CASES OF INTEREST

Cyan Continues to Wreak Havoc on Litigants and Courts Alike

The aftermath of the U.S. Supreme Court’s decision in Cyan, Inc. v. Beaver County Employees Retirement Fund, 138 S.Ct. 1061 (2018) has validated the initial concerns of many interested parties, and this case represents a recent example of why it is so important that Congress act to address this issue.

To set the stage, this case began as many securities cases do – multiple claimants filed putative class actions in state court alleging violations of the Securities Act of 1933. Defendants removed the cases to federal court and claimants sought to remand them back to state court. Prior to the federal court’s denial of the motion to remand, a third claimant brought suit in federal court, and all three cases were consolidated into one for purposes of judicial efficiency.

Soon thereafter, the Supreme Court issued the Cyan decision (see ERS 1Q2018 Update for a summary of the Cyan decision), which prompted the federal court to revisit its decision on whether remand to state court was proper. After a thorough discussion of case status and how Cyan altered the analysis of jurisdiction and whether remand was proper, the court found remand was required in the two cases originally filed in state court, while the third case was required to remain in federal court. Even though the third case arose out of the same facts and legal claims, it was originally filed in federal court and therefore could not be remanded to state court, meaning the defendants will now be required to fight similar allegations in two different venues.

As this case shows, courts and litigants are both struggling with the effect Cyan is having on their dockets and balance sheets, respectively. Litigants are being forced to defend claims in multiple courts and jurisdictions, all the while having the cases heard in state court by judges with very little experience handling cases alleging violations of federal securities laws.

Until Congress wades into the fray and fixes the underlying legislation that gave rise to this issue, we expect to see more situations like the above. In fact, we have already seen this same issue arise in the exact same state (Tennessee) as the above case, with litigation having been filed against SmileDirectClub in Tennessee and Michigan state courts, as well as in federal court, following its September 2019 IPO. Gaynor v. Miller, et. al., Case No. 3:15-cv-00545 (E.D. Tenn. December 6, 2019)

Insurer Sought to Deny Coverage for Lack of Cooperation by Insured

This case is being highlighted as a reminder of a provision contained in every insurance policy requiring the cooperation of the Insured in the investigation and defense of a claim. While this case represents an extreme example, in that the insurer also sought to rescind (i.e., void) the policy on other grounds, it is worth reminding policyholders of the need to work with insurers throughout the entire claim process.

During settlement negotiations of a False Claims Act (qui tam) lawsuit, the errors and omissions (E&O) insurer requested a laundry list of documents from the Insured. The Insured refused to provide materials that were never disclosed to governmental investigators, along with refusing to transcribe handwritten notes of staff that were arguably duplicative of summaries already provided to the insurance carrier. After the settlement was finalized, the dispute over the Insured’s production of documents to the Insurer continued. The Insurer then filed this case seeking a declaration that it had no obligation to cover the settlement due to the Insured’s failure to provide the requested materials, in addition to its attempt to invoke the prior knowledge exclusion as a defense to coverage entirely.

In denying the Insurer’s motion for summary judgment, the court reiterated what is required of policyholders in this context. The duty of disclosure “includes the obligation to make full, fair, complete and truthful disclosure of all facts relating to the subject of the insurance claim.” It further noted that “an insured only breaches this requirement if the information he refuses to provide is material – not merely technical or inconsequential in nature.”

Almost as a warning to policyholders, the court made it clear that “where an insurer requests information that is material to its investigation and the information is not provided by the insured, the mere materiality of the information makes the insured’s noncompliance prejudicial.”

The takeaway here is that knowing the obligations under an insurance policy is important and should never be assumed or ignored. A competent representative (broker) will have in-house legal and claims professionals who will help the Insured work through any dispute with the insurer and make sure coverage is never jeopardized. Lloyd’s of London Syndicate No. 2623 v. Navicent Health, Inc., 2019 WL 4889269 (M.D. GA Oct. 3, 2019)

Coverage for Spoofing Scam Upheld as Fraudulent Instruction

Social engineering scams involving spoofed emails and other nefarious tactics used to gain the trust of employees and deprive their employers of funds continue to proliferate. Insurance carriers have largely sought to restrict coverage for such schemes either under a sub-limit or by denying coverage altogether. This case represents an outlier, in that both a federal trial court and the appellate court found coverage under a Commercial Crime Policy, specifically the Fraudulent Instruction insuring agreement.

The claim arose when a scammer posing as an executive of the Insured persuaded an employee to wire $1.7 million to a foreign bank account. Coverage for the loss was denied by the Insurer, which took the position that the loss did not result directly from the alleged fraudulent instruction. The Fraudulent Instruction insuring agreement provided coverage for “loss resulting directly from a fraudulent instruction directing a financial institution to debit [the Insured’s] transfer account and transfer, pay or deliver money or securities from that account.”

The federal trial court found the policy language ambiguous and thus was required to rule in favor of coverage being available. The appellate court, taking a position contrary to that of numerous other courts facing similar coverage disputes, found the claim to fall squarely within the coverage grant. Couching its decision on Georgia law, it held the phrase “resulting directly from” to only require proximate causation.

“In Georgia, proximate cause is not necessarily the last act or cause, or the nearest act to the injury. Instead, it encompasses all of the natural and probable consequences of an action, unless there is a sufficient and independent intervening cause.” Lastly, while questions of causation are typically decided by a jury, the appellate court chose to decide the question as a matter of law.

While it is always a good result when insurance is found to cover a loss sustained by an Insured, the reasoning of the appellate court here may not be helpful for other victims of social engineering fraud outside of Georgia, given Georgia’s unique use of the “proximate cause” standard. Principle Solutions Group, LLC v. Ironshore Indemnity, Inc., 944 F.3d 886 (11th Cir. 2019)

Insurer Must Advance Defense Costs After Unreasonable Delay in Issuing Coverage Position

This coverage dispute arose in relation to a claim filed under a professional liability policy covering liabilities in the administration of loan programs. Two cases were filed against the Insured, both of which were tendered to the Insurer. However, the Insurer failed to provide its coverage position to the Insured for over six months. In the interim, the Insured retained legal counsel and defended the claims on its own. After incurring over one million dollars in defense costs combined between the cases, the Insurer took the position that it would not consent to the rates being charged by defense counsel. To make matters worse, the Insurer argued it was only liable for $70,000 of the over $1 million in costs incurred.

The Insured filed suit against its Insurer, seeking to recover the full balance incurred in defending the cases along with fees required to prosecute the coverage action. Finding in favor of the Insured, the court began by noting that an insurer may have a duty to advance legal fees even in the absence of a duty to defend and that an insured becomes legally obligated to pay legal expenses as soon as services are rendered.

As such, the court rejected the Insurer’s argument that defense costs do not need to be paid contemporaneously. In addition, it found that the Insurer’s failure to provide its coverage position months after the claim was tendered to be unreasonable, thereby alleviating the Insured’s obligation to receive Insurer’s consent before retaining defense counsel. Lastly, the court permitted the Insured to litigate its claims of bad faith and breach of the implied covenant of good faith and fair dealing in addition to its claim for breach of the insurance contract based on the Insurer’s conduct

Although this case played out in favor of the Insured, it is always best that this type of situation is avoided. As we noted in the “cooperation” case summary herein, competent brokers and claims professionals exist to ensure these problems never arise. Renovate America, Inc. v. Lloyd’s Syndicate 1458, 2019 WL 6716735 (S.D. Cal. December 10, 2019).

D&O Filings, SEC Update and Other Development

D&O Filings

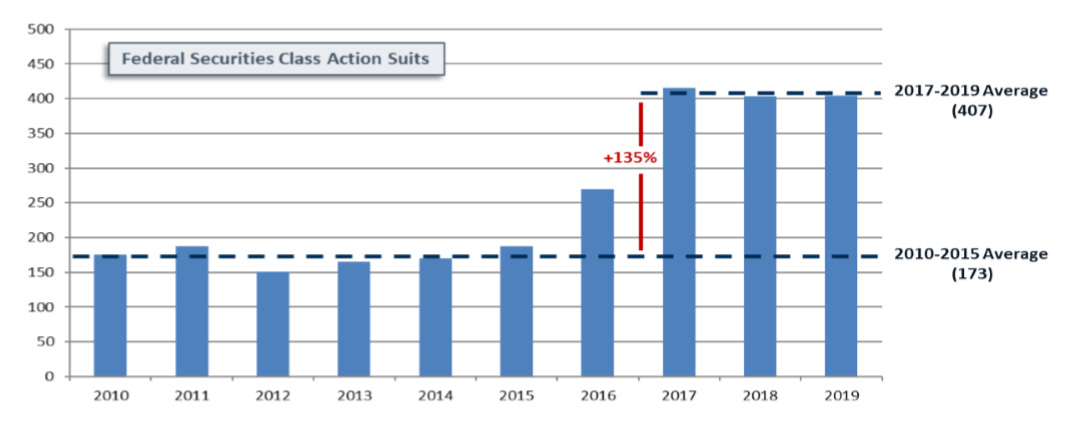

- As we previously reported, 2018 total D&O filings came in 94% above the trailing ten-year average.

- In 2019, filings continued at an elevated level, with 404 D&O Class Action Federal Securities Claims having been filed.

- The annual total of 404 filings exceeds the 2010-2015 annual average of 173 filings by 134%

- At this rate, approximately 1 in 11 public companies are being sued for securities fraud

Securities and Exchange Commission (SEC) Update

- SEC enforcement activity against public companies reached an all-time high in 2019, with 95 new actions.

- Removing actions related to the SEC’s two-year old Share Class Selection Disclosure Initiative (26 of the 95), the number of actions (69) is still 17% higher than the 2010-2018 average of 59.

- In November, the SEC proposed new rules that would give investors more transparency into how proxy advisors make recommendations and would make advisors legally liable under securities laws for any material misstatements.

- Many applauded this move by the SEC, arguing that proxy advisors have for too long provided incorrect information to shareholders and/or recommendations based on conflicts of interest.

- Needless to say, the proxy advisor duopoly (Glass Lewis & Co. and Institutional Shareholder Services control 97% of the market) did not take kindly to this, and in November ISS sued the SEC, citing a limitation on protected speech.

Other Developments and Considerations

- With D&O litigation remaining elevated, carriers will likely continue to push for rate increases in the first half of 2020.

- Price increases continue to be most noticeable for small cap companies and companies in challenging sectors.

- Companies considering an IPO can expect to see dramatically different terms versus 6 months ago. Retentions and pricing have been increasing noticeably, and carriers have also begun to cut back on limit deployment.

- Fortunately, we have not seen a broad pullback in coverage terms, and in many cases, the scope of coverage continues to expand.

Key Contacts

Brian R. Bovasso

Managing Director

IMA Executive Risk Solutions

303.615.7449

brian.bovasso@imacorp.com

Travis T. Murtha

Director of ERS Claims

IMA Executive Risk Solutions

Legal & Claims Practice

303.615.7587

travis.murtha@imacorp.com

About IMA

IMA Financial Group is a privately held, diversified financial services firm focused on protecting client assets and creating exceptional value for our clients around the world. Our diverse team of experienced and talented professionals shares an unwavering commitment to excellence.

IMA Executive Risk Solutions is our world-class team of 20+ professionals focused on providing thoughtful advice, a unique legal perspective, a broad range of executive risk insurance solutions, and excellent service to our valued clients. Our professionals have deep experience handling complex executive risk exposures for a variety of clients – from pre-IPO start-ups to multi-billion dollar corporations.