Using Your Carrier Wellness Funds

If your organization has ever received a wellness fund from your carrier, you may be thinking, “Wow, thanks… But what’s a wellness fund?” Or, “We didn’t spend all our funds last year, and I need help planning how to use it all this year.” These funds can be both an opportunity and a little intimidating. There are many resources out there to provide support for employees, improve employee experience, or help promote an internal initiative, but narrowing down what works for your company can be difficult.

The ultimate goal is to allocate wellness funds in a way that aligns with the company’s culture and wellness benefits but also positively impacts employee wellbeing.

First things first… what’s a wellness fund?

A wellness fund (sometimes called a health engagement or health improvement fund) is an amount of money provided by your medical insurance carrier that can be used to assist your organization in executing wellness initiatives. Sometimes you don’t even know this money exists, so first, you may need to contact your carrier to see if you have wellness funds available and how much, and what the criteria for using the funds include.

How can employers use the funds?

Some carriers have strict guidelines and criteria around what a wellness fund can be used for, while others are more lenient. You’ll want to check with your carrier to understand their rules and eligible expenses before spending any of the funds. Additionally, how you spend these dollars depends on many factors, including the amount you receive, how many employees you have, your organization’s demographics, culture, industry, etc.

Some employers are surprised to find that some initiatives and offerings they already spend money on qualify for wellness funds. For example, many companies stock fresh fruit in the break room as a healthy snack for employees to enjoy. This will often qualify as an approved expense, and carriers may reimburse this expense if receipts are submitted.

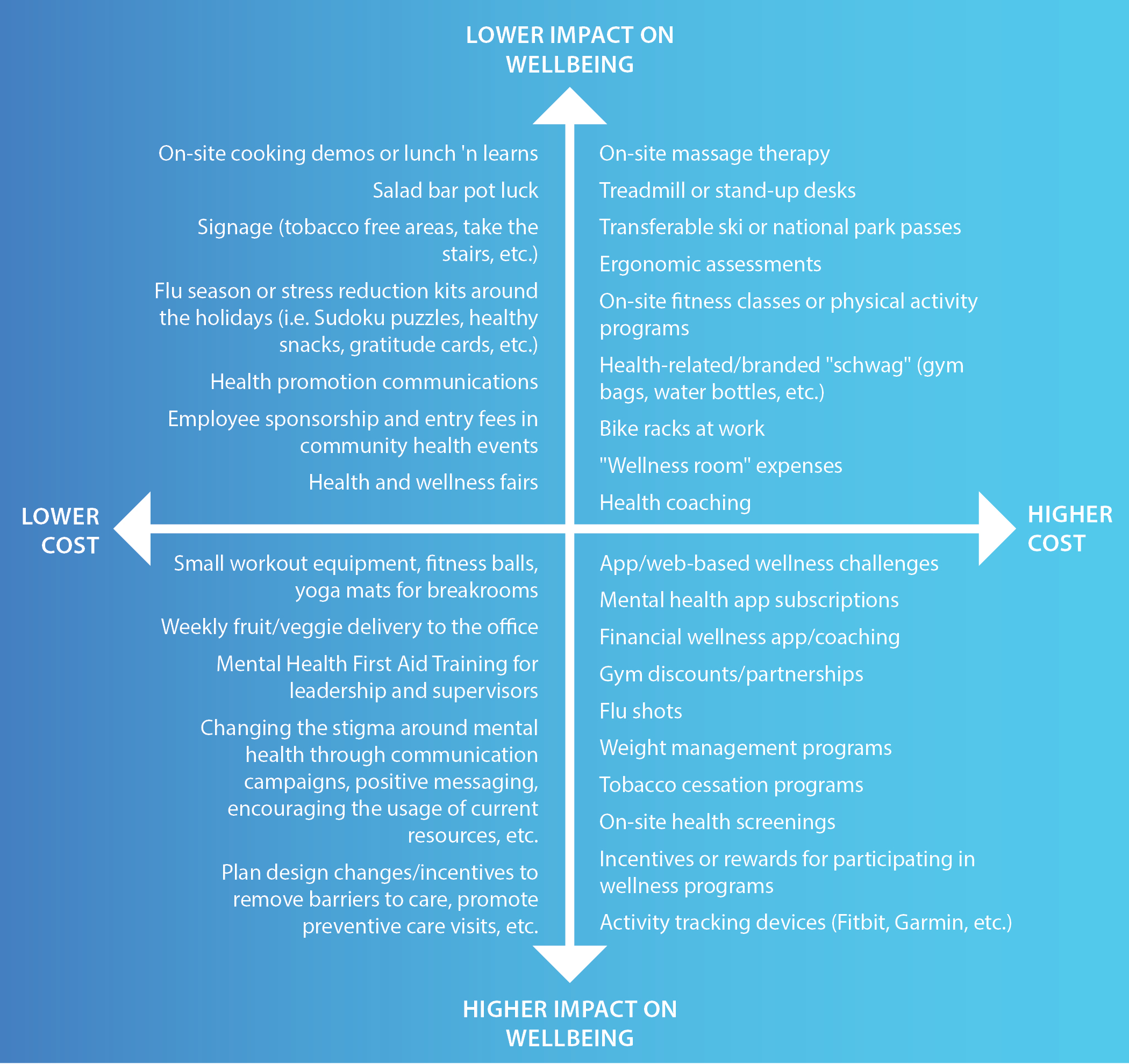

IMA has developed the below matrix with ideas on how to spend your wellness funds best depending on cost and potential impact on your employees’ wellbeing.

A few things to note

Regarding the level of impact, ideas are categorized based on the potential to positively influence the wellbeing of many employees. For example, transferable ski passes may sound like a great perk, but they’re costly and fewer employees may take advantage of this than other items.

Some offerings are subjective, so one person may find great value in on-site massage therapy, whereas another employee wouldn’t benefit from it. You should look to implement a variety of activities that will appeal to varying interests to foster engagement and excitement.

There is no right or wrong answer. On the one hand, any initiative/program/campaign that focuses on the health of your employees is worth it. So “low impact” initiatives shouldn’t be dismissed – it just depends on how you want to enhance the wellbeing of your employees.

Company culture and employee preferences are important. Consider these when reviewing suggestions and feel free to add your ideas and change where you think initiatives should fall on this matrix. This, along with soliciting input from others within your organization, can be a helpful tool in deciding how initiatives may impact your employees’ wellbeing.

How does it all work?

The money allotted in your wellness fund is available throughout your current benefit plan year, and any funds not used by the end of your plan year are forfeited. Therefore, it’s in your best interest to make use of the funds. Most funds require pre-approval before being spent, so always double-check before going shopping. Once you receive approval to spend the funds, you purchase the items or programs, then submit receipts for reimbursement.

A few final recommendations

- Think broadly. Spend your money on initiatives that will attract and motivate many employees (and their families, if possible) to make healthy choices.

- Survey employees. Ask for input if you’re unsure what programs interest your workforce, as well as to indicate how well current programs are going.

- Offer variety. Don’t expect that everyone will want a Fitbit or a bootcamp class. One employee may need mental health support while another may want a water bottle to remind them to hydrate. Spend your funds on a variety of wellness initiatives that employees can pick and choose from, depending on their needs and interests.

- Make a year-long plan. Ideally, spread your dollars across the entire year vs. one initiative or item. Monthly health education, a few challenge programs during the year with incentives, and one big company-wide event will go farther than one campaign that people forget about the next month.

If you have wellness funds this year, or you don’t know if you do, reach out to your IMA account team for assistance. In addition to your core team, we have a dedicated Whole Health Advisor with more than 15 years of experience in the wellness industry. Keep in mind, if you use all your funds this year, your carrier is more likely to offer it again (and may offer more money) in future years. Formulate a plan, preferably early in the year, of how you’ll spend those funds so you’re not rushing to spend them at the end of the year on items or initiatives that will be less impactful to your employees’ overall wellbeing.

This material is for general information only and should not be considered as a substitute for legal, medical, tax and/or actuarial advice. Contact the appropriate professional counsel for such matters. These materials are not exhaustive and are subject to possible changes in applicable laws, rules, and regulations and their interpretations.