PCOR Fee Indexed for the Last Time

The Patient Centered Outcomes Research (PCOR) Institute created by the Affordable Care Act (ACA) was funded by a temporary 7-year fee on health plans. While insurance companies typically take care of reporting and paying this fee for insured plans, an employer with a health reimbursement arrangement or a self-funded health plan is responsible to report and pay this fee each year by July 31 on IRS Form 720.

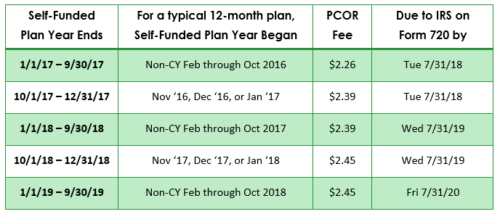

The fee started out at $1 per employee per year, then increased to $2 the second year, and then has indexed incrementally each year since. Today, the IRS has indexed the fee for its 7th and final year to

$2.45. Since the fee is based on plan year end date (rather than start date) and is not pro-rated for short plan years, we provide a chart below to help employers identify the fee and due date for their full 12-month plan years based on plan year start date. Please let your IMA Benefits team know if you have any questions.

Please let your IMA Benefits team know if you have any questions; we will continue to monitor regulator guidance and offer meaningful, practical, timely information.