CASES OF INTEREST

SEC Investigation Not Covered by D&O Insurance

An insurance coverage issue we have previously covered, and one that we are routinely discussing with clients, is coverage for costs incurred by a company in response to an SEC or other regulatory investigation.

Here, auto rental company Hertz Global Holdings, Inc. brought coverage litigation against its D&O insurers after the insurers denied coverage for costs Hertz incurred responding to an SEC investigation Total costs incurred by Hertz at the time of the ruling were $27 million, in addition to the $16 million penalty Hertz agreed to in a settlement agreement with the SEC.

The Hertz D&O program in force at the time of the investigation specifically excluded investigations from the coverage otherwise provided to the company (as opposed to the coverage provided to the D&O’s, which did cover investigations). As a result, Hertz was required to make the argument that the SEC investigation was really an administrative or regulatory proceeding, which the company does have coverage for under the D&O program.

An attempt was also made to secure coverage based on the allegation by Hertz that SEC Investigation Not Covered by D&O Insurance that the investigation was part of a separate securities class action claim which was being covered under the D&O program. However, the District Court ruled that the SEC investigation did not arise from the class action lawsuit and therefore was not covered.

Despite the best attempts of Hertz to fit “a square peg” into “a number of round holes”, coverage was ultimately not afforded for its costs relating to the SEC investigation because the Hertz D&O program simply did not provide coverage for company investigations. In fact, the Hertz D&O program explicitly excluded company investigation costs.

We oftentimes proclaim that D&O insurance is first and foremost a legal consideration, and secondarily (but not insignificantly) a financial consideration, and this case is yet another reminder of the importance of securing the necessary scope of coverage within a D&O program. Hertz Global Holdings, Inc. v. National Union Fire Insurance Company of Pittsburgh, PA, et al, 19-cv-06957 (S.D. NY March 30, 2021).

Beware of Excess Insurers Challenging Coverage Determinations of Underlying Insurers

Two recent decisions highlight the importance of every word in executive liability insurance policies, including the excess layer “follow form” policies where insurers can and do take different coverage positions from the underlying insurers.

The first case involved a fiduciary liability insurance program consisting of a primary layer and two excess layers of insurance totaling $45,000,000 in limit. A lawsuit brought by the Department of Labor (DOL) was accepted as a covered claim by the primary and first excess insurers Defense costs plus the settlement exhausted the primary layer policy’s limit and eroded a portion of the first excess layer.

A second lawsuit was then filed on behalf of the insured’s Savings Plan, which was also eventually settled. That settlement payment resulted in the exhaustion of the first excess policy, The second excess insurer agreed to fund the remainder of the subsequent lawsuit but informed the insured of its intention to seek reimbursement of amounts paid, arguing the DOL settlement fell outside of the coverage afforded.

The second excess layer insurer then initiated coverage litigation against the insured, alleging the DOL settlement constituted disgorgement and was uninsurable under California law. The trial court agreed; however, on appeal, the Ninth Circuit reversed.

The appellate court began its analysis by noting that while excess insurers are not bound by an underlying insurers’ policy interpretations, excess insurers are not entitled to challenge payment decisions of underlying insurers unless there is evidence of fraud or bad faith. Moreover, in this case, the second excess insurer sought to reduce its liability for an admittedly covered claim by disputing the validity of a different claim that its policy was never asked to cover. The court reinforced its decision by noting the ‘covered loss’ provision in the second excess policy was silent on its ability to challenge payment decisions of underlying insurers. Any such right therefore must clearly be set forth in the policy itself or be rooted in evidence of fraud or bad faith.

The second case involved breach of fiduciary duty claims asserted in the context of a merger, for which coverage was sought under the target’s D&O policies. Shareholders challenged the merger, alleging the Board of Directors failed to obtain the highest price for shareholders in the sale process. The case was settled for $30 million, with the insured paying $26 million out of pocket to indemnify its directors.

The primary layer insurer paid its limit, but all excess layer insurers denied coverage, which resulted in this coverage litigation All parties agreed the shareholder action was a Claim and allegations of breach of fiduciary duties qualified as Wrongful Acts; however, the excess insurers took the position that language contained in the definition of Loss alleviated them of the obligation to reimburse the Insured.

The “bump up exclusion” that came into play here read in part as follows: “In the event of a Claim alleging that the price or consideration paid or proposed to be paid for the acquisition or completion of the acquisition of all or substantially all of the ownership interest in or assets of an entity is inadequate, Loss with respect to such Claim shall not include any amount of any judgment or settlement representing the amount by which such price or consideration is effectively increased.”

A bench trial was held, in which extensive testimony and evidence was presented on the history and intent of the bump up exclusion. The court began its decision by noting that even if the primary layer insurer believed there was coverage under its policy, the excess insurers were entitled to contest coverage under the language in the primary layer policy.

The court then went through various iterations the exclusion had taken over the years and took testimony on the drafter’s intent. At the end of the day, however, the court found the language unambiguous and precluded coverage for the $30 million settlement, which was determined to be an increase in the consideration paid to shareholders.

Given the stakes involved and the technical nature of the policy provisions at issue, minor mistakes or omissions can be very costly. Ensuring primary and excess policies align and are not in conflict, and that all underwriters are on the same page regarding the intent of the coverage, is the best way to avoid conflicts of this sort. Axis Reinsurance Co. v. Northrop Grumman Corp., 975 F.3 d 840 (9th Cir. 2020); Onyx Pharmaceuticals Inc. v. Old Republic Insurance Co., et. al., Case No. CIV 538248 (Cal. Super. Ct., San Mateo Cty. October 1, 2020).

Delaware Supreme Court Holds Appraisal Action is

Not a Covered Claim

As an update to our 3 Q 2019 ERS newsletter, the Delaware Supreme Court reversed a lower court’s finding that an appraisal action qualifies as a Securities Claim under the relevant D&O insurance policies.

Following an acquisition which gave rise to shareholder litigation in the form of an appraisal action, the target company’s D&O insurers denied coverage for defense costs and pre judgment interest incurred (coverage was never sought for the fair value amount paid to dissenting shareholders). The lower court found a Securities Claim was not limited to cases alleging wrongdoing and, absent limiting language in the definition of Loss, defense costs and pre judgment interest were covered (which combined, here, totaled $51 million). The court also held Delaware law to imply a prejudice requirement in insurance contract consent clauses, meaning the Insured’s breach thereof did not bar coverage unless the insurer could show actual prejudice.

On appeal, the Delaware Supreme Court reversed the lower court’s findings and held the appraisal action was not for a ‘violation’ of any federal, state or local statute, regulation, rule or common law regulating securities and therefore did not qualify as a Securities Claim. The insurers relied heavily on the argument that petitioners did not allege misconduct by directors or officers and proof of wrongdoing was not required to obtain the requested relief.

While explicitly noting ‘the contravention of a right or duty‘ as being within the plain meaning of a ‘violation’, the court seemingly chose to ignore the fact that underlying all appraisal actions is an allegation of breach of fiduciary duty by directors in obtaining the highest price for shareholders. The court then relied on Delaware’s appraisal action statute as merely a remedy to shareholders not involving a determination of wrongdoing. Moreover, the court reasoned that since such actions are directed at the surviving entity, which itself does not owe fiduciary duties, appraisal actions are not designed to address breaches of fiduciary duties or other wrongdoing.

Practically speaking, for companies incorporated in Delaware, this gives shareholders a method by which they can challenge a merger price for which D&O coverage will not be available, even solely for defense costs. Given the Delaware Supreme Court’s illogical conclusion that an appraisal action to determine the fair value of securities is not a Securities Claim, this is now squarely an issue to be addressed directly with insurance markets. In re Solera Insurance Coverage Appeals, 240 A.3d 1121 (Del. 2020).

Insured not Obligated to Disclose Unrelated Investigation

This case arises out of a denial of coverage for an Employment Practices Liability claim that was related to a Department of Justice False Claims Act investigation. Unbeknown to the Insured, a False Claims Act qui tam suit was filed under seal in November of 2016. In January 2017 the DOJ issued a Civil Investigative Demand regarding fraudulent billing practices. The Investigative Demand did not disclose the existence of the qui tam complaint.

Two years later, the Insured did not disclose the DOJ investigation in its executive liability insurance application. The qui tam complaint was unsealed during the 2019-2020 policy period, wherein the Insured learned for the first time of employee retaliation claims being asserted against it. Coverage was denied based on the Insured’s failure to disclose the DOJ investigation. The Insured settled the False Claims Act case for $10 million and the employee retaliation claims for $2.2 million. It then brought suit challenging the denial solely with respect to the retaliation claims.

Finding in favor of the Insured, the court held the Insured’s interpretation of the insurance application questions was reasonable. Since the Insured was not seeking coverage for the DOJ investigation or fraudulent billing portion of the False Claims Act case, the application question regarding open investigations was limited to coverage for which the Insure d was seeking. Moreover, the application was completed prior to the Insured learning employees had filed retaliation claims in the qui tam action. As such, the Insurer’s denial was found to be improper.

We highlight this case because of the confusing nature of disclosure obligations that arise in the context of sealed complaints or investigations. It goes without saying an insured cannot disclose something it is unaware of; however, upon being made aware of the existence of a sealed action or investigation, policyholders must closely examine insurance applications to determine what they are required to provide. In that regard, if there is ever a doubt about how to answer a particular question in an insurance application, we welcome the opportunity to discuss the matter and ensure coverage will not be jeopardized by an inadvertent omission. SHH Holdings, LLC v. Allied World Specialty Insurance Co., 2020 WL 6411553 (N.D. OH. November 2, 2020).

D&O Filings and Settlements

D&O Filings

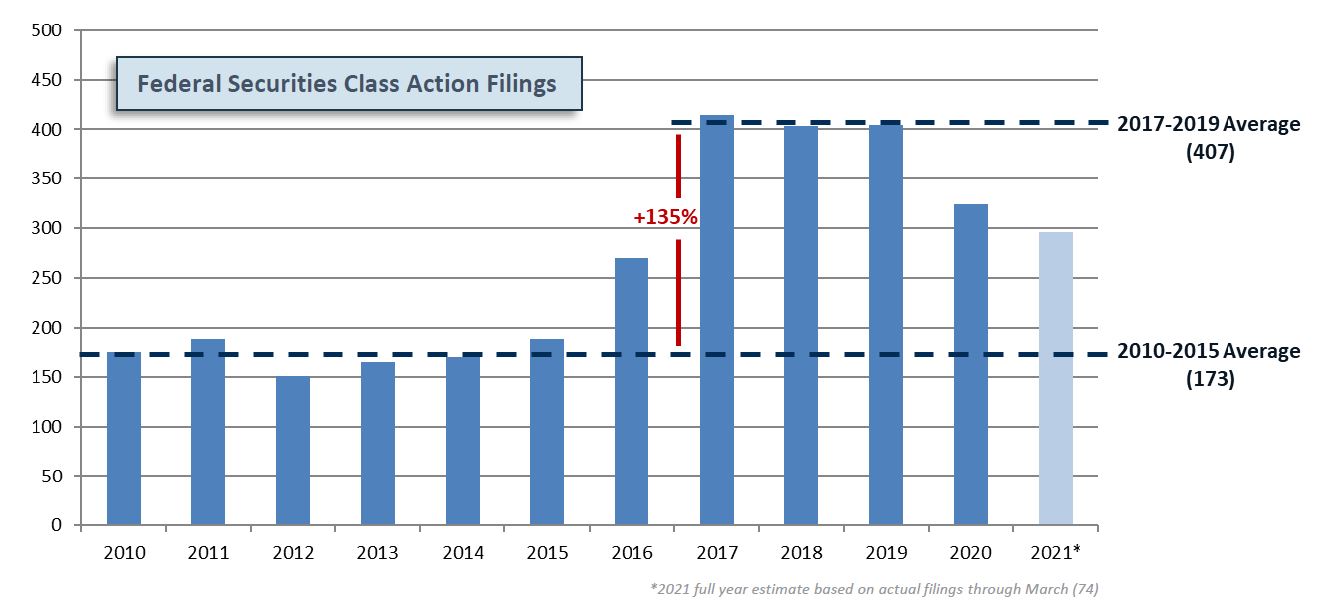

- As we have previously reported, D&O Federal Securities Class Action Claims have been elevated since 2016.

- The 2017-2019 average of 407 filings exceeded the 2010-2015 average of 173 filings by 135%.

- In 2020, filings remained elevated but we finally saw a noticeable decrease in the total number of filings (324).

- In 1Q2021, filings continued at a lower rate (74 total) but were still well above historical norms.

- Filings through March 2021 imply an annualized number of 296 filings, which would be an 8.6% decrease over 2020.

D&O Settlements

- 77 Federal Class Action Securities Claim settlements were approved in 2020, versus 74 in 2019.

- A small increase in the number of settlements was not unexpected, given the elevated filing levels that began in 2016 and a median time of 3+ years from filing to settlement.

- Average settlement size increased 96% to $54.5 million (due primarily to several large settlements), while the median settlement size decreased 13% to $10.1 million.

- Settlement sizes for other forms of D&O litigation (i.e., derivative claims) have also been increasing, as have defense costs.

- Dismissal rates are still in the mid- to high-40s, meaning around 47% of core federal filings are dismissed.

Key Contacts

Brian R. Bovasso

Managing Director

IMA Executive Risk Solutions

303.615.7449

brian.bovasso@imacorp.com

Travis T. Murtha

Director of ERS Claims

IMA Executive Risk Solutions

Legal & Claims Practice

303.615.7587

travis.murtha@imacorp.com

About IMA

IMA Financial Group is a privately held, diversified financial services firm focused on protecting client assets and creating exceptional value for our clients around the world. Our diverse team of experienced and talented professionals shares an unwavering commitment to excellence.

IMA Executive Risk Solutions is our world-class team of 20+ professionals focused on providing thoughtful advice, a unique legal perspective, a broad range of executive risk insurance solutions, and excellent service to our valued clients. Our professionals have deep experience handling complex executive risk exposures for a variety of clients – from pre-IPO start-ups to multi-billion dollar corporations.