Q3 2019

Pricing Update

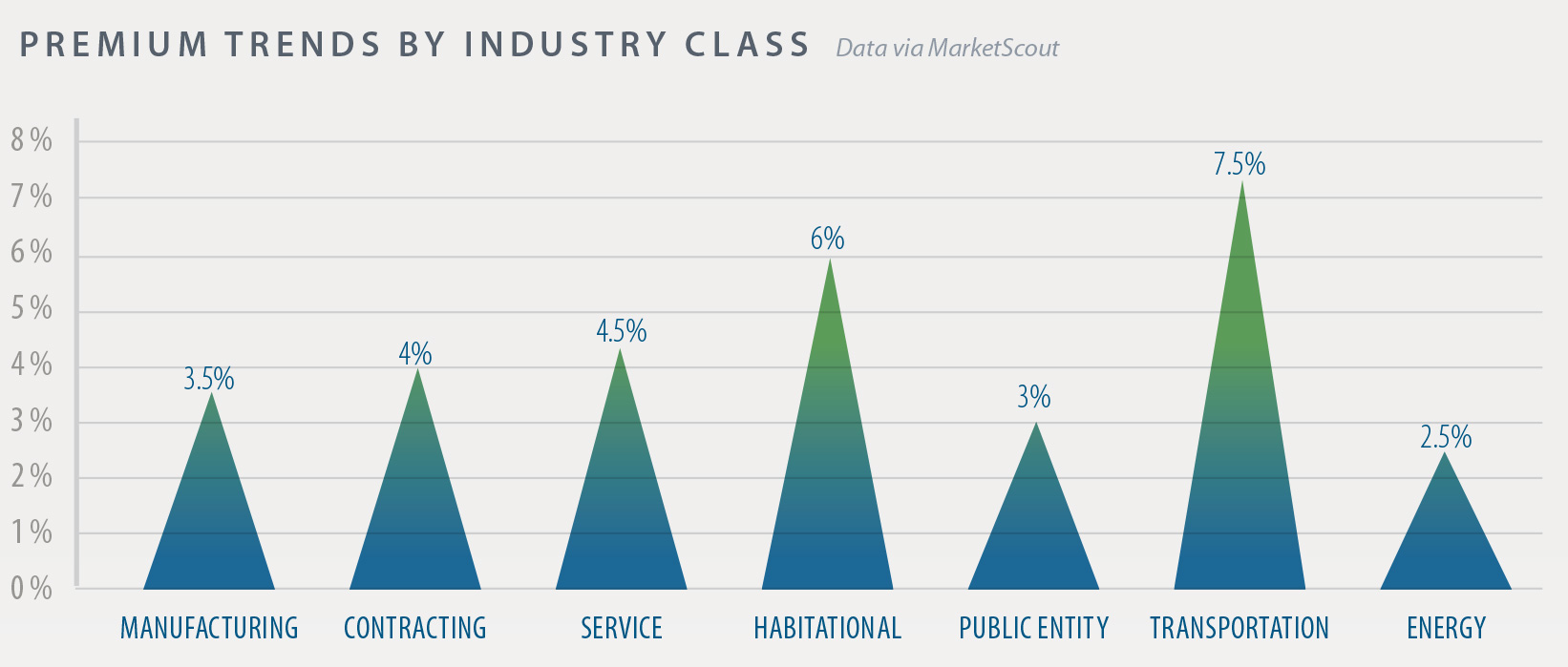

RATES UP 4% IN THIRD QUARTER

Habitational and transportation risks were hammered again by rate increases in the third quarter, leading average rate growth at 6% and 7.5% respectively. Habitational risks have been hit especially hard during 2019 as CAT losses in the Southeast and Gulf Coast, combined with wind and hail losses across the Midwest over the last 18 months drove through primary retentions and impacted pricing in the reinsurance market, costs that are now beginning to trickle down to insureds.

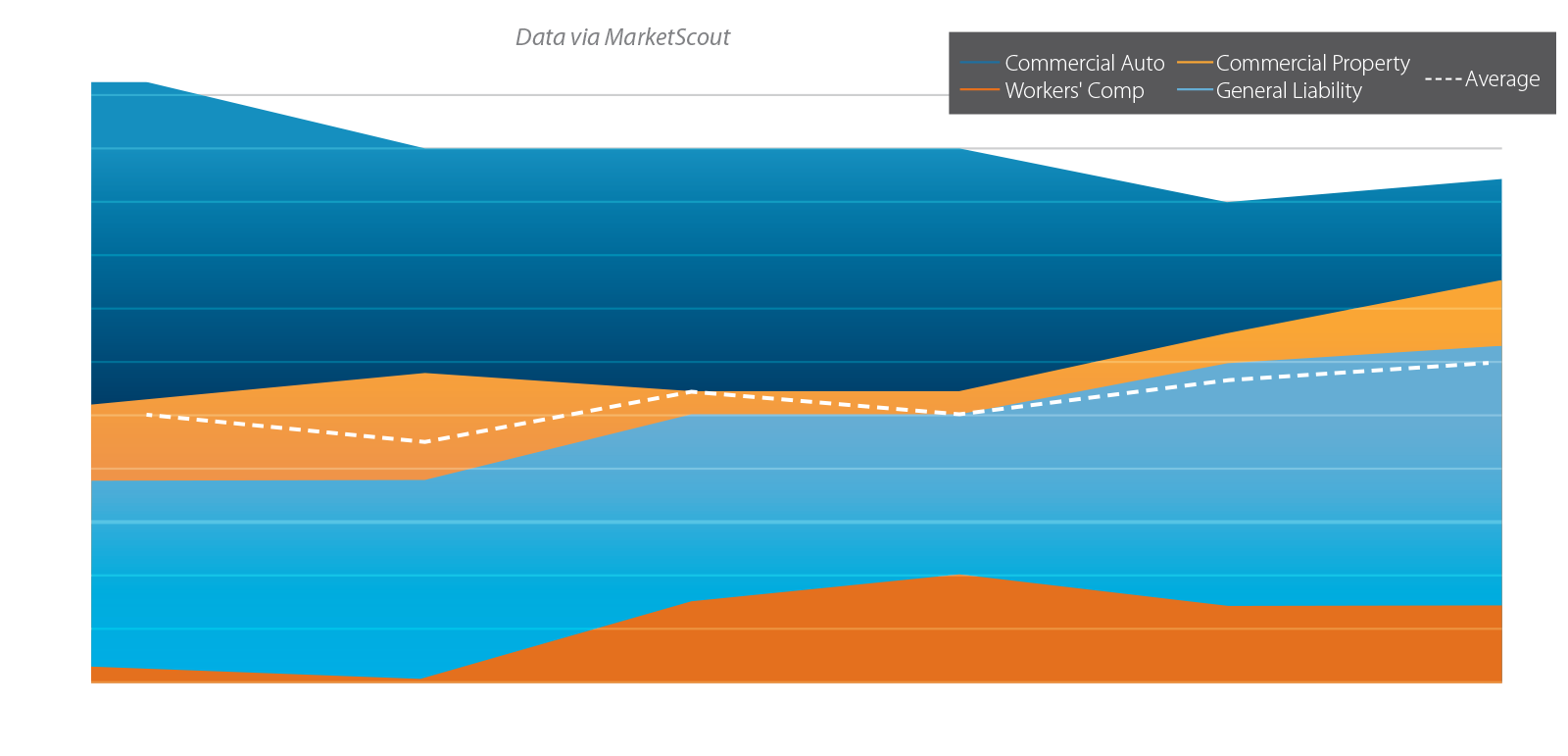

PREMIUM TREND BY COVERAGE CLASS

Actual rate increases are predicated on specific loss experience per company

“Thus far, we have had a relatively benign third quarter for property insurers. This helped slow the rapid pace of increases; however, property rates continue to trend upward. Liability and other lines also continue the upward trend. Workers’ compensation rates are still down, but we do see signs indicating workers’ compensation rates may move up in the fourth quarter of 2019.”

– Richard Kerr, CEO of MarketScout

| RATE CHANGE BY COVERAGE LINE | |

|---|---|

| Business Interruption | +4.0 % |

| Commercial Auto | +6.5 % |

| Commercial Property | +4.5 % |

| D&O Liability | +4.5 % |

| Employment Practices | +4.0 % |

| Inland Marine | +3.0 % |

| Surety Bonds | +1.0 % |

| Umbrella | +4.5 % |

| Workers' Compensation | -1.5 % |

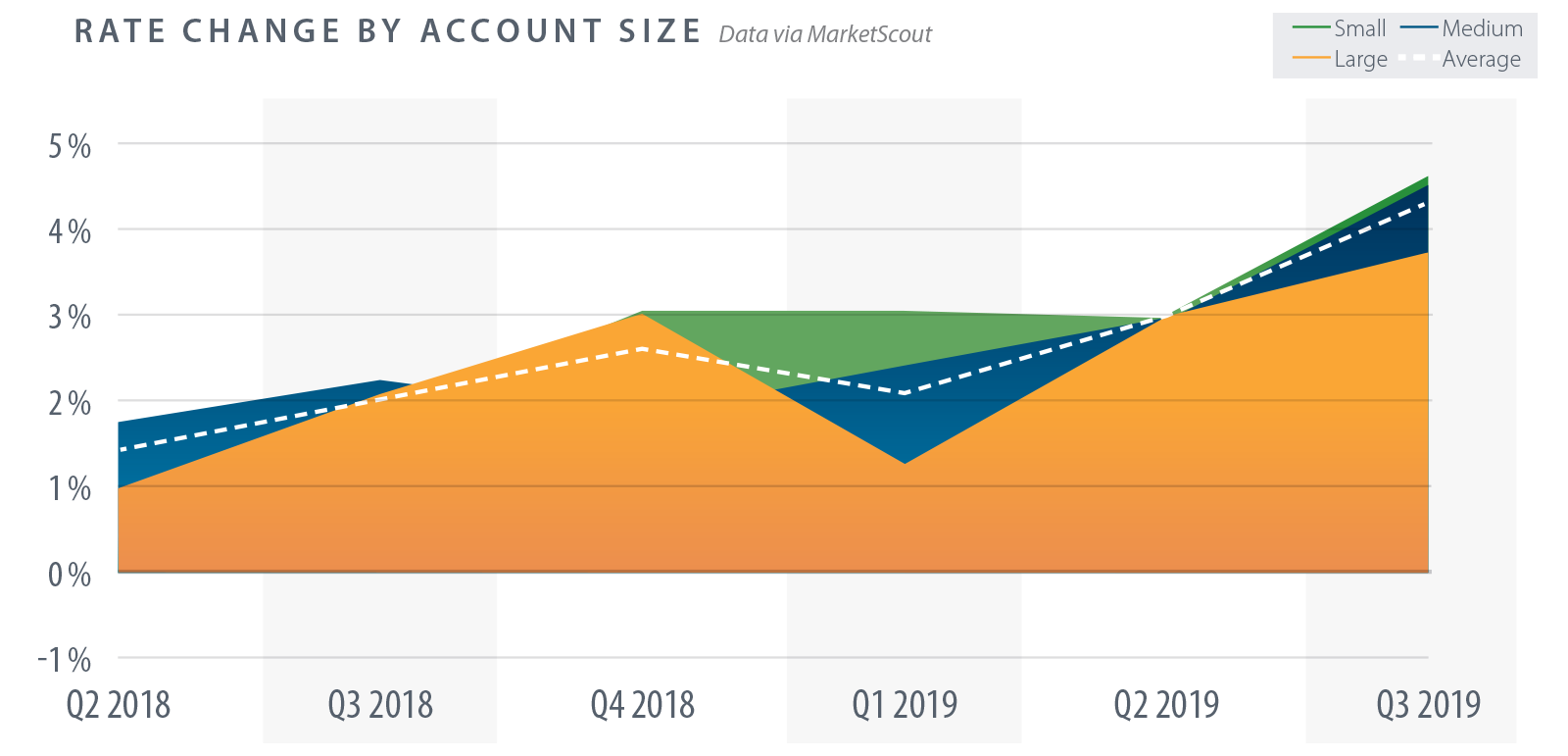

As the insurance market began to harden in 2018, large insureds (those paying over $250,000 in premium) consistently saw significantly smaller increases in premium rate compared to smaller companies. While rate increases for large insureds did lag behind their smaller brethren, the gap closed significantly in Q3 with larger accounts averaging a 3.5% increase vs. 4.5% for smaller accounts.

As the legal environment surrounding commercial auto becomes more difficult, the severity of claims continues to increase significantly. Per Insurance Business America “a claim that used to be considered a working layer….is now penetrating that $1 million excess layer”.

The combined increase in both severity and frequency indicates insurers remain far from being able to profitability, and sustainability price commercial auto, a situation which potentially predicts continued rate increases.