IMA Compliance Alert

Oct 16, 2017

With Congressional repeal and replace off the table for now and a new year on the horizon, regulators and courts are stepping up their activity again. Below are several updates to keep you in the know!

While we don’t have an official release from the IRS, we are projecting the annual flexible spending account (FSA) limit to increase $50 to $2,650 for plan years beginning on/after January 1, 2018.

We calculated the 2017 consumer price index (CPI) to 6.68% over the 2012 CPI. Increasing the original $2,500 FSA limit 6.68% is $2,667, which rounded down to the nearest multiple of $50 is $2,650.

We will publish an update after the official IRS announcement expected in a week or two.

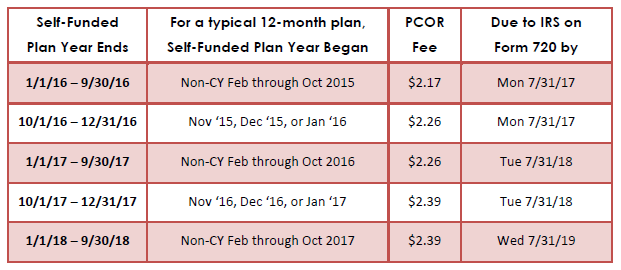

IRS Notice 2017-61 officially indexes the Patient Centered Outcomes Research (PCOR) fee to $2.39. While insurers file and pay this fee for insured medical plans, employers are responsible to file and pay for their self-funded medical plan or their health reimbursement arrangement (HRA) integrated with their insured medical plan. Below is a table which may help illustrate the indexing and due dates, but please feel free to contact your IMA Benefits team for clarification.

The Departments of Health and Human Services, Labor, and the Treasury (the Departments) have issued two interim final rules (IFRs) that make it easier for employers to claim a religious or moral objection to some or all of the contraceptive/sterilization mandate. This area has been the subject of much litigation over the last 5 years which resulted in the U.S. Supreme Court declaring the government had gone too far, that closely held for-profit entities with sincerely held religious beliefs should be protected, and that the accommodation process may need to be more accommodating.

Under existing rules, churches and integrated auxiliaries are exempt from the mandate, while religiously-affiliated non-profit organizations and closely-held for-profit companies with sincerely held religious objections must follow an accommodation process to ensure their claims administrator provides the free contraceptive/sterilization to which they object. Many of these employers have filed suits complaining the accommodation process makes them complicit in providing their employees with the contraceptives/sterilization to which they object.

Now we have an IFR which immediately expands the religious exemption to “non-governmental plan sponsors that object based on sincerely held religious beliefs, and institutions of higher education in their arrangement of student health plans.” This will allow any non-governmental plan, whether for-profit, non-profit, or publicly traded, to object on religious grounds to some or all contraceptive/sterilization without being required to inform their claims administrator or HHS if they don’t wish to. However, “the accommodation is also maintained as an optional process for exempt employers” that would like to ensure their claims administrator provides the free contraceptive coverage to which the employer objects.

“The Departments have also decided to create a process by which a willing employer and issuer may allow an objecting individual employee to obtain health coverage without contraceptive coverage.” There is no requirement for insurance companies or employers to make this happen, but it would be allowed under the new rules.

The second IFR states non-religious objections also exempt any non-governmental entity (except a publicly traded company) to the extent of their sincerely held moral objection without being required to inform their claims administrator or HHS if they don’t wish to. Similar to the religious exemption IFR, the accommodation process is available but not required.

“The mechanisms for determining whether a company has adopted and holds certain principles or views, such as sincerely held moral convictions, is a matter of well-established State law with respect to corporate decision-making, and the Departments expect that application of such laws would cabin the scope of this exemption.”

In addition to these IFRs, the Department of Justice released a 25-page memorandum on October 6, 2017 about religious liberties and protections and how they can apply to organizations and businesses.

Gender Identity

Back in December 2014, Attorney General Eric Holder had issued a memorandum stating “the Department of Justice will take the position in litigation that the protection of Title VII of the Civil Rights Act of 1964 extends to claims of discrimination based on an individual’s gender identity, including transgender status.” This was followed by much legal activity which continued under Attorney General Loretta Lynch but then had to cease August 21, 2016, as a result of a federal injunction in Texas v. United States.

On October 4, 2017, Attorney General Jeff Sessions issued a memorandum reversing this 3-year DOJ policy. “Title VII does not prohibit discrimination based on gender identity per se. This is a conclusion of law, not policy…As a law enforcement agency, the Department of Justice must interpret Title VII as written by Congress.”

He goes on to say, “Nothing in this memorandum should be construed to condone mistreatment on the basis of gender identity, or to express a policy view on whether Congress should amend Title VII to provide different or additional protections.” The memo also notes gender identity discrimination is specifically protected by the Matthew Shepard and James Byrd, Jr. Hate Crimes Prevention Act and the Violence Against Women Reauthorization Act in certain contexts, so those will continue to be enforced.

Sexual Orientation

This follows on the heels of this summer’s Zarda case, in which the DOJ is not a party but decided to file an amicus brief stating sexual orientation is not a Title VII protected civil right. This opposes the Equal Employment Opportunity Commission (EEOC), the federal agency leading this case. “Because such claims necessarily involve impermissible consideration of a plaintiff’s sex, gender-based associational discrimination, and sex stereotyping, the EEOC believes they fall squarely within Title VII’s prohibition against discrimination on the basis of sex.”

Earlier this year in March, the 2nd and 11th circuits both ruled sexual orientation is not protected under Title VII, but a month later in April, the 7th Circuit was the first court to rule that sexual orientation is protected. The split in the circuits likely means the U.S. Supreme Court will need to review the issue.

The Department of Labor (DOL) had issued a final rule regarding disability claims and appeals to begin January 1, 2018, regardless of plan year. The DOL is now requesting public comment on whether to extend the applicability date of that rule an extra 90 days in order to ensure the rules are fair and balanced.

“Following publication of the Final Rule, various stakeholders and members of Congress asserted that it will drive up disability benefit plan costs, cause an increase in litigation, and in so doing impair workers’ access to disability insurance benefits. Pursuant to Executive Order 13777, the Department of Labor has concluded that it is appropriate to give the public an additional opportunity to submit comments and data concerning potential impacts of the Final Rule. The Department of Labor will carefully consider the submitted comments and data as part of its effort to examine regulatory alternatives that meet its objectives of ensuring the full and fair review of disability benefit claims while not imposing unnecessary costs and adverse consequences.”

On January 2, 2014, a proposed rule would have required all health plans to have a health plan identifier (HPID) and obtain HIPAA certification with electronic transaction standards. During the comment period, it was quickly determined that the insurance and provider markets had taken care of these requirements without regulatory guidance, so the proposed rule was indefinitely delayed. We now have an official withdrawal of the rule.

The U.S. District Court for D.C. has directed the Departments of Health and Human Services, Labor, and the Treasury (the Departments) to explain their reasoning for one component of the emergency room patient protections under the Affordable Care Act (ACA).

In the rule in question, plans must provide “benefits for out-of-network emergency services in an amount equal to the greatest of three possible amounts—

Numerous public comments expressed concern with the use of unreliable UCR pricing and suggested instead that the transparent FAIR Health database be used. In the final rule, the Departments simply said they “believe that this concern is addressed by our requirement that the amount be the greatest of the three amounts specified.” The plaintiffs in this case filed suit that their concerns were largely ignored and dismissed, and the Court agrees.

Now the Departments must further validate their reasoning. If they cannot provide a meaningful response, then they must revise the rule to better accommodate the concerns expressed.

The U.S. District Court for D.C. had also directed the Equal Employment Opportunity Commission (EEOC) to explain and possibly revise its final wellness incentive rules. “The real point of contention in this case is whether the agency’s decision to interpret the term ‘voluntary’ to permit a 30% incentive level is reasonable and whether the agency has offered an adequate explanation for that interpretation. AARP does not dispute that some level of incentives may be permissible under the statutes; rather…AARP argues that the 30% level…is too high.”

The EEOC has given a potential timeline to issue revised regulations in August 2018, accept public comment, review those comments and then issue final regulation by October 2019. Since any new rules would typically not be enforced until the January 1 following 6 months after rules are published, that would put any new rules effective for plan years on/after January 1, 2021. In response, the AARP feels it is inappropriate for employees to have to wait over 3 years for relief and has asked the Court vacate the rules January 1, 2018, or “as of mid-2018” if the Court feels employers need more time. We will be keeping a careful eye on this case.

The IRS has announced they will not accept “silent” returns that do not answer the question about having health insurance. Even paper returns “may be suspended pending the receipt of additional information and any refunds may be delayed.”

While the reporting remains largely similar to last year’s reporting (mainly just removing transition relief), many employers may be interested in an overview of the 1094/1095 forms and instructions. As a result, we now have a second webinar time available. Feel free to register for either one and mark “IMA” as the firm that invited you.

Both sessions are on Thursday, October 26, 2017.

IMA will continue to monitor regulator guidance and offer meaningful, practical, timely information.

This material should not be considered as a substitute for legal, tax and/or actuarial advice. Contact the appropriate professional counsel for such matters. These materials are not exhaustive and are subject to possible changes in applicable laws, rules, and regulations and their interpretations.