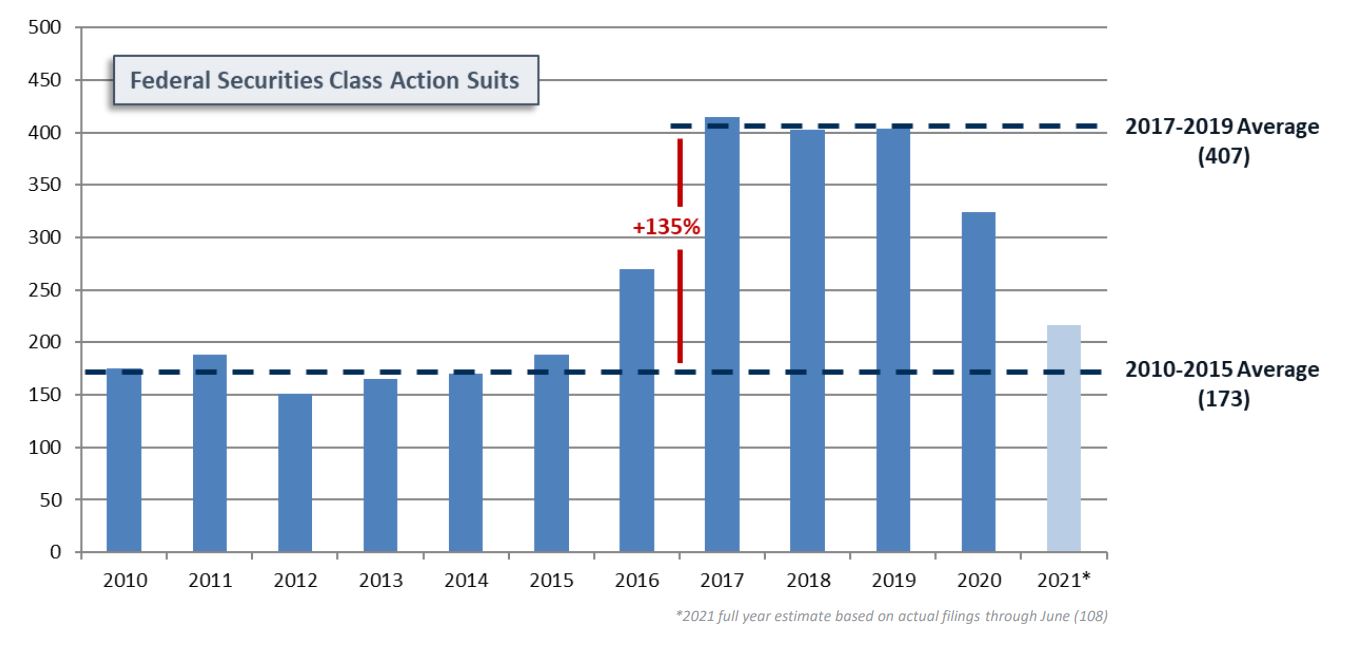

- In 2020, there were 324 Federal Securities Class Action Claims – the first measurable year-over-year decrease in eight years.

- Although filings were down ~20%, the 2020 total remained well above historical norms.

- In 1H21, filings have continued their downward trend, with 108 total Federal Securities Class Action Claims.

- This implies an annualized number of 216 filings, which would be a 33% decrease over 2020.

D&O Settlements

- With D&O litigation on the decline, dismissal rates remaining elevated, new capacity entering the marketplace, and an improved broader economic outlook versus one year ago, D&O pricing for recent renewals has generally been more favorable than year ago levels.

- Average D&O price increases are well below 2020 levels, with some recent renewals seeing single-digit premium increases and, in limited circumstances, premium decreases.

- Companies considering an IPO or de-SPAC transaction can continue to expect elevated pricing and retentions, but both of these

are also generally more favorable than year ago levels. - D&O pricing is also still dependent on a company’s specific situation, so messaging the risk profile in the right way to D&O underwriters remains important.

- Despite noticeable premium increases over the last several years, D&O insurer performance (i.e., profitability) remains under pressure and many D&O insurers continue to post an underwriting loss.

Key Contacts

Brian R. Bovasso

Managing Director

IMA Executive Risk Solutions

303.615.7449

brian.bovasso@imacorp.com

Travis T. Murtha

Director of ERS Claims

IMA Executive Risk Solutions

Legal & Claims Practice

303.615.7587

travis.murtha@imacorp.com

Daniel Posnick

Transactional Liability Leader

IMA Executive Risk Solutions

303.615.7747

daniel.posnick@imacorp.com

About IMA

IMA Financial Group is a privately held, diversified financial services firm focused on protecting client assets and creating exceptional value for our clients around the world. Our diverse team of experienced and talented professionals shares an unwavering commitment to excellence.

IMA Executive Risk Solutions is our world-class team of 20+ professionals focused on providing thoughtful advice, a unique legal perspective, a broad range of executive risk insurance solutions, and excellent service to our valued clients. Our professionals have deep experience handling complex executive risk exposures for a variety of clients – from pre-IPO start-ups to multi-billion dollar corporations.