Medicare Part D Notice Reminder

Each September, IMA provides a reminder for employers to distribute the annual Medicare Part D notice to all enrolled employees, retirees, COBRA participants, and dependents not residing with the employee by October 14.

This notice explains whether the employer’s prescription drug coverage is “creditable” (or at least as good as Medicare Part D prescription drug coverage).

While there is no penalty for not providing this notice, those who fail to enroll timely in Part D may be subject to late enrollment penalties payable for life.

Can I just include the full notice with annual open enrollment materials and skip a separate mass distribution in the fall?

Providing the full notice at annual open enrollment is allowed, but there are specific rules to know:

- DOL electronic delivery rules apply. 2009 guidance permits delivering this notice electronically to employees with access to a computer as an integral part of their daily job (per the DOL’s e-delivery rules) or to anyone that gives proper consent. When posted electronically, employees must be notified each year via email, postcard, or other means of:

- the significance of the notice,

- instructions to retrieve it or request a free paper copy, and

- a heads-up that only providing to the employee means the employee is obligated to provide to any enrolled dependents that might be eligible for Medicare Part D.

- Separate notice to certain enrolled non-employees. Despite notice to the employee being sufficient as notice to the family, the employer must mail a separate notice to an enrolled dependent known to reside apart from the employee and to those enrolled under COBRA or retiree coverage. It’s usually impractical to get their consent to e-delivery.

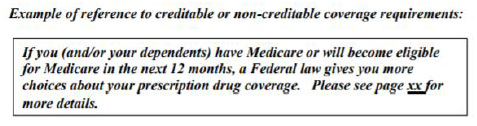

- Must be “prominent and conspicuous.” Under this standard, it would ideally be a separate notice. However, if bundled into a guide, it “must be prominently referenced in at least 14-point font in a separate box, bolded or offset on the first page” (such as in the table of contents).

What should I provide?

The Center for Medicare and Medicaid Services (CMS) provides model notices, and the current versions have not changed since 2011. Below are some tips for working with the model notices:

- While employers are not required to use the models, there is required content employers must disclose and additional content which CMS recommends. Each model notice covers it all.

- Since CMS only provides the model notices in PDF, we have them in Word format below:

- Model Creditable Coverage Notice (also in Spanish)

- Model Non-Creditable Coverage Notice (also in Spanish)

- Please note there are bracketed portions of the model notice you must tailor.

- IMA has an already tailored model notice available for your consideration. Just ask your IMA Benefits account team if interested.

- IMA has prepared an optional cover letter which may help explain the notice to participants.

- The models provide an optional box on page 3 which isn’t necessary for the annual mailing.

- If the plan loses creditable coverage status, the employer must provide a non-creditable notice to affected individuals within 30 days of the renewal. In this situation, the employer will want to complete this box to indicate the dates the employee had creditable coverage, making this a personalized notice customized to each employee.

Other tips

- Keep an audit trail. In the event an employee experiences a Part D late enrollment penalty, it may be best to have some proof you provided adequate communications, including:

- a log of which individuals were provided the notice each year with their address (if mailed) or email address (if emailed),

- a copy of the communication provided to announce e-delivered notices,

- a copy of the notice template used (in its final tailored format, not the original model), and

- a copy of each personalized notice provided to individuals losing creditable coverage.

- Notify CMS shortly after renewal each year.

- Notify CMS at this website of your prescription benefits’ creditable or non-creditable status within 60 days of renewal every year, or within 30 days of a change in creditability.

- Don’t forget new hires.

- An abbreviated notice can be provided rather than the full notice. This helps new hires understand whether enrolling in the employer’s plan will make it safe to delay enrolling in Part D without penalty.

This material should not be considered as a substitute for legal, tax and/or actuarial advice. Contact the appropriate professional counsel for such matters. These materials are not exhaustive and are subject to possible changes in applicable laws, rules, and regulations and their interpretations.