Ensure you’re getting what you’re paying for when it comes to managing and mitigating risk

If you’re a construction contractor, you’re well aware of the risks you face. Should you be insured? You probably don’t have a choice in many cases – certain coverage is required by law or the contracts you’ve signed.

Good for us at IMA. You’ve got to love being in an industry that sells products companies are forced to buy!

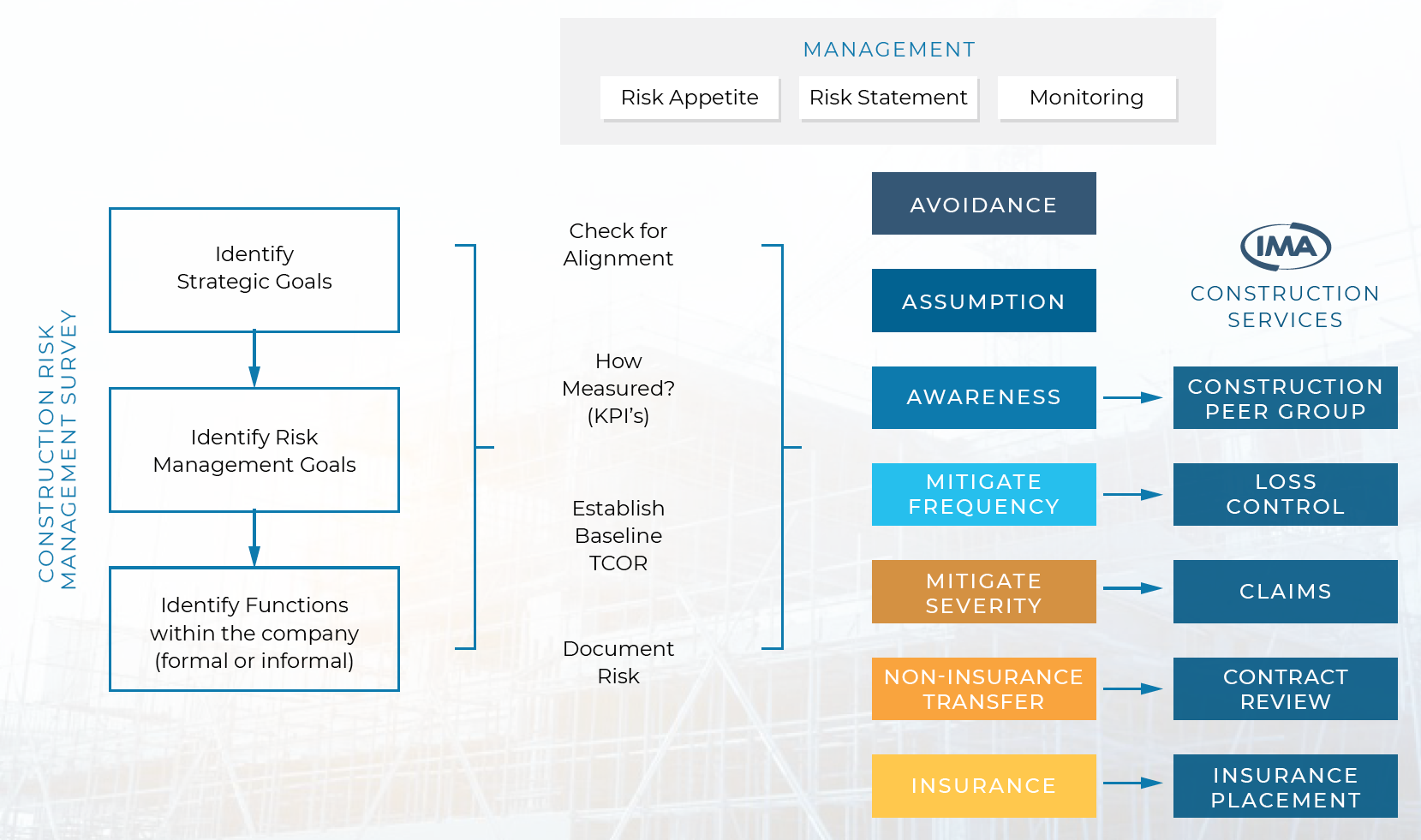

But our National Construction Practice team offers far more than insurance policies. After all, insurance is the last-ditch, most reactionary way to mitigate risk. That’s why we help our clients identify, address and monitor insurable and uninsurable risk. We’re in the risk minimization industry.

The risk minimization approaches for the construction industry described below are intuitive. Some even seem simplistic. Indeed, they’re both of those. They’re also integrated – you can direct more than one of them toward nearly every insurable and uninsurable risk you face as a contractor.

Let’s be clear, though: these aren’t necessarily alternatives to insurance. Integrating these practices into your operations, though, can keep a lid on your premiums and minimize the frequency of your claims. And that’s good for everyone!

AVOIDANCE

AT THE RISK OF MIXING METAPHORS, IF YOU’RE CONSIDERING BIDDING ON A JOB, IT’S OKAY TO PUSH THE ENVELOPE…

just don’t get too far outside your comfort zone. At what point does “too far” trigger a “just say no” response? You should have an objective process to help you determine when to pass up on a job (or subcontract it out) if you’re not really comfortable doing it.

ASSUMPTION

SOMETIMES IT’S OKAY TO TAKE CHANCES, TO ASSUME A RISK.

By this we mean a conscious assumption of risk, where you identify the risk, but decide that since the incident is not likely to occur, you’re willing to take a chance. However, do whatever you can to minimize your unconscious assumption of risk – taking actions without even being aware of your exposure to loss. We refer to this as “accidental self-insurance” and it’s not a risk management strategy we recommend!

AWARENESS

CALLS FOR AT LEAST TWO KINDS OF RISK MITIGATION ACTIVITY.

You should share information with your crews and employees about incident trends – if specific risks are top of mind, related incidents will decline. Awareness also calls for identifying and correcting root causes of incidents. This is a bottom-up exercise – your crews and employees can best advise you on how to mitigate the hazards they’re facing.

FREQUENCY AND SEVERITY MITIGATION

IF YOU CAN’T ELIMINATE INCIDENTS RELATED TO A CERTAIN RISK…

you should reduce them as much as possible by improving your processes and other practices. And at the same time, you should identify similar approaches that lessen the consequences of those incidents.

NON-INSURANCE TRANSFER

TECHNICALLY REFERRED TO AS “SUBCONTRACTOR INDEMNIFICATION,”

non-insurance transfers allow you to contractually shift liability to another firm that has agreed to handle an inherently risky activity on your behalf. Of course, these arrangements can never be iron-clad – the financial viability of the subcontractor will determine if you can ultimately avoid financial exposure if an incident occurs.

APPLICATION OF THE PRINCIPLES

THESE RISK MITIGATION STRATEGIES FORM THE BASIS OF OUR RELATIONSHIP WITH EACH CLIENT AS WE:

• EXPLORE AND IDENTIFY their portfolio of risks

• HELP THEM UNCOVER new procedures and practices to mitigate their risks

• INSURE AGAINST their risks where possible and necessary

•MONITOR their overall risk mitigation program • CONTINUALLY ADJUST the program as needed

INSURANCE SHOULD BE YOUR LAST RESORT

WE BELIEVE THERE ARE SEVEN WAYS TO TREAT RISK.

Insurance is the most reactionary and expensive method. We want to help our clients with the first six ways… which will in turn make insurance more efficient (cheaper) and effective (broader). By helping our clients manage risk, both insurable and non-insurable, using the full spectrum of risk management techniques, we want to turn risk into a competitive advantage for our clients thus making their business better (more profitable).