TAFT-HARTLEY

Strengthening your Fund: to protect families, businesses and plan offerings.

Consultative Philosophy/Approach: Our consultative approach is rooted in two foundational components: Being educational and informative so clients can make well-founded decisions, and following a strategic and active approach to plan management.

Educated and Informed Trustees Enable High Performing Plans

Informing & Educating Clients

Are You Currently Receiving the Information You Need To Manage Your Plan

QUESTIONS TO ASK

Yourself and Broker

ASK YOURSELF:

- Do I feel informed and educated on our offerings?

- Do I know the current financial health of our offerings?

- Do I understand the cost drivers and market conditions driving our plan costs

- Do I feel empowered to make informed decisions?

- Am I presented options and am educated on those options to a degree to which I feel comfortable making an informed decision?

- Am I being advised on strategies to control costs and improve member benefits?

- Does my current broker measure and present results of past recommended strategies/decisions?

ASK YOUR BROKER/ACTUARY:

- Can you provide detailed information regarding the current and continued health/performance of our plan?

- Have you brought solutions to help control costs & improve benefits?

- Will you measure and report to us on the impact of your consultation/recommendations/strategic approach?

Annual

Service Plan

1st

General Update / Compliance

2nd

Strategy / Pre-Renewal

3rd

Renewal / Data Informed Decisions

4th

Implementation, Document Review, Open Enrollment Support

STRATEGIC, ACTIVE PLAN MANAGEMENT

Plan

Components

FUNDING

FUNDING

Impact – Year 1 of Change

Plan Funding

Reserve Utilization

STRUCTURAL

STRUCTURAL

Impact – Year 1 of Change

Network

Stop Loss Coverage

- Specific Deductible

- Lasers

- Aggregate SL?

- Contract terms

Plan Administration

- UM/CM/DM/UR

- Payment accuracy

PBM

- Contract terms

- Pricing

Budgeting

PLAN SET-UP

PLAN SET-UP

Impact – Longer Term, Future Spend Mitigation

Plan Design:

Deductible/Out of Pocket, Max/Coinsurance

- Less efficient means of “savings”

Other Options

- Value Base Plan Design,

- Narrow Network,

- Incent COE, Near-site Clinic

- Clinic Arrangements with Local Providers

- Direct Contracts

- Etc

PLAN SET-UP:

SAMPLE MED/RX PLAN STRATEGIES

(Not an exhaustive list)

COST

STRUCTURAL: Year 1 impact, ongoing

Reference Based Pricing

Tiered & Narrow

Networks

Direct

Contracting

Unbundled Plan Administration

Cost

Transparency

CARE

RIGHT SERVICE, RIGHT PLACE: Future impact, ongoing

Onsite/Near site

Clinic

Condition

Management

Centers of

Excellence

Health Risk

Management

Plan

Design

EFFICIENCY

CONDITION MANAGEMENT: Future impact, ongoing

Pharmacy Management

Site of Service Differentials

Value Based Plan Design

Transparency Incentives

Patient

Advocacy

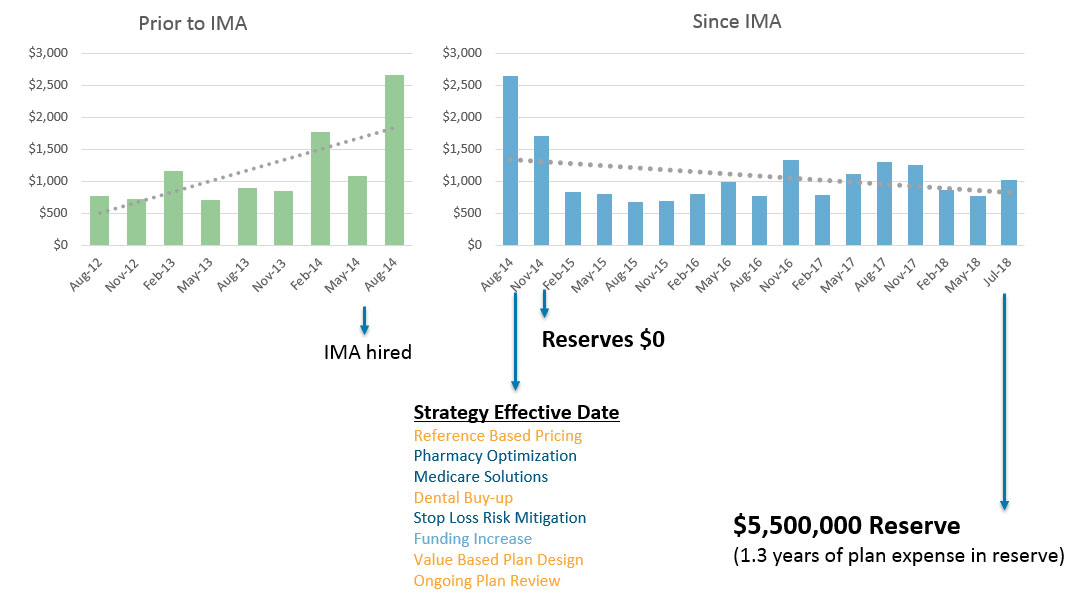

Proven Results

CASE STUDY –

PEPM MED/RX CLAIMS

~400 Member Taft Hartley Fund. Plan facing insolvency when IMA Was hired.

CASE

STUDY – 400EE

| Incremental Strategies, Ongoing Savings | First 2 Years Savings/Cost Avoidance: | |

|---|---|---|

| structural | PHARMACY OPTIMIZATION | $160,882 |

| RISK MANAGEMENT – SPECIFIC STOP LOSS | $78,000 | |

| PLA SET-UP | POPULATION MANAGEMENT | $725,000 |

| ANCILLARY MANGEMENT | $185,000 |