Energy Insurance Pricing & Market Update

Q3 2023

Property valuations are another issue on top of mind for energy company leaders in 2023. The global energy marketplace remains unstable due in large part to labor shortages and supply chain/ transportation bottlenecks carrying over from the pandemic. With the more recent inflationary pressures affecting supply and component costs, it’s little wonder that property valuations aren’t keeping up with true replacement costs.

To protect themselves from under-valuation, underwriters are scrutinizing reported values and routinely making requests for more frequent formal appraisals. Appraisals are expensive, however, and the services of reputable appraisers must be scheduled many months in advance of a renewal. Thus, companies are making more frequent indexed valuation adjustments in the interim.

While underwriters don’t have as much confidence in valuations derived through indexing, the use of an historically valid index methodology often serves as a suitable compromise. But in the absence of appraisal or index documentation, underwriters may be inclined to adjust a reported valuation by a relatively high percentage as a matter of course.

Regarding supply chains, the situation is improving overall, with just a few significant exceptions. Equipment containing electrical components is still difficult to obtain given copper and circuit board shortages. Smaller items with electrical components used to be readily available but now can take four months to arrive. Larger items in this category, compressors, for example, often are not available for up to a year. Until these situations resolve, companies are likely to stockpile hard-to-obtain, business-critical items and components and maintain backup equipment to ensure business continuity and avoid significant Business Interruption Insurance claims.

Click here for a full analysis of the impacted valuations.

The traditional energy industry is facing increasing scrutiny related to their focus around environment, social, and governance (ESG) practices from growing population of diverse stakeholders. This is particularly true in the area related to the environment and their ability to future proof their carbon intensive business model. However, energy companies and their suppliers are stepping up to the challenge by accelerating the deployment of innovative solutions that decrease environmental impact while increasing transparency and accountability to all interested stakeholders. One area that has seen great strides focuses on efforts to reduce methane emissions from across the oil and gas supply chain. Companies in the upstream and midstream can now monitor and quantify their methane intensity from operations supporting efforts to continually improve their footprint while differentiating their delivered product based on its measured climate performance. While these efforts may not be widely known today, the technology and practices to scale them across industries are gaining momentum quickly moving from best practices to standard procedure. The ability to reward these types of proactive environmentally beneficial measures will be dependent on driving objective consensus around the methodologies by which companies are assessed and rewarded for the practices they adopt.

Despite concerns around ESG investment agendas impacting capacity for the oil and gas industry, we have generally seen ample volume for favorable risks even with some insurance carriers pulling out of oil and gas for ESG concerns.

Recently, Chubb announced their new climate and conservation focused underwriting standards in this press release. In follow up conversations with Chubb, below are further details:

In Scope

Companies that produce more than 30% of their total revenue from directly operated crude oil extraction, and/or natural gas extraction upstream assets classified under SIC code 1311.

Data Requirements

For business with effective dates beginning July 1, 2023, Chubb is requesting the following from all “in scope” insureds:

Rising costs of services have artificially increased claims payouts. In many cases, particularly for property insurers, the policies were written on a replacement cost basis without consideration for any under reporting of values. This allowed for carriers to pay out more than they received benefit of premium dollars. This same concept would apply to liability losses where the insurance carrier is responsible to make a third party whole, yet the cost to “make them whole” has now increased significantly.

Claims costs that rise above general economic inflation are considered “Social Inflation”. These “added” claims costs are particularly difficult to predict as they are generally tied to social shifts of a new accepted norm. These losses tend to:

Natural catastrophic losses exceeded $400 billion for two consecutive years.

For two consecutive years natural catastrophic losses exceeded $400 billion, with 2022 exceeding the 10-year average by 40%, according to some carriers. While it is easy to focus on hurricanes as the only natural disaster, it seems that catastrophic events are hitting virtually all states as can be witnessed in several notable examples: Hurricane Ian, the 2021 deep freeze in Texas, wildfires in virtually every state from Colorado westward, convective storms in the Plains and Midwest, large earthquakes in California and 100-year flood events that seem to be every few years. Regardless of the cause of these natural disasters the frequency and rising severity has continued to grow indicating that this is a trend that is here to stay. With these large losses we have seen some large primary property carriers who have restricted the cat limit they will provide for clients, while still increasing the rates significantly. This means that in order to get the same coverages and balance sheet protection any property program would have to be stacked causing even more volatility in true rate increases.

As you may expect with Cat losses on the rise, inflation increases (social and otherwise) the insurance carriers have continued to absorb more losses and are now regularly exceeding their own financial positions and are now passing some of these losses to reinsurance markets, which has resulted in increased expenses with reinsurance renewal premiums skyrocketing to record levels in January 2023. The big companies will be able to take on more risks and drop their reinsurance coverage to try to offset the challenging renewals, but this will have a trickle-down effect in both risk control efforts of the oil and gas companies and increased rates and or premiums to further isolate carrier balance sheet from the brunt of large losses. While the big carriers will be able to be creative with not passing all the risk to customers by focusing on risk control, the smaller companies will likely pass 100% of costs off to customers.

While insurance companies are known to hold bonds and other long-term investments, the increase in interest rates should help increase investment yields for carriers for any new investments. Once realized, this increased return on investment should also help limit rate pressures. Unfortunately, just like all the other Insurance headwinds included herein, investment income faces its own challenges as economists largely predict a global recession is possible in 2023. See below graph from World Economic Forum:

Probitas Managing Agency is launching an energy account with former Munich Re Syndicate energy chief James Grainger geared towards supporting traditional energy companies.1 The energy offering will comprise a panel of consortium partners in the Lloyd’s market.1 This capacity is intended to support cleaner oil and gas producers, with those failing to show measurable improvement in sustainability over time being phased out of the portfolio.1

Berkley Oil and Gas has announced that with effect from July 1, they can no longer write excess layers above $10M which is reduced from their standard $25M capacity.

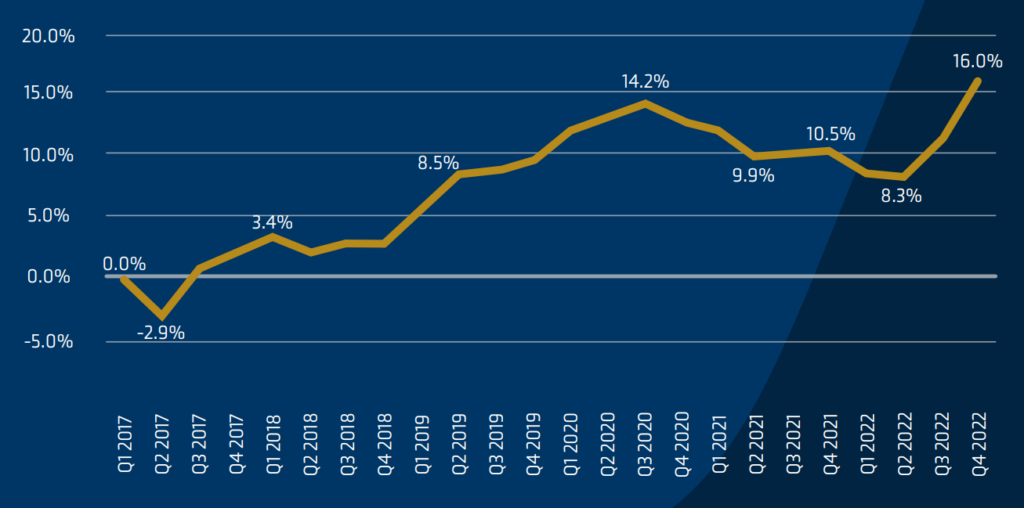

The premiums of Commercial Property saw the greatest increase of all lines of business in Q4 of 2022, with an average increase of 16%.2 However, the market continues to bifurcate between CAT exposed risk and non-CAT exposed risk, onshore versus offshore and the various parts of the value chain.

“Inflation and supply chain woes have resulted in a rise in demand for Business Interruption coverage.”

General Liability

Excess Liability

Control of Well

Commercial Auto

The commercial auto industry has been severely impacted by large settlements, legal expenses and payments for claims being higher than profits.4 This is a major difficulty for those running large fleets of vehicles.3 To manage this, numerous auto carriers have invested in telematics and fleet monitoring systems to decrease their loss ratios.3

Workers’ Compensation

Carriers have found profitability in Workers’ Compensation coverage, and buyers should expect competitive rates, subject to Modification Factors and prior loss history. Accounts with acceptable loss histories should be able to take advantage of the competitive market among carriers to secure more cost-effective pricing.

Cyber

| Property – Non-CAT exposed with favorable loss history | 10% to 15% increases |

| Property – CAT exposed with favorable loss history | 15% to 25% increases |

| Property with unfavorable loss history and/or a lack of demonstrated commitment to risk improvement (unresolved recs, pattern of same issues, etc.) | 10%+ increases for non-CAT 30% to 50%+ increases for CAT exposed accounts and higher depending on frequency/severity of losses and when there are limited markets for a risk due to occupancy/class of business or concerns related to loss control |

| General Liability | Up 5% to 15% |

| Workers’ Compensation – Dependent on experience modification factor and loss history | Down 10% to Up 5% |

| Auto | Up 10% to 25% Up 30% if large fleet and/or poor loss history |

| Umbrella & Excess Liability –Middle Market | Up 5% to 25%+ |

| Umbrella & Excess Liability – Risk Management and other Complex/Hazardous Exposures | Up 10% to 150% |

| London Placed Business with generally favorable loss history | Upstream E&P: 2.5% to 10% increases Midstream: 5% to 15% Increases Downstream: ~10% to 20% increases Onshore Contractors: 7.5% to 12.5% Offshore Contractors: 5% to 10% increases |

Alex Fullerton

Marketing Specialist

Brian Leugs

Writer

Daniel Posnick

Transactional Liability Leader,

Executive Risk Solutions

Stacy Roberts

National Energy Practice Director

Austin Struble

DFW Energy Practice Leader