DOL Expands Ability to Create Association Health Plans

Final Rule Expands Ability to Form Association Health Plans

Back on October 12, 2017, President Trump signed Executive Order 13765 which included a directive for the Department of Labor (DOL) to find ways within existing ERISA law to expand the availability of association health plans (AHPs). The goal is to allow small employers and self-employed business owners more ways to band together and gain access to more insurance options.

Some small employers share enough common ownership with other entities to make a combined large group plan. However, those without enough common ownership find it very difficult to join a larger plan as it creates a multiple employer welfare arrangement (MEWA) with extra compliance obligations.

In response to the President’s directive, the DOL issued an 83-page proposed rule in January introducing expanded opportunities to create AHPs. After reviewing over 900 public comments, they announced a 198-page final rule on Tuesday, June 19, which largely follows the proposed rule with only a few modifications.

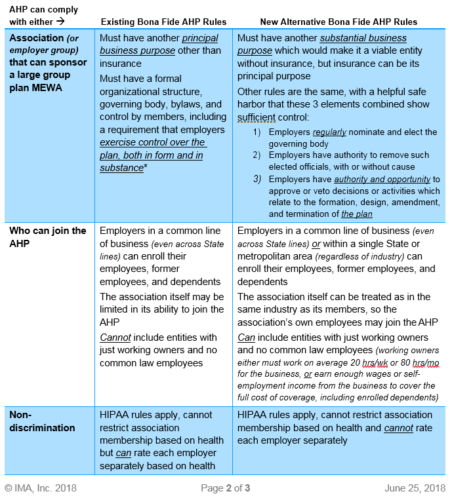

One key provision of the final rule is that AHPs can be allowed under existing AHP guidance without changes. The final rule offers a new way to create AHPs subject to different rules. To show the two possibilities, we will summarize the two types of AHPs on the next page, but both types are still MEWAs and therefore still complicated by extra federal and state requirements/restrictions. First, MEWAs must file Form M-1 with the DOL at least 30 days before the plan begins (and annually thereafter), and many states have similar registration requirements. In addition, various states prohibit participation across different industries, prohibit self-employed individuals from being covered by MEWAs, prohibit MEWAs from operating in the state if established solely for the purpose of obtaining or providing insurance, and/or prohibit AHPs from self-insuring. These obstacles are not overcome in the final rule.

There are other ways to have a MEWA, but the DOL created these two “bona fide” AHP pathways to allow the AHP to be recognized as one ERISA plan in the large group market, thus allowing small employers to escape some small group market requirements (such as needing to cover all 10 categories of essential health benefits and to be community rated). Small employers could escape these requirements by self-insuring their own plan, but self-funding is often out of reach at this size.

It’s also worth noting that groups not subject to ERISA, such as governments, tribes, and churches, are not subject to these ERISA rules and would follow different state criteria when interested in forming a joint plan with other similar entities.

The new rules are available for insured AHPs effective 9/1/18, for existing self-funded AHPs effective 1/1/19, and for new self-funded AHPs effective 4/1/19.

*Existing bona fide AHP rules consider many factors, including: how members are solicited; who is entitled to participate and who actually participates in the group or association; the process by which the group or association was formed, the purposes for which it was formed, and what, if any, were the preexisting relationships of its members; the powers, rights, and privileges of employer members that exist by reason of their status as employers; and who actually controls and directs the activities and operations of the benefit program. The employer members must also have a sufficient employment-based common nexus or other genuine organizational relationship unrelated to the provision of benefits. That determination is made on the basis of all the facts and circumstances involved. The employers that participate in a benefit program must also exercise control over the group or association’s group health plan, both in form and in substance, in order to act as a bona fide employer group or association with respect to the plan.

There are some unanswered provisions needing further guidance as well, such as:

- Since most AHPs will need to establish a trust, will the IRS and Department of the Treasury align Voluntary Employees’ Beneficiary Association (VEBA) rules under §501(c)(9) with the new AHP final rule so these trusts may be tax exempt?

- Since COBRA applies unless “all employers maintaining such plan normally employed fewer than 20 employees on a typical business day during the preceding calendar year,” will small employers in an AHP qualify for the <20-employee exemption from COBRA?

- Will self-funded AHPs be required to run §105(h) non-discrimination testing across the entire AHP combined or employer by employer?

The DOL’s final rule declines to impose any limits on the ability of states to regulate AHPs as a matter of state insurance law, beyond existing ERISA limitations. The final rule also declines to address state insurance law issues such as the “situs” of an insurance policy issued to an AHP, noting that the application and coordination of state insurance law remains the province of the states. Thus, compliance with state insurance regulation will continue to be a significant consideration for AHPs, even if they meet the criteria to be “bona fide” AHPs under the final rule.

Groups looking to form AHPs will have a lot to consider, including federal and state compliance, taxes, legal assistance, communications, marketing, funding, reserves, coordination, and more. It will be best to tackle this slowly with clear goals and experienced counsel.

Please let your IMA Benefits team know if you have any questions; we will continue to monitor regulator guidance and offer meaningful, practical, timely information.