CASES OF INTEREST

U.S. SUPREME COURT UPHOLDS MANDATORY INDIVIDUAL ARBITRATION PROVISIONS IN EMPLOYMENT CONTRACTS

In a case being considered a victory for employers, the U.S. Supreme Court held arbitration agreements requiring employees to arbitrate claims on an individual, rather than collective or class basis, are enforceable and not in violation of the National Labor Relations Act (“NLRA”).

Basing its decision on the text and breadth of the Federal Arbitration Act (“FAA”), the Court held arbitration agreements must be enforced as written and class/collective action waivers included therein do not run afoul of the NLRA. The decision therefore provides clarity for employers regarding the legality of class/collective action waivers contained in employment documents, policies or contracts.

In 2012, the National Labor Relations Board (“NLRB”) issued its decision in D.R. Horton, Inc., 357 N.L.R.B. 2277 (2012), wherein it held individual employment arbitration agreements violated the NLRA. Several federal appellate courts subsequently rendered differing decisions on the enforceability of such waivers, which gave the Supreme Court the opportunity to resolve the circuit split.

Interestingly, lawyers for the federal government appeared on both sides of the case. The Department of Justice originally supported the position of the employees, but reversed course under the new administration, leaving the NLRB to argue on behalf of its policies regarding the enforceability of class action waivers.

The majority opinion concluded the ‘savings clause’ in the FAA, which permits those objecting to arbitration over litigation to rely on standard legal defenses regarding the formation of the contract, as falling outside the purview of the clause since the issue here was focused on only the right to pursue claims individually rather than collectively, not the enforceability of the contract for arbitration itself.

The Court also rejected petitioners’ other arguments that the NLRA, enacted after the FAA, overruled its provisions solely with respect to collective actions in the employment arena. The Court chose not to give the NLRB’s view any deference, concluding its interpretation created a conflict between the statutes that didn’t actually exist.

This ruling is likely to result in a significantly lower number of employees pursuing claims against employers given that the costs involved usually vastly exceed the wages allegedly improperly withheld. It is also likely to result in more employers requiring individual arbitration as the sole means of resolving employment disputes.

The dissent by Justice Ginsburg noted the troubling manner in which certain employers are creating mandatory arbitration provisions, for example, by simply emailing employees and presuming their consent. She also opined that employees being forced to pursue claims individually opens them up to retaliation and results in a much higher likelihood of conflicting results.

Epic Systems Corp. v. Lewis 584 U.S. ___ (2018).

INSURER HELD TO HAVE WRONGFULLY REFUSED ADVANCEMENT OF DEFENSE EXPENSES

This coverage dispute represents a unique approach by the court in its analysis of an insurer’s obligations under a directors and officers liability (“D&O”) insurance policy. Following the departure of a company executive to a competitor, her prior employer brought suit alleging misappropriation of electronic information, namely a customer database. The insurer advanced defense costs under the policy for the individual, but denied coverage for the company itself. The underlying case was resolved through mediation, which then gave rise to this coverage action.

The court began its analysis by noting the differences between Delaware and Kansas law on an insurer’s duties, but concluding the differences were immaterial in this case. It then went on to find the claims brought against the individual were for conduct she engaged in at the new employer as an insured under the policy, thereby rejecting the insurer’s argument the claims arose from conduct occurring prior to her time as an insured.

Next, the court assessed whether all of the causes of action and allegations fell within the exclusion relied upon by the insurer, such that no indemnity obligation would exist. The court found allegations of civil conspiracy and violations of the Computer Fraud and Abuse Act were not within the exclusion relied upon by the insurer relating to unfair trade practices or misappropriation of trade secrets. Thus, the court found a duty to defend existed on the part of the insurer, given the potential for coverage.

The interesting aspect of this case is that insureds retained the obligation to defend themselves against any claims and the insurer was responsible for reimbursement of covered expenses. Despite the policy not being of the ‘duty to defend’ variety, the court analyzed coverage under those principles. In addition to not weighing in on the policy’s allocation provision, the court also failed to address contentions by the insurer that the fees incurred in the defense of the underlying case were unreasonable. As such, the lesson here is to always test an insurer’s positions regarding coverage since courts and judges routinely come to different conclusions on coverage.

WoodspringHotels LLC v. National Union Fire Insurance Co. of Pittsburgh, PA., 2018 WL 2085197 (Del. Sup. Ct. 2018).

CRIME POLICY DOES NOT COVER FRAUD COMMITTED BY PHONE

This case represents yet another example of courts finding no coverage under a commercial crime policy for losses incurred through the use of both phones and computers.

The insured sold credits for pre-paid debit cards that are loaded onto the card’s account by the company’s computers following a telephone call from the customer. Fraudsters exploited a vulnerability in the system whereby credits could be redeemed multiple times by making concurrent calls to the insureds computer system. The fraudulent redemptions resulted in $11.4 million in losses; however, upon presenting the claim to the insurer, coverage was denied.

The insureds challenged the denial in court but were unsuccessful in convincing the court it was a covered loss. While the court found the fraud was accomplished through “the use of a computer”, the loss did not “result directly” from the use of a computer, thereby breaking the chain of causation. For purposes of the insurance policy, the court held “one thing results ‘directly’ from another if it follows straightaway, immediately, and without any intervention or interruption. Here, the court reasoned the crediting of the cards was not when the actual loss occurred. In its view, the loss only occurred when the partner bank used by the insureds paid merchants for purchases made by cardholders. “Far from being immediate, the loss was temporally remote: days or weeks –even months or years –could pass between the fraudulent chit redemption and the ultimate disbursement of the fraud-tainted funds…The lack of immediacy –and the presence of intermediate steps, acts, and actors –makes clear that the loss did not ‘result directly’ from the initial fraud.”

Interactive Communications International, Inc. v. Great American Insurance Co., 2018 WL 2149769 (11thCir. 2018).

EXCESS INSURER MUST PROVE BAD FAITH TO RECOVER AGAINST PRIMARY INSURER UNDER COLORADO LAW

This case arose following a dispute between a professional liability primary insurer and the excess insurer over what constituted a reasonable settlement in an underlying medical malpractice suit. After the primary insurer refused a policy limits settlement demand from the claimant, the excess insurer funded the settlement. The excess insurer then brought a claim for equitable subrogation against the primary insurer for the amount paid. In a reversal of the trial court’s decision, the Colorado Court of Appeals held the excess insurer’s claim against the primary insurer was derivative in nature, meaning it only possessed the same rights as the policyholder and was required to prove the primary carrier acted in bad faith.

Because only the primary insurer possessed the duty to defend as well as the ability to accept or reject settlement offers, the only way the excess insurer could obtain reimbursement for the settlement funds paid to resolve the underlying case was by proving the primary insurer’s rejection of the settlement demand constituted bad faith.

The court went on to explain the excess insurer’s rights under an equitable subrogation theory were based on the rights the insured would have had, and no greater since no contractual relationship existed between the carriers. “The [primary insurer] bargained for the discretion to settle, subject only to the legally imposed obligation of good faith, and that bargained-for discretionary obligation was the only potential source of any obligation the [primary insurer] had to settle…It is inequitable to allow an excess carrier to nullify the primary insurer’s contractual right merely because the excess insurer disagrees with the primary insurer over the risk of exposure.”

As a result of the manner and legal theory upon which the excess carrier presented its claims, the appellate court found the claims not legally viable and dismissed the suit.

The takeaway here is simply a reminder that when complex claims involve multiple insurers, coordination of the defense and ensuring everyone is on the same page is of utmost importance to prevent issues like occurred in this matter.

Preferred Professional Insurance Co. v. The Doctor’s Co., 2018 WL 1633269 (Colo. Ct. App. April 5, 2018).

D&O INSURER ATTEMPTS TO DENY COVERAGE FOR CEO IN “SELLING SHAREHOLDER” CAPACITY

After a corporate acquisition resulted in litigation over misrepresentations allegedly made in the transaction process, the directors and officers (D&O) insurer attempted to deny coverage. Relying on the allegations as set forth in the complaint, the Wisconsin Court of Appeals found the insurer’s failure to defend and denial of coverage to be in violation of its obligations to the policyholder.

The heart of this dispute concerned the conduct of the acquired company’s CEO. Following consummation of the transaction, the acquirer brought claims against the former CEO and others for not disclosing pertinent business data. (The procedural history of this case is somewhat convoluted and had no effect on the insurance issues at stake, so it is not described herein.) The former CEO sought coverage under its D&O policy, which was denied. The carrier based its declination on the fact that the former CEO was sued as a selling shareholder, as opposed to in his role as the CEO. The trial court agreed with the insurer; however, on appeal, this decision was reversed. The appellate court held the allegations in the complaint were focused on the former CEO’s conduct in his capacity as an insured officer/director and therefore covered. “The insurer’s obligations are not circumscribed by the plaintiff’s choice of legal theories. The plaintiff’s complaint, upon which the insurer’s duty depends, need not even set forth the plaintiff’s legal theories. What is important is not the legal label that a plaintiff attaches to the defendant’s (that is, the insured’s) conduct, but whether that conduct as alleged in the complaint is at least arguably within one or more of the categories of wrongdoing that the policy covers.” (emphasis in original)

The appellate court also rejected the insurer’s arguments related to late notice, specifying that under Wisconsin law an insurer must show prejudice to deny claims solely on the basis of late notice. Thus, even if the legal theories advanced by claimants do not appear to involve invoke coverage on first glance, it is important to focus on the allegations themselves, which override the manner in which a claimant decides to prosecute their claims.

Paula M Grigg, as Special Administrator of the Estate of Raymond B Grigg v. Aarrowcast, Inc. et. al., 380 Wisc.2d 464 (Wisc. App. Feb. 27, 2018.)

DEPARTMENT OF JUSTICE SUBPONEA TRIGGERS COVERAGE AND QUALIFIES AS A CLAIM FOR A WRONGFUL ACT

A federal trial court in Illinois recently rejected an insurer’s attempt to deny coverage under a directors and officers liability (D&O) policy for legal fees incurred in response to a DOJ investigation commenced by the issuance of a subpoena. After incurring legal fees in excess of the primary and two excess policies, the insured challenged the denial in court.

The investigation began with a subpoena demanding documents from the insured relating to an industry-wide investigation of pharmaceutical companies by the DOJ for alleged federal health care offenses. It commanded the insureds to appear and produce documents as well as advising that failure to comply would result in judicial enforcement proceedings. The insured and DOJ also subsequently entered into a tolling agreement permitting the government to bring charges within a specified time period that would otherwise exceed the applicable statute of limitations.

The insureds submitted the subpoena and tolling agreement to its D&O insurers for coverage. All three insurers on the program disputed coverage on various grounds. For instance, the primary carrier asserted the subpoena did not constitute a written demand for relief, but was simply a request for documents.

The court analyzed each argument presented by the insurers against the policy language at issue, finding in favor of the insureds in all respects. Communications between the DOJ and insureds revealed the DOJ’s belief that federal law had been violated by charitable contributions to patient assistance programs that offer subsidized prescriptions for qualifying individuals. Based on the foregoing, the court held the “DOJ issued the subpoena to [the insureds] because of these allegedly unlawful acts. And because the DOJ alleged that plaintiffs’ charitable contributions were unlawful, those acts constitute an ‘alleged error or act’ under the policy.” With respect to the tolling agreement, the court stated: “[s]incethe policy’s definition of a ‘Wrongful Act’ includes an alleged act, the tolling agreement’s reference to ‘a possible violation’ together with the allegation that the government told [the insureds] its conduct violated the law, is enough to allege that the DOJ entered into the agreement because of [the insureds] wrongful act.”

As such, the court found the subpoena and tolling agreement both satisfied the policy’s requirements and entitled the insureds to coverage for legal fees incurred in responding to the DOJ.

Astellas US Holding, Inc. v. Starr Indemnity & Liability Co., 2018 WL 2431969 (N.D. Ill. May 30, 2018).

D&O FILINGS AND OTHER DEVELOPMENTS

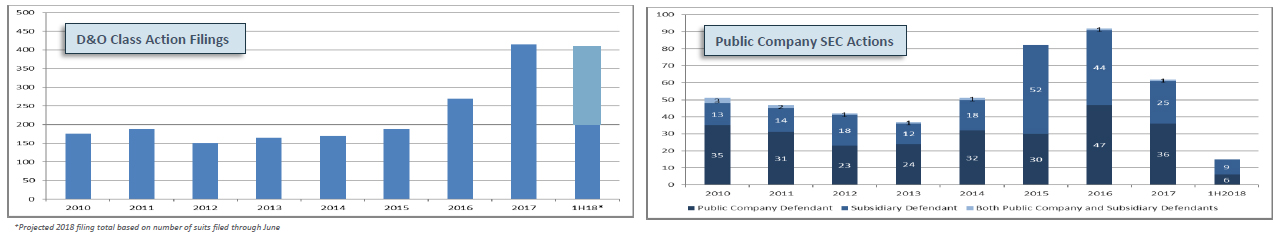

D&O Filings

As we previously reported, 2017 D&O filings were up 54% over 2016 and at their second-highest level ever (highest = 2001)

- In 1H2018, filings continued at an elevated level, with 204D&O Class Action Federal Securities Claims having been filed

- This implies an annualized number of 408 filings, which would be a SLIGHT increase over 2017 (412)

- At this rate, approximately 1 in 9 public companies are being sued for securities fraud

SEC Enforcement Actions and Settlements

Securities and Exchange Commission (SEC) enforcement actions continue to rapidly decline, with only 15 filed in 1H2018

- This compares to a 1H2017 filing total of 45

Monetary settlements have also decreased significantly

- Largest monetary settlement in 1H2018 = $14 million

- The average monetary settlement in 1H2018 was $4.3 million

- Next-lowest semiannual average = $13.3 million

56% of public company defendants cooperated with the SEC in 1H2018 (compared to 63% in 1H2017 and 55% in 2017)

Sources: Cornerstone Research; Stanford Law School; Center for Research in Security Prices; A.M. Best data and research

KEY CONTACTS

Please be advised that this communication is an educational and informational resource only. The views and statements expressed herein are not to be construed as legal advice from the authors or IMA and such communication is not protected under the attorney client privilege. Recipients should seek specific legal advice from competent legal counsel of your choice.