EMERGING RISKS

The pollution marketplace has been on a gradual softening trend for the last decade.

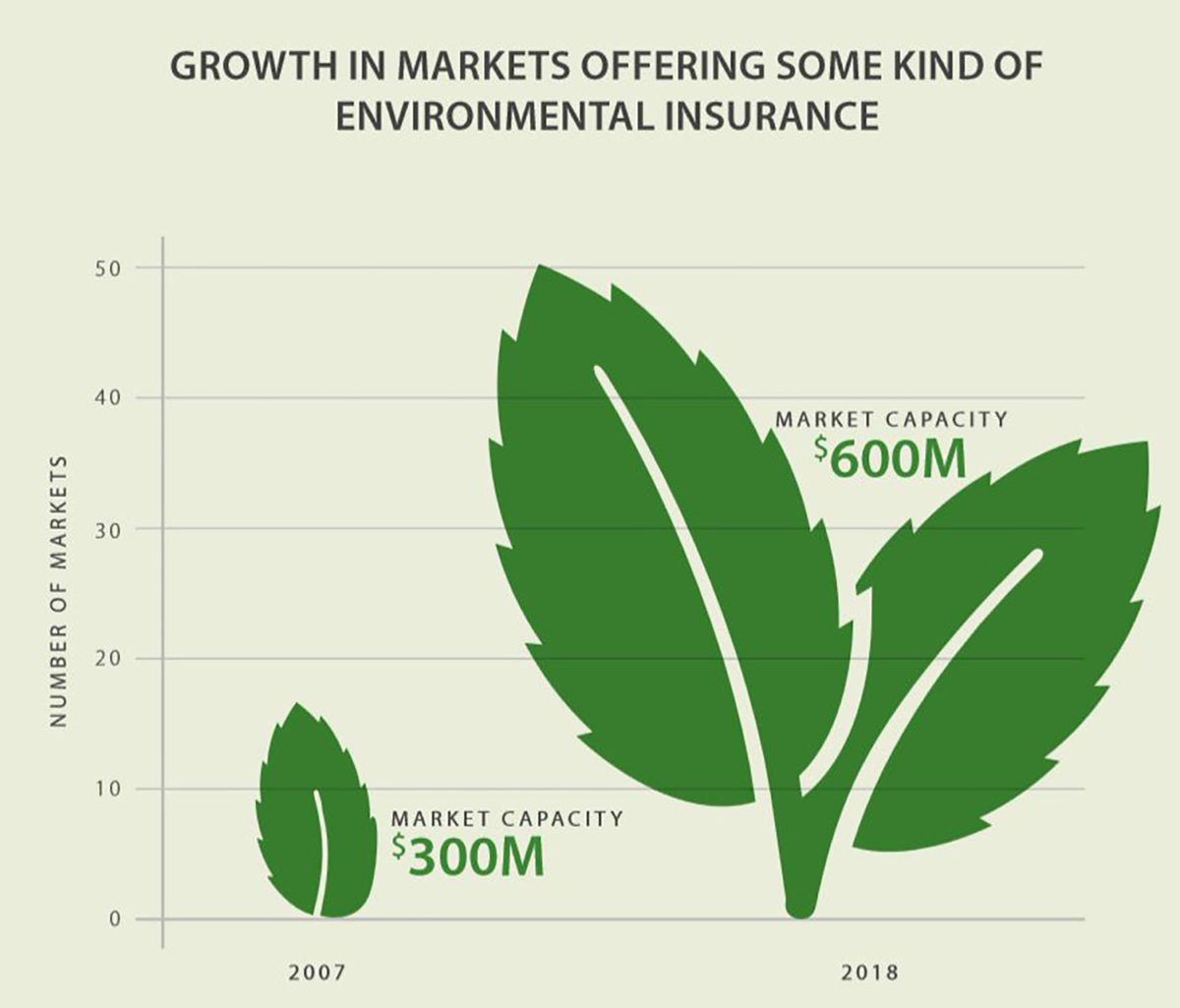

More markets are dipping their toes into environmental underwriting, thereby increasing competition and aggregated carrier capacity. While there are exceptions to the rule, regardless of how “hairy” an account exposure may be, generally you can find a few carriers willing to go on risk. With that said, certain trends are emerging where finding a carrier fit is becoming increasingly difficult.

OIL AND GAS PIPELINES

Underwriters always say that it isn’t a matter of IF an underground storage tank will leak, but WHEN. Liquid pipelines are starting to get the same reputation. While there are obvious concerns of corrosion and inadequate maintenance on older pipelines, many recent pipeline releases have been associated with failed valves and connections on newly installed pipe. Produced water pipeline losses have been the most catastrophic. Not only is the resultant damage costly to address, but often the monitoring of these lines is less rigorous, leading to a prolonged release before an insured is aware of the breach. A few select carriers are still writing these accounts. However, a clean loss history, an underlying buffer of sudden and accidental pollution in the casualty program, and solid operations and maintenance protocols are needed to get these markets comfortable.

PER-AND POLYFLUORINATED SUBSTANCES (PFAS)

I always knew Teflon was too good to be true! An emerging contaminant in the insurance market is PFAs—chemicals used in a variety of products, like Teflon, due to their resistance to heat, oil, water and stains. PFAs are most frequently associated with textiles, fire-fighting foams, and other industrial applications. Unfortunately, these contaminants do not easily break down in the environment and bioaccumulate in fish, wildlife and humans. The human health effects of PFAs are also uncertain, though the initial studies are not encouraging. What makes these chemicals challenging from an insurance perspective is that there isn’t a federally-enforceable limit to tie coverage to. Without federal guidance, certain states are taking their own regulatory steps. However, there is inconsistency among the states—some being more and others being less stringent than the federal advisory level. Furthermore, while many of these chemicals have or are being phased out in the U.S., many products are still in circulation and the residual effects in soil and groundwater are here to stay.

HOSPITALITY (MOLD)

Hotels have been getting a bad rap for purchasing pollution liability as a mechanism to pay for their expensive renovations. Find mold in one bathroom and the carrier could be on the hook for remediating all the bathrooms throughout the hotel. Carriers are putting their foot down and are either no longer writing this class of business, or adding restrictions such as per door or higher mold deductibles, or including renovation exclusions. While there are a few markets that are providing unrestricted coverage, the account must be picture perfect.

QUESTIONS ABOUT YOUR ENVIRONMENTAL INSURANCE?

Contact us: imacorp.com/contact