The D&O Marketplace and Preparing for an Upcoming Renewal

The D&O marketplace for U.S. public companies continued to present challenges in the second quarter of 2020. As we previously reported in our last Quarterly Update, the D&O marketplace has seen general upward pressure on pricing and retentions since mid 2019, and this “hard” market activity has become even more pronounced over the last several months.

In addition to significant premium increases and a steady rise in retention (aka, deductible) levels, D&O carriers are also increasingly looking to scale back their limit deployment, particularly in certain areas such as IPOs, distressed companies, and companies in certain industries such as Life Sciences.

Fortunately, the scope of coverage available in the D&O marketplace continues to be quite broad, and we have generally not seen carriers look to add “COVID-19”, “Bankruptcy” or other exclusions as many were predicting earlier in the year. However, there remains the possibility that the D&O marketplace continues to harden and that carriers look to scale back coverage on a widespread basis, so we will continue to closely monitor this as the year progresses.

For those with an upcoming D&O renewal, plan to start the process early as it will likely take much longer than prior years. A detailed plan for marketing the company to insurance underwriters will be a necessity, with a particular emphasis on the company’s financial flexibility and ability to weather the current storm. Cash position, cash burn and opportunities to raise additional capital, if necessary, will be of great interest to D&O underwriters. In addition to this, companies should look to structure their D&O programs with insurers that have shown a long term, consistent approach in the marketplace, particularly with regard to their ability and willingness to pay claims. Now is not the time to partner with newer entrants in the marketplace.

The second important factor for a successful D&O renewal will be to work with an experienced representative who can effectively navigate the current D&O marketplace. Ideally, someone who has worked through a prior hard market, such as the one we find ourselves in right now. Working closely with an experienced and knowledgeable representative will pay dividends in today’s marketplace.

CASES OF INTEREST

“Disgorgement” Authority of the SEC Upheld by U.S. Supreme Court but with Limitations

Following a civil action in which Charles Liu and his wife were found to have violated the terms of offering documents and misappropriating millions of dollars, they challenged the Securities and Exchange Commission’s (SEC) ability to obtain disgorgement as a remedy. In an 8-1 decision, the Supreme Court found disgorgement to be within ‘equitable relief’ afforded to the SEC as long as the amount awarded does not exceed the wrongdoer’s net profits and is distributed to shareholders damaged by the conduct .While ‘disgorgement’ is explicitly set forth in the statute authorizing the SEC to bring administrative proceedings, the word itself is not found in the provision under which the SEC has authority to bring civil actions. Nevertheless, the Court upheld the trial court’s ability to impose such relief as being well within traditional equitable remedies available.

The Court went on to clarify the limitations of this right as well. First, the SEC is not permitted to retain disgorged funds and is not allowed to simply deposit such funds in the Treasury. Second, amounts sought as disgorgement are limited to net profits obtained by the wrongful conduct, and legitimate expenses not associated with the fraud should also be deducted from the award. With respect to the ruling’s implication on executive liability insurance, the Court noted the term disgorgement to be of relatively recent vintage, but likened it to restitution, unjust enrichment or accounting for profits. All of the foregoing are typically excluded from coverage and, as such, it will be incumbent on defense attorneys representing insureds to do everything in their power to ensure settlements avoid any mention of such equitable awards Liu v Securities Exchange Commission, 140 S.Ct. 1936 (2020).

Rejection of Potential Claim Deemed Improper but Professional Services Exclusion Upheld

Included within most, if not all,all,“claims made” liability insurance policies is the ability to provide notice of potential claims prior to the end of the policy period. The purpose of which is to ensure coverage is afforded for disputes arising within one policy period that do not ripen into a ‘Claim’ until a subsequent policy period.

For any such notice of a “circumstance”, insurers generally require the alleged wrongful act and other particulars be given so as to prevent insureds from using the provision as a means of providing blanket notice for any and all claims that may be filed down the road.

In this insurance coverage dispute, an Insured sought coverage under both D&O and E&O (Errors and Omissions) policies for a dispute that arose between it and a client. Here, the Insured tendered a letter from the client seeking the preservation of documents relevant to the relationship and stating that a dispute was likely The insurer, who provided primary coverage under both the D&O and E&O policies, accepted the matter as a potential claim under the E&O policy, but rejected it under the D&O policy. A defense was afforded under the E&O and the matter was eventually resolved via settlement. The Insured then brought suit against the entire D&O tower seeking coverage for loss (defense costs and settlement funds) in excess of the E&O policy limits.

While rejecting the insurer’s rationale for the very same letter being accepted under one policy but not under another, the court found the denial of coverage under the D&O policies to be proper under multiple exclusions. The court found both the “professional services” and “insurance related services” exclusions enforceable as written and unambiguous, along with a third exclusion barring coverage for claims arising from services provided to a third party. The court found each consistent with the purpose and distinction between D&O and E&O coverage.

This case is being highlighted as a reminder to policyholders of their right to provide notice of potential claims and to always involve IMA claims professionals to ensure compliance with the policy provisions, as each insurer has different requirements for acceptance thereof Benecard Services, Inc v Allied World Specialty Insurance Co., 2020 WL 2842570 (D.N.J. May 31, 2020).

Revisiting the Enforceability of Bankruptcy Exclusions

With the economic fallout being experienced from the current global pandemic, and the expected ongoing challenges associated therewith, the presence and impact of “bankruptcy” exclusions in D&O policies is likely to be a focus of significant attention. While the attempts of underwriters to include any such exclusion within D&O policies appear limited at this juncture, the legality thereof remains in question as well.

In the past, insureds have challenged bankruptcy exclusions under two provisions of the U.S. Bankruptcy Code Specifically, Section 541(c) invalidates agreements intended to restrict or condition interests of a debtor upon its financial condition or insolvency. In 2011 an Illinois appellate court ruled that a bankruptcy exclusion within a D&O policy is unenforceable because policy proceeds were property of the debtor’s estate and the exclusion ran afoul of the purpose of Section 541(c).

In addition, Section 365(e)(1) was recently found by a federal bankruptcy court to prohibit invocation of a bankruptcy exclusion by an insurer seeking to deny coverage under a bankrupt hospital’s D&O policy The court found the D&O policy to be an executory contract entered into prior to the initiation of bankruptcy proceedings and that the bankruptcy exclusion was an unenforceable ipso facto provision. Ipso facto refers to the Latin phrase meaning ‘by the fact itself’. It generally refers to clauses that deem a particular act such as filing for bankruptcy protection, to constitute breach of the contract whereby the counterparty is absolved of further contractual obligations Such clauses are generally prohibited under bankruptcy law however, it remains an unsettled issue of law and requires an experienced broker to ensure exclusions like those mentioned herein are never included within a client’s D&O policy regardless of their legality. Yessenow v Executive Risk Indemnity, 953 N.E.2d 433 (Ill. App. 2011). In re Community Memorial Hospital 2020 WL 3296994 (E.D. Mich. July 23 2019).

Motion to Dismiss Granted in Merger Objection Lawsuit

The proliferation of merger objection lawsuits in recent years has been described by some as a racket, effectively imposing a tax on parties to a merger which is paid to plaintiff’s lawyers in order to avoid litigation and/or delay in closing. In the usual course of events, supplemental proxy materials are drafted to include materials previously not included and which claimants deem material to the transaction Here, the defendant refused to provide supplemental disclosures and chose to litigate after the fact.

In granting the defendant’s Motion to Dismiss, the court distinguished between what is required under Delaware law and under Section 14 of the Securities Exchange Act of 1934. While Delaware law prohibits the omission of material facts when seeking shareholder approval of a transaction, a violation of Section 14 only occurs if SEC regulations specifically require disclosure of the omitted information, or the omission renders other statements in the proxy materially false or misleading.

“As helpful as this information might have been to investors, Plaintiff fails to allege any facts suggesting that its absence made any statement in the Proxy misleading”. Whether this approach is taken by others remains to be seen however, it buttresses the view held by many courts and companies alike who view these suits as meritless. Karp v SI Financial Group, Inc., 2020 WL 1891629 (D. Conn. April 16, 2020).

D&O Filings and Settlements

D&O Filings

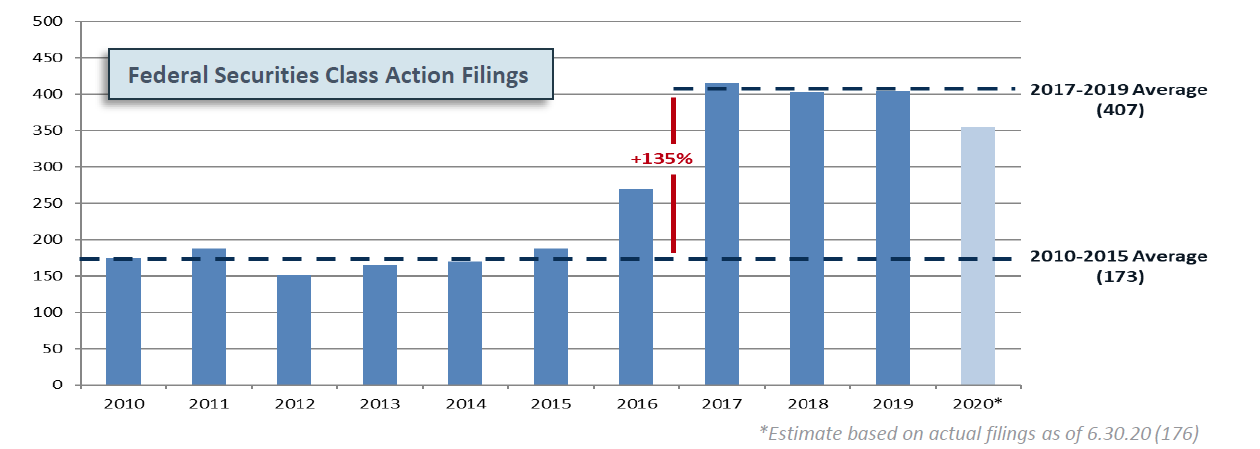

• In 2019, there were 404 Federal Securities Class Action Claims, which is 134% above the 2010-2015 annual average.

In 1H2020, filings continued at an elevated level, with 176 D&O filings.

• This implies an annualized number of 355 filings, which would be a welcome decrease over 2017-2019 levels.

• At this rate, approximately 1 in 11 public companies are being sued for securities fraud.

Other Developments and Considerations

With D&O litigation remaining elevated, carriers continue to push for noticeable rate increases on most layers.

- Price increases continue to be most dramatic for small cap companies and companies with challenging risk profiles.

- Companies considering an IPO can continue to expect elevated pricing and retentions (oftentimes $10M+), as well as a cut back in carrier limit deployment.

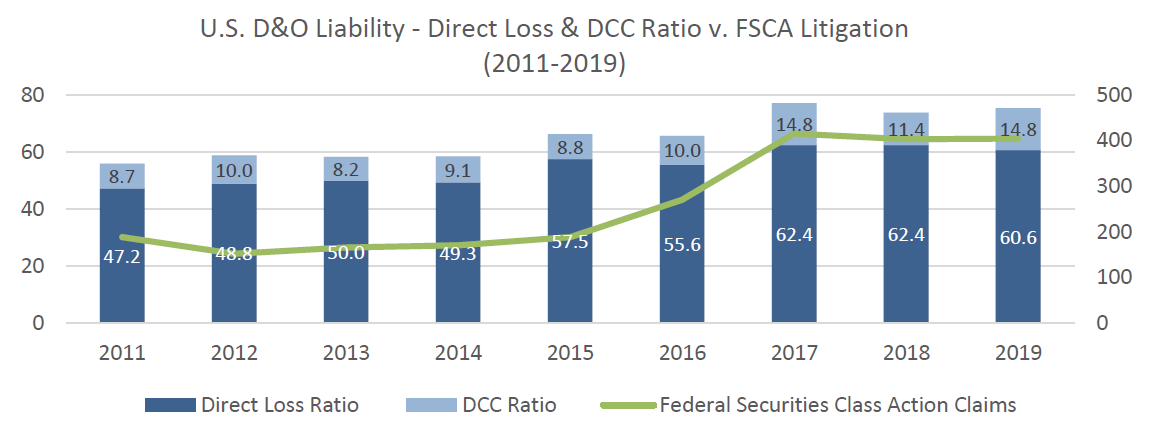

D&O insurer performance continues to deteriorate, with many insurers recognizing an underwriting loss.

- The average D&O loss ratio (direct loss + DCC) in 2019 was 75.4, up from 73.8 in 2018.

- Public D&O claims and losses continue to drive these results more so than private D&O claims and losses.

Key Contacts

Brian R. Bovasso

Managing Director

IMA Executive Risk Solutions

303.615.7449

brian.bovasso@imacorp.com

Travis T. Murtha

Director of ERS Claims

IMA Executive Risk Solutions

Legal & Claims Practice

303.615.7587

travis.murtha@imacorp.com

About IMA

IMA Financial Group is a privately held, diversified financial services firm focused on protecting client assets and creating exceptional value for our clients around the world. Our diverse team of experienced and talented professionals shares an unwavering commitment to excellence.

IMA Executive Risk Solutions is our world-class team of 20+ professionals focused on providing thoughtful advice, a unique legal perspective, a broad range of executive risk insurance solutions, and excellent service to our valued clients. Our professionals have deep experience handling complex executive risk exposures for a variety of clients – from pre-IPO start-ups to multi-billion dollar corporations.